Review Article

Review Article

The Short-Term and Long-Term Effects of COVID-19 on the Fashion Retail Industry

Jung-Hwan Kim, Associate Professor, Department of Retailing, College of Hospitality, Retail and Sport Management, University of South Carolina, Columbia, SC 29208, USA.

Received Date: March 17, 2021; Published Date: June 16, 2021

Abstract

This paper addresses how the COVID-19 pandemic has affected the short-term and long-term outlook on the fashion retail industry. Included are a review of secondary sources such as journals, papers, and articles and the results of two studies (i.e., consumer survey and industry interviews) conducted to recognize the changes seen now and in the future of the fashion retail industry. Combining an assessment of secondary reliable sources with actual consumer self-reported behavior during the pandemic and professional interviews with representatives from prominent retailers in the U.S. gives detailed and valuable ideas of how the industry is going to change in response to and in preparation for changing consumer attitudes and behavior.

Introduction

No one could have predicted that a global pandemic would take over the world and disrupt every aspect of life and business. In March of 2020, the world was in a state of shut down due to the rapid and deadly spread of the COVID-19 virus. The coronavirus pandemic affected all facets of life across the entire globe. Nonessential workers were requested to stay at home and the amount of person-to-person interaction was limited. Although, with millions of vaccine doses being administered in the United States and life starting to change once again, this pandemic is still globally ongoing.

One of the sectors hit hard during the viral outbreak was the fashion retail industry. Many people lost their jobs due to COVID-19 restrictions, which lowered their disposable income. There was a complete shift in consumer demand for clothing and an abrupt swing in trends due to lockdowns and exceptional circumstances related to COVID-19. There was less need to buy new clothes, and certain types of clothing like workwear were needed less because most people were not going into their offices after the pandemic started.

At the beginning of the COVID-19 outbreak in the US, there were shortages of essential items due to panic buying that caused widespread worry throughout the country. The focus on stocking up on essentials put retailers in a panic as consumers had less money to spend on non-essential goods and services [1,2]. It also severely affected many small businesses such as barbershops and restaurants [3].

Throughout the pandemic and resulting lockdown, there were phases of consumer behavior that seemed to change. After the initial panic, a sense of boredom developed, which was initiated by all of the free time people had from either working from home, schooling from home, or being unemployed. This led many people to spend a great deal of time on social media where viral trends and activities were influential and causing panic buying which let to shortages in non-essential goods like puzzles and other entertainment.

In light of the pandemic, the current research was begun to examine how COVID-19 was affecting the fashion industry and purchasing trends through changing consumer behaviors and societal shifts, in specific, the short-term and long-term effects of COVID-19 on the fashion industry. The paper includes information about (1) how COVID-19 has changed consumer shopping behaviors and (2) where the industry is headed and what retailers need to consider in the transformed marketplace to satisfy their consumers and get ahead of their competition, gathered from a review of secondary sources, a consumer survey, and interviews of representative in the fashion industry.

To understand the short-term and long-term effects of COVID-19 on general consumer behaviors and the fashion industry, secondary sources such as McKinsey & Company reports [4], online industry reports, fashion magazines, and journal articles were scrutinized. For the consumer survey, online questionnaire was employed to gauge consumer perceived behavior before, during, and after the pandemic. The survey included sections about purchasing essential items, non-essential items, and apparel items. A convenient sample of 153 college students was recruited at a large university in the southeastern United States. For conversations with representative in the fashion industry, 5 professionals were interviewed over a twoweek period. The industry professionals included district managers and store managers from the large department stores Kohl’s and Nordstrom and the small business owner of a local clothing store. Each of the participants had a unique point of view based on what their department or store sells, what their location is, and what their customer base is. Each interview took approximately 20-45 minutes.

By thoroughly reviewing the extant secondary sources and the data obtained from the consumer survey and industry interviews, the current paper provides practical implications to practitioners and academia in understanding (1) how COVID-19 has impacted consumer shopping behaviors, (2) what changes in attitude consumers have had on their shopping experiences and their expectation of retailers in the future, and (3) the trajectory of both consumer behavior and the industry changes in a post COVID-19 world.

