Research Article

Research Article

Determinants of Savings Capacity among Agribusiness Entrepreneurs in Yobe State, Nigeria

Moses JD1, Okpachu SA2*and Okpachu OG3

1Department of Agricultural Economics and Extension, Adamawa State University, Mubi

2Department of Agricultural Education, Federal College of Education (T), Potiskum

3International Institute of Tropical Agriculture, Abuja

Corresponding AuthorOkpachu SA, Department of Agricultural Education, Federal College of Education (T), Potiskum.

Received Date: October 23, 2019; Published Date: October 29, 2019

Abstract

The study is an attempt to determine the savings capacity among agribusiness entrepreneurs in Yobe State of Nigeria. The specific objectives of the study were to describe the types of savings prevalent among agribusiness entrepreneurs; and identify and analyze the socio-economic factors that determine the probability of savings decision among agribusiness entrepreneurs. Data were collected from 200 agribusiness entrepreneurs selected using multi-stage sampling technique. Data collected were analyzed using frequency distributions, percentages, and Logit model. The results indicate that socio-economic characteristics of agribusiness entrepreneurs significantly influence the probability that they will save; agribusiness entrepreneurs prefer saving their money Asusu mode of saving. It was recommended that policies to improve savings should inculcate the socio-economic characteristics of these entrepreneurs; campaigns to promote the benefits and dangers of not saving should be encouraged; and conventional banks should partner with Asusu to mobilise savings amongst agribusiness entrepreneurs in the study area.

Keywords: Determinants; Savings capacity; Agribusiness entrepreneurs; Yobe state

Introduction

Traditionally, agriculture is seen as a low-tech industry with limited dynamics dominated by numerous small family firms which are mostly focused on doing things better rather than doing new things. Over the last decade, this situation has changed dramatically due to economic liberalization, a reduced protection of agricultural markets, and a fast changing, more critical, society. Agricultural companies increasingly have to adapt to the vagaries of the market, changing consumer habits, enhanced environmental regulations, new requirements for product quality, chain management, food safety, sustainability, and so on. These changes have cleared the way for new entrants, innovation, and portfolio entrepreneurship. It is recognized by all and sundry that farmers increasingly require entrepreneurship, besides sound management and craftsmanship, to be sustainable in the future [1].

Over the past 30 years, there has been a major shift in agricultural markets and the international trade of agricultural products. The world is moving from local and national markets towards a global system of trading, which means that neighboring farmers working on small plots of land may be competing with large industrial farmers from another country in a single marketplace. In developing countries, there is increasing pressure on farmers to commercialize their operations. This change is driven by the following factors:

• Declining land size, which means that farmers need more intensive production systems to support their family needs;

• Urbanization and rapid population growth and

• General modernization, which means that farming families need to generate larger incomes to support their family needs and expectations in terms of medical support, education, transport, communication and to cover the rising costs of their cultural traditions.

In order to meet the drive for greater commercialization, extensionists need to develop new skills to support the agripreneur needs of farmers and other actors in the value chain. For the farmer, this includes working with individual farmers to develop farm plans, as well as working with various levels of farmer organizations— from groups to cooperatives—in areas of market analysis, financing, sales and building business opportunities for farming clientele.

Entrepreneurship, value chains and market linkages are terms that are being used more and more when talking about agriculture and farming. Many small-scale farmers and extension organizations understand that there is little future for farmers unless they become more entrepreneurial in the way they run their farms. They must increasingly produce for markets and for profits. A farmer-entrepreneur is someone who produces for the market. A farmer-entrepreneur is a determined and creative leader, always looking for opportunities to improve and expand his agribusiness. A farmer-entrepreneur likes to take calculated risks and assumes responsibility for both profits and losses. A farmer-entrepreneur is passionate about growing his business and is constantly looking for new opportunities. Farmer-entrepreneurs are also innovators, who always look for better and more efficient and profitable ways to do things. Being innovative is an important quality for a farmer-entrepreneur, especially when the business faces strong competition or operates in a rapidly changing environment.

In most recent times, the emphasis on agri-food chain coordination, value creation and the institutional setting under which chains operate, have significantly increased the importance of the agribusiness sector. However, the scenario appears different in Nigeria due to neglect and perceived under development of the agribusiness sector, which has retarded poverty alleviation in the country.