Discussion

This section features both the observed and projected shortterm and the long-term effects of COVID-19 on the fashion retail industry based on a combination of primary and secondary exploration.

Short-Term Effects of COVID-19

Shifts towards casualwear

The pandemic unexpectedly affected fashion greatly. Many people changed their lifestyle to include more fitness and relaxation activities which made athletic wear and loungewear increase in popularity and demand more than was expected at the outset of the season [5]. According to a recent report by USA Today (2021), some of the most popular trends that the pandemic brought are loungewear, slippers, activewear, sneakers, and pajamas [6]. In accordance with this popularity movement, 69% of the respondents in the consumer survey claimed that the pandemic changed their clothing style with about 40% indicating that their style become more casual. The casualization of workwear was brought up several times in the professional industry interviews.

In one interview, a department manager at Nordstrom mentioned that workwear has already changed massively in terms of becoming more casual. Similarly, a district manager at Kohl’s indicated that they are in the process of creating a private label brand that will produce casual/work-from-home wear due to shifting consumer demands. The manger added that now denim is seen as the new work uniform. This comment is consistent with what the Nordstrom manager saw in 2020 with denim being extremely popular in the men’s department. According to an industry article [5] consumers will not let go of their comfortable clothing which has been the biggest trend during the COVID-19 pandemic. Looser fits will continue to be trendy from tops to trousers even in the post-pandemic period.

Internet viral trends-DIY fashion and secondhand clothes

With more people spending time on their mobile phones due to COVID-19, especially on social media, internet viral trends have had a strong effect on popular styles throughout the pandemic, for example the increased prevalence of DIY (Do It Yourself) [7]. DIYing garments became extremely popular not only for the fact that it was something fun and engaging that could be done at home [8] but also because consumers were getting bombarded with tutorials of viral DIY trends [9]. Tie dyeing and refurbishing old clothes were two of the most popular trends that could be found on multiple social media platforms.

A fashion magazine, InStyle [10] indicated that the online secondhand fashion market is set to burst. Online retail sites such as The RealReal, Poshmark, and ThredUp that buy and sell secondhand consigned clothing have gained increased popularity [10,11]. In the professional interview, the owner of a small retail clothing store mentioned that buying secondhand and refurbishing or renewing a garment has become very popular during the pandemic, especially with Gen Z. The owner further stated that this trend has also opened people’s eyes to sustainability and surpluses in fashion.

Shifts towards a more digital world

According to Bhatti, et al. [12], coronavirus induced customers to use the internet and make it habit in their daily routine. This means that consumers were not only shopping more online than ever before, but that now the trend is ingrained in consumer behavior and not expected to slow down. A recent report by McKinsey & Company [13] demonstrated that in a matter of months the consumer and business adoption of digital platforms accelerated ahead by five years.

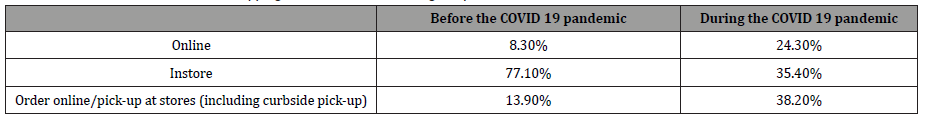

According to a recent survey with 2654 marketing leaders in the U.S [14], 87.5% of the B2C product leaders and 90.6 % of B2C services leaders observed that consumers placed and increased value on digital experience. To support this article, in this study’s consumer survey, approximately 8% of the respondents reported that they purchased essential items online before the pandemic but 24% indicated that they purchased essential items online during the pandemic (Table 1).

Table 1:Consumer essential items shopping habits before and during the pandemic.

In 2019, Nordstrom created a program called Style Boards which allows salespeople to create personalized boards of items from Nordstrom stock to send to their clients. The link can be sent via text directly to the customer’s phone making it extremely convenient for them to shop (Figure 1). Customers can also send messages to their stylists through the board if they have any questions or comments. During the pandemic period, this program contributed tremendously to drive sales and are now a part of the daily duties of salespeople. This is one example of how retailers can innovate with new ways to connect with their customers and create new shopping experiences for them in an online setting to stay competitive in the industry.

With regards to the shift in consumer shopping habits from traditional brick-and-mortar to digital, another notable movement that became increasingly important in the short-term was buy online and pickup in store or pickup curbside. Customers that ordered their goods online could either use an app or call to let the store know they had arrived in the designated parking area. Then an employee would bring out the purchase in a completely contactless way. This alternative was mentioned by the managers from Kohl’s as extremely important for their business during the pandemic. In the study’s consumer survey, more than 37% of the respondents reported that they used a contactless pick-up option during the pandemic. Several articles addressed that this option is a trend that is going to pick-up in popularity and be an essential service from retailers [15,16]. A few retailers offer other contactless options like porch pick-ups and curbside returns [17]. These additional choices will be another potential area of growth that will differentiate retailers once the majority have created contactless pick-up options.

Social media usage increase

Social media is quickly becoming exceedingly critical in the fashion retail space. A recent article [18] indicated that almost a quarter of US and European consumers expect to increase their spending via social channels. According to this study’s consumer survey data, 75.4 % of the respondents indicated that they shopped through Instagram during the pandemic, 42.6% via TikTok, 24.8% via YouTune, and 21.3% via Pinterest. During the professional interview, one store manager mentioned that people now want to shop through one click. That is, shoppers do not want to spend 30 minutes or more scouring websites for pieces to buy, rather they want to see a product and buy it right then. This immediacy is what social media is able to give to consumers.

According to a report by Boston Consulting Group [19], consumers’ purchases through social media accelerated and the digital platforms accounted for a large portion of the total sales during the pandemic period. More and more consumers expect individualized digital shopping experiences delivered via social media. This trend was also evident in the consumer survey conducted for this paper. Several respondents indicated that their good online shopping experiences involve understanding and interaction with a brand on a personal level. The intimate connection with a brand through social media is not only beneficial to consumers but also helps them create a bond with the brand that will keep them coming back.

Accelerated growth of e-commerce and changed retail landscape

A recent business article [19] in connection with COVID-19 projected that the majority of physical stores will be smaller, sell merchandise that is customized for the area and be set up to fulfill online orders, and that flagship stores will remain for brand image purposes. In accordance with this projection, the department managers at Nordstrom and Kohl’s addressed in the interviews that 70% - 75% of business was done in retail stores before COVID-19 but the retails stores during the pandemic mostly were employed for fulfilling online orders. According to this study’s consumer survey, 73.8% of the respondents shopped non-essential items in stores before the pandemic but 85.8% reported that they shopped non-essential items online during the pandemic. However, the store managers did not think that the accelerated growth of e-commerce and stores employed as fulfillment centers would last long-term but expect that it would stay at some level as part of the stores’ functions.

Another trend in relation to the changing retail landscape reported by McKinsey & Company [20] is creating emotional connections with customers. That is, brick-and-mortar stores will become more about building an emotional connection between the brand and the consumers and will be a place that connects innovative technology with personal experiences. During the pandemic many retailers realized that carrying all of the inventory in stores was burdening the business and affecting the bottom line. This realization could lead to physical retail spaces serving half as a mini distribution center and half as a way to personally connect with customers.

Long-Term Effects of COVID-19

Increasing focus on wellness and health

The major lifestyle change observed in the U.S. during the pandemic was the trend toward wellness and health. The spike in athleisure sales coupled with a rise in sales of fitness equipment during the pandemic was an indicator of how this lifestyle change began. According to Heuritech’s Instagram analysis [5], 1 out of 4 #covid19 posts were related to a healthy lifestyle during the pandemic confinement. In the interviews, the Kohl’s and Nordstrom professionals emphasized that athleisure was one of the product segments that was being bought extensively and sold quickly. Both retailers have continued to add new athletic and athleisure brands to their product offerings and have been met with success. To support this occurrence, in the study’s consumer survey respondents revealed that they bought fitness equipment along with leggings and other athletic clothing during the pandemic.