Capital accumulation and savings are regarded as the engine of growth in any country. Unfortunately, the relative poverty of the rural agribusiness entrepreneurs in Nigeria hampers savings and investment potentials and this together with the poor attention from the government have continued to perpetuate low growth and productivity in the food and agricultural sector of the country.

Sustainable growth in any sector of an economy is a function of capital accumulation and increased savings. Unfortunately, the relative poverty of the rural agribusiness entrepreneurs in Nigeria hampers savings and investment potentials which retard growth and productivity in the food and agricultural sector of the economy. Leads to Savings to a large extent determine the growth rate of the productive capacity and output. It is the views of Egwu & Nwibo [2], that the lack of access to productive resources and low returns to agricultural production as well as the bureaucracy involved in opening bank account are some of the limitations to the saving capacity of agribusiness entrepreneurs. In a bid to save, some of these entrepreneurs prefer to loan out their cash after sales to reap interest, invest in livestock, store their produce after harvest when prices are low and sell during lean period when prices will rise.

Having recognized the importance of savings in the growth and development of an economy, it becomes imperative to look at the determinants of savings capacity of agribusiness entrepreneurs in the country in an effort to develop the food and agricultural sector. The understanding of these determinants will spur innovative decisions from stakeholders in the country responsible for agribusiness development to come up with strategies that will improve the sector’s performance.

The main objective of this study was to examine the determinants of savings capacity among agribusiness entrepreneurs in Benue State. The specific objectives were to describe the types of savings prevalent among agribusiness entrepreneurs; and to identify and analyze the determinants of savings decision among agribusiness entrepreneurs.

Theoretical Framework

The theoretical framework for this study is the collective Entrepreneurship Theory. Collective Entrepreneurship has emerged as a new concept in the literatures of economics, management and entrepreneurship [3]. It emerged as a strategy to accrue economic benefits and improved market access [4]. Steward [5] was the first person to put forward the concept of collective entrepreneurship based on the result of his ethnographic research on high-performing work team. While Stewart [5] is recognized for coining the concept of collective entrepreneurship he didn’t relate the concept to the field of agriculture. Pal [6] were the first to relate collective entrepreneurship to agriculture, focusing on agricultural cooperatives. They defined collective entrepreneurship as a form of rent-seeking behavior exhibited by formal groups of individual agricultural producers that combine the institutional frameworks of investor-driven shareholder firms and patron-driven forms of collective action. Further, Pal [6] point out that for any form of a collective organization to achieve the highest performance, members’ decisions about their own on-farm activities and investments should be aligned with the cooperative. They posited that this is the risk associated with collective entrepreneurship that producers should be willing to take.

Farmer organizations or farmer groups to which collective entrepreneurship applies are common in Africa. By 2005, farmer organizations in Africa had grown to 70 (FANRPAN, 2005). The growth of farmer organizations in Africa emanated from proactive response to be successful in pursuit of significant growth in a rapidly changing economic, social and political environment [7]. Farmer organizations help solve farmers’ collective action problems, that is, how to procure inputs most efficiently and market their outputs on more favorable terms than they could achieve by themselves [7]. Collective action has the potential to organize smallholder farmers in developing countries in the wake of agricultural market liberalization (Mukindia, 2014).

Although collective entrepreneurship is considered as an appropriate tool for linking smallholder farmers to markets and upgrading their socio-economic status, there are potential problems which can undermine its effectiveness. These include low institutional capacity, inadequate qualified personnel, low entrepreneurship skills, lack of financial resources, lack of market information, lack of communication and participation among members, patronizing the business activity of the groups, control and support, mismanagement, financial scandals and poor governance [8]. Collective entrepreneurship can play an important role for rural development. However, farmer organizations or farmer groups are not always successful, and there is a need to better understand under what conditions of collective entrepreneurship is useful and viable. It is important to study the group entrepreneurial behavior that enable farmers to address market challenges.

Methodology

Study area

The study was conducted in Yobe State is located in the North-Eastern part of Nigeria between latitude 12 °00′N 11 °30′, Longitude12 °N 11.5 °E. Potiskum Local Government Yobe State was created out of the old Borno State in 1991 and has seventeen local government areas. The study covered Potiskum Local Government Area, where Agribusiness entrepreneurs abound in the state such as suppliers of farm equipment, agro-chemicals etc. Also, agribusiness entrepreneurs who are engaged in arable crop production like Maize abound as well as those involved in Maize marketers, Sorghum, etc.

Sampling technique and data collection

The data for the study was collected from the respondents using a structured questionnaire from 200 agribusiness entrepreneurs who are involve in the production and marketing of Maize and Sorghum. The respondents were selected using multistage sampling techniques to capture their determinants of savings

Data analysis

The data collected for the study were analyzed using descriptive statistics such as frequency distribution, percentages to describe the types of savings prevalent among respondents. Following Okeke and Mbanasor [9]. Logit model was used to realize the determinants of savings decision among respondents.

Model specification

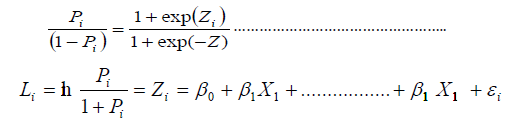

The Logit model was estimated with maximum likelihood estimation technique. The Logit model for this study is specified as:

= is the ratio that the probability that a respondent

saves to the probability that a respondent did not save. Hence, the

dependent variable is binary, and its value is 1 for a respondent

who saves and 0 for a respondent who does not save. As Zi range

from −∞ to +∞, Pi range from 0 to 1, and Pi is non-linearly related to

Zi. Zi is a linear function of the explanatory/independent variables

Xi defined as follows:

= is the ratio that the probability that a respondent

saves to the probability that a respondent did not save. Hence, the

dependent variable is binary, and its value is 1 for a respondent

who saves and 0 for a respondent who does not save. As Zi range

from −∞ to +∞, Pi range from 0 to 1, and Pi is non-linearly related to

Zi. Zi is a linear function of the explanatory/independent variables

Xi defined as follows:

X1=Annual Income (Naira)

X2=Gender (male = 1; female = 0)

X3= Household size

X4= Years of Experience (years)

X5= Risk of capital loss (perceived = 1; do not perceived = 0)

X6= Educational Status (years)

X7= Extension Contact

X8= Rate of return (perceived = 1; do not perceived = 0)

X9= Safety (perceived = 1; do not perceived = 0)

X10= Ease of accessibility (perceived = 1; do not perceived = 0)

The a priori expectation was that the coefficient household size will be negative while those of gender, educational status, years of experience, annual income, membership of cooperative, rate of return, risk of capital loss, safety, and ease of accessibility will be positive