According to a Global Athleisure Market Report from Allied Market Research, athleisure is indeed on the rise. The market size of athleisure was estimated at $155.2 billion in 2018 and it is projected to reach $257.1 billion by 2026 [21]. The technological innovation in textiles such as waterproof and breathable membrane fabrics and wearable smart textiles have accelerated a consumer trends shift towards health and wellness and the rise of athleisure [22]. Some companies advanced these innovations by producing clothing that regulates the amount of heat that passes through the clothing based on body temperature and ambient temperature [23]. Retailers need to keep an eye on such innovative textiles in functional clothing to be able to prosper in the fashion industry over time.

Sustainability, fair treatment, and social justice

The COVID-19 pandemic also made people more conscious about sustainability [19], fair treatment and social justice [24]. According to a recent survey by IBM in association with NRF [25], 57% of the respondents were willing to change their purchasing habits to help reduce negative environmental impact. In a McKinsey & Company report [4], 66% of consumers said they would stop or reduce their shopping with a brand if that brand did not treat their employees or their suppliers’ employees fairly and safely. With these trends, Bianchi, et al. [19] indicated that retailers now need to make sure that they operate their businesses in environmentally and socially responsible ways because sustainability has become a minimum requirement for more and more consumers when purchasing products. In link with this movement, a store manager from Kohl’s revealed that Kohl’s makes a conscious effort to vet all potential suppliers to make sure they operate within Kohl’s company standards. In this study’s consumer data, approximately 20% of the college students addressed that they purchased products from the most sustainable brands during the pandemic. About 33% purchased goods from secondhand/thrift stores.

Compared to older generations, Millennials and Gen Z are more health-conscious, socially aware, and environmentally responsible [26]. They care more about sustainability, fair treatment, and social justice and are willing to shop at brands that are transparent with their sustainability efforts and use of fair treatment produced products and outspoken about their morals and ideology. A report from McKinsey & Company [18] pointed out that the quarantine has accelerated consumer buying shifts towards purpose-driven sustainable action and that this trend will become more intensified over time.

Technological innovations and implementations

One of the major long-term effects of COVID-19 on the fashion retail industry is in the realm of technology. The COVID pandemic accelerated a more rapid adoption of new technologies worldwide that will result in dramatic changes in consumer behavior [27]. For instance, new technology adaptations retailers quickly implemented during the pandemic include facial check-in services, AI temperature checks, and delivery app services [28]. Consumers’ changed habits during the pandemic such as using streaming services instead of going to the movies, working from home instead of commuting to an office, and mainly shopping online from home are also likely to continue. In the interviews, a department manager at Nordstrom and a district manager from Kohl’s addressed that technology was one of the most influential factors in the survival of retailers when COVID-19 hit. The retailers who made investment in technology as a top priority were less affected by COVID compared to the retailers who did not. That is, brands that had already invested in technology to better serve their customers were on their front foot and were able to continue to develop customer communications through their already built-up channels during the pandemic.

One of the most influential spaces where brands expect to interact with customers now and in the future is the social media platform. The retailers who already had social media and e-commerce infrastructure-maintained customer relationship during the pandemic [29]. According to Bianchi, et al. [19] personalization at scale or one-on-one engagement with customers will be a critical growth area over the next decade. In the digital era, content created on social media is more powerful than traditional advertising since social media helps retailers build deeper relationships with customers through two-way interactive conversations with customers [30]. During the pandemic, many brands vigorously utilized social media platforms to connect with consumers. Through its Instagram site, the luxury brand Dior shared their new collections and behind the scenes views of their popular styles to make connections with customers. Similarly, the luxury brand Kenzo launched a community-focused program on its Instagram site with the hashtag #stayhomewithKENZO to support community with a personal level emotional connection [31].