Results and Discussions

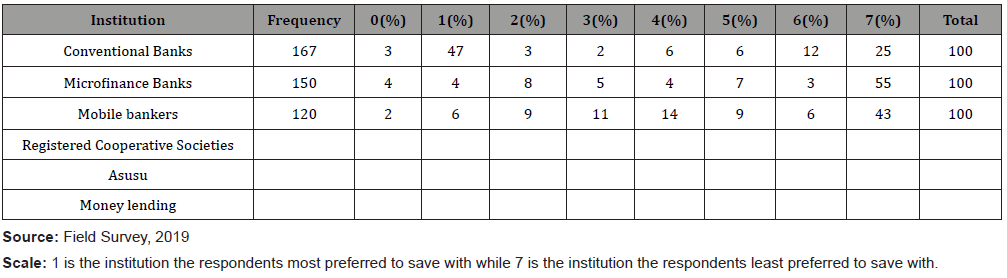

Types of savings prevalent among respondents

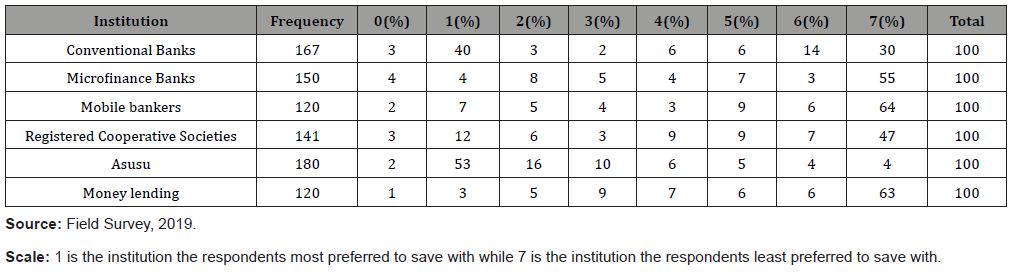

The distributions of agribusiness entrepreneurs according to their most preferred institutions to save with are presented in Table 1. Analysis of Table 1 shows that majority (53%) of agribusiness entrepreneurs regarded Asusu as their most preferred institution to save their money. The policy of asusu is based on the monthly collection of fixed amounts of money from member contributors and loaning out the money to members on low interest rate (mostly 5%) and higher interest rate to non-members (mostly 10%). At the end of the financial year, both the accrued interest paid, and the principal contributions will be shared among members. Agribusiness entrepreneurs prefer saving with asusu as there are no conventional banks within their locality, provides them with benefits such as loans, meat at the end of the year etc., provides them the opportunity to know one another, perception of asusu as a way of life, their low literacy level, their lack of trust for the bank system, and the ease of operation associated with asusu. This finding was in consonance with Nwibo and Mbam [10], Babani [11] that farmers make use of informal financial sectors to mobilize savings and develop their rural communities because it gives them access to loans that they cannot get from formal financial institutions due to lack of collateral.

Furthermore, Table 1 shows that 40% of agribusiness entrepreneurs saw conventional banks as their second most preferred saving institution The preference of agribusiness entrepreneurs to save in conventional banks can be attributed to the safety and ease of accessibility of their money, and easy transaction between them and their customers which they attach to saving with such banks. This finding is corroborated by Haruna [12] who in a study on the determinants of saving and investment in deprived district capitals in Ghana, reported that people prefer saving in banks to “isusu” groups due to high security, trust and proximity.

The result from Table 1 shows that the least preferred institution by the respondents (64%) to save their money was Microfinance banks. The poor rating of microfinance bank as an institution to save with by agribusiness entrepreneurs can be attributed to the unavailability of such microfinance banks within the locality of these entrepreneurs as well as the popularity of Asusu and commercial banks. This finding is corroborated by Sukhdeve [5] who in a study on informal savings of the poor: prospects for financial inclusion, reported that majority of households park their saving in banks while the remaining save their money in informal ways which offer easy access and convenience.

Table 1:Types of savings prevalent among respondents.

Determinants of savings decision

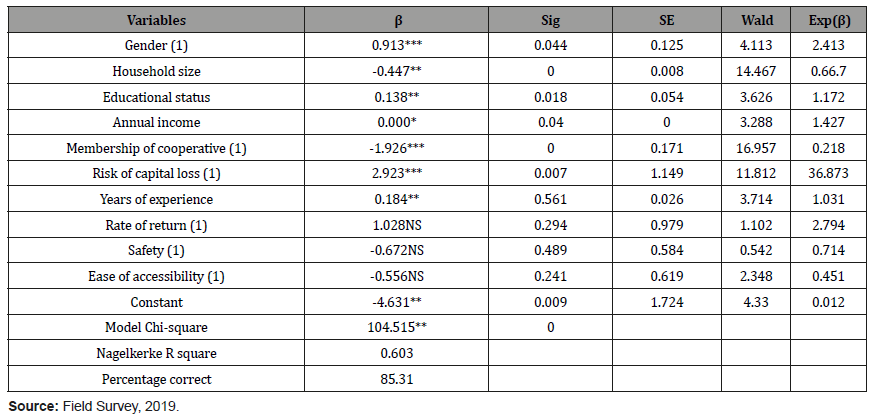

The determinants of savings decision among the respondents was obtained using the Logit model and presented in Table 2. The result from Table 2 shows that the model chi-square was 104.515 which were significant 5%, this indicate that that there is a significant between the socio-economic characteristics of agribusiness entrepreneurs and their savings decision.

Table 2:

The Nagelkerke R square value of 0.603 indicates that exist a strong relationship of 60.3% between the predictors and the predictions. The analysis also revealed that none of the independent variables had a standard error (S.E) greater than 2.0 thus confirming the absence of numerical problem such as multicollinearity among the independent variables

The prediction success overall was 83.1% Thus, the independent variables could be characterized as useful predictors distinguishing survey respondents who have deliberately saved part of their earnings from survey respondents who have not deliberately saved part of their earnings.

The relationship between gender and likelihood of savings was Positive and statistically significant at 5%. The positive sign of the coefficient is in consonance with the a priori expectation, implying that if an agribusiness entrepreneur is a male, he is 2.580 times more likely to save part of his earnings [13]. Male agribusiness entrepreneurs often engaged themselves in other income generating activities which increases their income and thus their savings when compare to the female agribusiness entrepreneurs who devote much of their earnings on their families, clothes, and jewelries. This finding agrees with Ayenew [14] who indicated that female heads spends their money on the purchase of jewelry, clothes, and crockery etc which reduces their income and subsequently their savings. However, this finding is at variance with Shitu [15] who revealed that rural women save more than their male counterpart.

The coefficient of household size was significant at 5% and negatively related to savings decision. The negative sign of the coefficient correlates with the a priori expectation, implying that as the household size of agribusiness entrepreneurs increases, they are 0.667 times less likely to save part of their earnings. Large household size implies high dependency ratio and increase in nonfarm business expenses such as hospital bills, children’s school fees, social events or household consumables which translates to low savings among agribusiness entrepreneurs. This finding is affirmed by Ike and Umuedafe [16] who posited that large family size is among the major causes of fewer savings.

Table 3:Determinants of savings decision.

The result also revealed a positive savings-income relationship, which was statistically significant at 10%. This implies that as income increases, there is greater probability of saving. This finding is supported by Konig, Silva and Mhlanga [17] who posited that the higher the income, the more revenue the farmer generates from his produce and hence, the more he is encouraged to save part of his earning.

The coefficient of membership of cooperative society was significant at 5% and positively related to savings decision. The positive sign agrees with the a priori expectation, implying that agribusiness entrepreneurs who are members of cooperative society are more likely to save part of their earnings. Cooperatives offer its members the opportunity to increase their monthly income which translates to more savings through the social networking platform it provides to its members.

The coefficient of risk of capital loss was significant at 1% and positively related to savings decision. The positive sign of the coefficient is in consonance with the a priori expectation, implying that the perceived risk of capital loss among agribusiness entrepreneurs will make them more likely to save part of their earnings. Agribusiness entrepreneurs will likely embark upon precautionary savings to provide an emergency cushion in case of a sudden loss of income or an unexpected spike in expenditure. Khan and Hye [3] in a study on the financial sector reforms and household savings in Pakistan corroborated this finding by reporting that greater uncertainty increases savings as risk aversion consumers set aside resources as a precaution against possible adverse changes in income.

The coefficient of working experience was found to be significant at 5% in influencing savings in the study area. This implies that the more experienced a respondent has in agribusiness activity, the higher the likelihood of savings. This is expected because the more experience a respondent has, the better her skills which will earn her more. This could also mean that knowledge gained over time from working experience could make the agribusiness entrepreneur more efficient and therefore more remunerated, that is, it is expected that the agribusiness entrepreneur will accumulate physical assets with long working experience and also save more. This finding agrees with Nwibo & Mbam [10] who in a study on the determinants of savings and investment capacities of farming households in Udi Local Government Area of Enugu State, posited that farmers with long experience in farming tend to have wider experience and are more inclined to saving and investment in agricultural activities whose rate of returns are higher [18].

Conclusion and Recommendations

The result from the study shows that majority of the respondents prefer Asusu as their mode of saving. Also, evidence from the study indicates that the socio-economic characteristics of the agribusiness entrepreneurs significantly influence the probability that they will save.

Based on the findings of the study, the following recommendations were made:

• Policies geared towards improving the savings of agribusiness entrepreneurs should inculcate their socioeconomic characteristics in its formulation to ensure better result.

• With the preference for Asusu, Formal financial institutions should develop a synergy to partner with Asusu in order to mobilize savings among agribusiness entrepreneurs in study area.

• There should be an aggressive campaign geared towards promoting the benefits of savings as well as the dangers of not saving should be encouraged especially in the areas of these entrepreneurs.