In the future, technology will allow businesses and companies to do things that were unimaginable in the past [32]. The digitally savvy generations Y and Z will be the largest consumer markets in the near future and in response the future market will be dominated by retailers that build emotional connections with customers through diverse technological innovations and implementations [32].

Accelerated demand for personalization

One of the more recent trends is consumers demanding more personalization. Mass customization has resulted in response to that demand, but now consumers want more than product customization. They want individual connections and interactions with the brands they shop. This personalization trend will be another long-term trend in the fashion industry that will not subside. In association with this trend, a store manager from Nordstrom addressed a digital appointments service used during the COVID-19 lockdown. Using the service, a Nordstrom’s stylist would set up a dressing room for a client as if they were both in the store in person, then the stylist would video call the client and show the pieces and outfits the client had picked out. The stylist would be able to transact the purchase and send the items to the client without ever needing to have the clients come into the store.

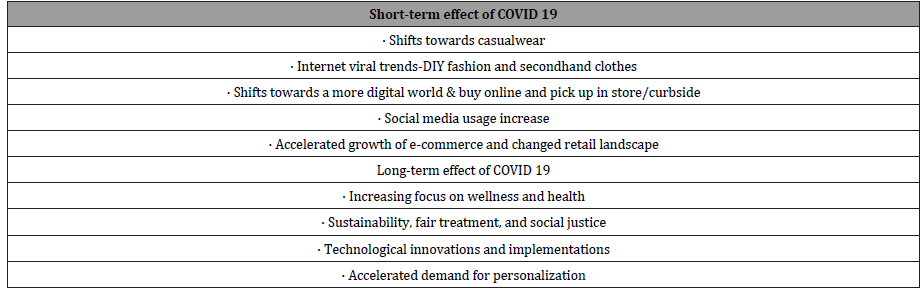

Table 2:Summary of short-term and long-term effects of COVID-19.

According to another manger from Nordstrom, consumers’ shopping post COVID is expected to be a more at-home experience. With this statement, the manager added that with the aid of advanced technologies such as virtual reality or some other technologies, retailers soon will be able to bring the store to their customers and offer them personalization, comfort, and convenience on a whole new level. Likewise, a report from McKinsey & Company [33] indicated strong successful companies will soon scale up and strengthen their digital capabilities such as livestreaming, omnichannel inventory capabilities, and social commerce platforms as new ways of engaging with consumers online to improve the customer journey and a broader customer experience. Although there is no clear answer to how consumers will shop after the pandemic, the vital element to succeed in the digital era is that brands need to understand customers as whole human being with minds, hearts, and spirits and apply humancentric marketing to attract customers [30]. That is, companies now need to engage with consumers at a personal level by paying close attention to each individual consumer’s specific needs and desires and provide more personalized shopping experiences. Table 2 provides the summary of short-term and long-term effects of COVID-19.

Conclusion

The fashion retail industry is an industry that affects every person, and every person who shops for apparel impacts the fashion retail industry. The COVID-19 pandemic, the lockdown it caused, and the adjustments it forced upon the country have seriously affected the future of this industry and the future of apparel shopping. Consumer behavior and attitudes toward shopping and apparel caused by the pandemic have altered the retail path by radically accelerating the advancements that were already planned for the future of the fashion retail industry. Retailers have to quickly adjust to these changes before they become obsolete in this extremely saturated global market. Through the extensive research that was conducted and collected on this topic, this paper identified areas of change and discussed how these changes are going to be important to succeed in the fashion retail industry.

Acknowledgement

None.

Conflict of Interest

Authors declare no conflict of interest.

References

- JP Morgan (2020) How COVID–19 has transformed consumer spending habits: Have consumer spending habits changed for good as a result of the COVID-19 pandemic?

- Retail Customer Experience (2020) Consumers back to non-essential shopping, reveals study.

- CNBC (2020) GOP congressman says US should ‘slowly’ reopen for business, barbers can wear masks.

- McKinsey & Company (2020) Consumer sentiment and behavior continue to reflect the uncertainty of the COVID-19 crisis.

- Mollard M (2020) Fashion trends during and post-pandemic: What is and will be trending?

- USA Today (2021) A year of pandemic dressing: 8 ways our style changed in quarantine.

- The Wall Street Journal (2020) Tie-dye clothes are everywhere. When will it end?: The pandemic helped cement tie-dye as the biggest fashion trend of 2020, but even longtime fans fear that the pattern has become too popular.

- CNN (2020) Tie-dye on the rise as a pandemic pastime.

- Insider (2020) Tie-dye is making a massive comeback during the pandemic- and its resurgence mirrors a history of the trend’s popularity during times of societal unrest.

- Instyle (2020) American fashion hanged after the depression, and it’s about to reinvent itself again.

- The New York Times (2020) Secondhand shoppers worry about their favorite local spots.

- Bhatti A, Akram H, Muhammad Basit H, Usman Khan A, Mahwish Raza Naqvi S, et al. (2020) E-commerce trends during COVID-19 Pandemic. International Journal of Future Generation Communication and Networking 13(2): 1449-1452.

- McKinsey & Company (2020) The state of fashion 2021: In search of promise in perilous times.

- The CMO Survey (2020) COVID-19 and the State of Marketing: The CMO survey report of results by Firm & Industry Characteristics.

- CNBC (2020) Curbside pickup at retail stores surges 208% during coronavirus pandemic.

- Total Retail (2021) Retail trends that will outlast the pandemic.

- Deloitte (2021) 2021 retail industry outlook: The new rules of retail.

- McKinsey & Company (2020) The State of Fashion 2020 Coronavirus Update.

- Bianchi F, Dupreelle P, Krueger F, Seara J, Watten D, Willersdorf S (2020) Fashion’s Big Reset. Boston Consulting Group.

- McKinsey & Company (2021) The state of fashion 2021.

- Businesswire (2020) Global athleisure market expected to grow with a CAGR of 6.7% during the forecast period, 2019-2026.

- Pickartz M (2019) 4 trend technologies for the functional clothing for the future.

- The Week (2019) Temperature regulated smart clothes that keeps you cool.

- Berg A (2021) Five charts that set the tone as New York Fashion Week 2021 kicks off. McKinsey & Company.

- IBM (2020) Meet the 2020 consumers driving change: Why brands must deliver on omnipresence, agility, and sustainability.

- Hassim A (2021) Why younger generations are more willing to change in the name of sustainability.

- Sheth J (2020) Impact of Covid-19 on consumer behavior: Will the old habits return or die? Journal of Business Research 117: 280-283.

- Lau A (2020) New technologies used in COVID-19 for business survival: Insights from the hotel sector in China. Information Technology & Tourism 22: 497-504.

- Walk-Morris T (2020) How the COVID-19 pandemic is pushing brands to connect digitally. Retail Dive.

- Kotler P, Kartahata H, Setiawan I (2017) Marketing 4.0: Moving from traditional to digital. Wiley, Hoboken, NJ.

- Elle (2020) Fashion brands are launching digital workshops & live Q&As - Here's how to connect with your fave designers.

- Kotler P, Kartahata H, Setiawan I (2021). Marketing 5.0: Technology for humanity. Wiley, Hoboken, NJ.

- McKinsey & Company (2020) The great consumer shift: Ten charts that show how US shopping behavior is changing.

-

Meredith Nealon, Jung-Hwan Kim. The Short-Term and Long-Term Effects of COVID-19 on the Fashion Retail Industry. 8(4): 2021. JTSFT.MS.ID.000691.

-

COVID-19, Fashion, Retail Industry, Consumer survey, Fashion industry, Athletic wear, DIY trends

-

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.