Acknowledgement

None.

Conflict of Interest

No conflict of interest.

References

- Ogidi AE (2016) Agribusiness vs Economic Growth: Whither Nigeria? International Journal of Sustainable Development 11(1): 01–10.

- Egwu PN, Nwibo SU (2014) Determinants of saving capacity of Rural Women Farmers in Ebonyi State, Nigeria. Global Journal of Agricultural Research 2(1): 1-10.

- Khan REA, Hye QMA (2010) Financial Sector Reforms and Household Savings in Pakistan: An ARDL approach. African Journal of Business Management 4(16): 3447-3456.

- Chagwiza C, Muradian R, Ruben R, Tessema W (2011) Collective entrepreneurship: a comparison between two producer organizations in the Ethiopian honey sector. Paper presented at the International Conferences on Economics and Management of Networks, Cyprus, pp. 1-24.

- Stewart A (1989) Team entrepreneurship. Newbury Park, California: Sage Sukhdeve ML (2008) Informal Savings of the Poor: Prospects for Financial Inclusion. Working paper, Cab Calling.

- Pal V (2012) Entrepreneurship and economic process. EXCEL International Journal of Multidisciplinary Management Studies 2(2): 34- 42.

- Sifa CB (2012) Role of cooperatives in agricultural development and food security in Africa. (Publication of the ATA agricultural Cooperatives Sector Development Strategy 2012- 2016), pp. 1-8.

- Bula HO (2012) Evolution and theories of entrepreneurship: A critical review on the Kenyan perspective. International Journal of Business and Commerce 1(7): 81-96.

- Mudiwa, Benjamin (2017) Theories of Smallholder Agribusiness Entrepreneurship in the African Context: A Critical Review. International Journal of Arts and Humanities (IJAH) Bahir Dar- Ethiopia 6(1): 221-236.

- Nwibo SU, Mbam BN (2013) Determinants of Savings and Investment Capacities of Farming Households in Udi Local Government Area of Enugu State, Nigeria. Research Journal of Finance and Accounting 4(15): 59-68.

- Babani E (2015) Saving and Investment Behaviour of Small-Scale Farmers in Kauru and Lere Local Government Areas of Kaduna State, Nigeria. Unpublished M.Sc Dissertation Submitted to Department of Agricultural Economics and Rural Sociology, Faculty of Agriculture, Ahmadu Bello University, Zaria, Kaduna State, Nigeria, pp. 1-84.

- Haruna I (2011) Determinants of Saving and Investment in Deprived District Capitals in Ghana. A case Study of Nadowli in the Upper West Region of Ghana. Continental J Social Sciences 4(1): 1-12.

- Okeke AM, Mbanasor JA (2017) Determinants of Savings Capacity among Agribusiness Entrepreneurs in Benue State, Nigeria. International Journal of Innovative Finance and Economics Research 5(4): 66-72.

- Ayenew W (2014) The Determinant of Saving Behaviour of Women in Urban Ethiopia: In Case of Arba Minch Town. Developing Country Studies 4(21): 130-139.

- Shitu GA (2012) Rural Households’ Income and Savings Pattern in South Western Nigeria. Agricultural Journal 7(3): 172-176.

- Ike PC, Umuedafe DE (2013) Determinants of Saving and Capital Formation among Rural Farmers in Isoko North Local Government Area of Delta State, Nigeria. Asian Economic and Financial Review 3(10): 1289-1297.

- Konig G, da Silva CA, Mhlanga N (2013) Enabling Environments for Agribusiness and Agro-Industries Development: Regional and Country Pespectives. Food and Agricultural Organization, Rome, pp. 1-71.

- Dorin C, Alexandru GS (2014) Dinamics of the entrepreneurship concept. Literature review. University of Timisoara, Romania: Finance department, Faculty of Economics and Business Administration West, pp. 1-7.

-

Okpachu SA, Moses JD, Okpachu OG. Determinants of Savings Capacity among Agribusiness Entrepreneurs in Yobe State, Nigeria. World J Agri & Soil Sci. 3(4): 2019. WJASS.MS.ID.000570.

-

: Determinants, Savings capacity, Agribusiness entrepreneurs, Yobe state

-

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.