Research Article

Research Article

The Importance of Food Supplements in Pharmacies and The Evaluation of Sales Marketing Dynamics

Asli Buyukkoc*, Sidika Ozturk, Hale Buyukhelvacıgil, Beril Koparal and K Taha Buyukhelvacıgil

Department of Pharmacology Research, Zade Vital, Yeditepe Eczacilik, Zade Globalc, Turkey

Aslı BÜYÜKKOÇ Zade, Vital® Nutritional Supplements, Chemıst, Project and Training Specialist, Istanbul, Turkey, Tel: +90 553 498 84 09; Email: abuyukkoc@zade.com.tr.

Received Date:March 08, 2019; Published Date: April 09, 2019

Abstract

Herbal products have been in use for thousands of years. According to a notification issued by the World Health Organization (WHO) [1], 70-80% of the world population uses herbal additives and supplements within the framework of basic healthcare services. It is stated that 60 billion USD are spent each year in the USA in this field while 5 billion USD were spent for “over-thecounter” products in Europe in 2003. This study is significant in terms of determining the strategy for healthcare requirements of people and the importance of visual and category design for food supplements in pharmacies in the field of sales and marketing in Turkey, the preferences of customers entering pharmacies, the contribution of campaigns to the sales, the ratios of product groups sold in pharmacies, the age range of customers entering pharmacies, the preferred price scale, the product variety within pharmacies as well as the importance of food supplements in our lives. This exploratory study is conducted with 219 pharmacists from various cities in the whole of Turkey. Data about the location of the pharmacy, the number of persons entering the pharmacy, the most preferred product categories, the age range, preferences and price scales, the contribution of campaigns to sales and the impact of in-pharmacy category management, product variety, visual quality on people and sales within the pharmacy are collected via a questionnaire. In this study, answers to the above-mentioned questions yielded positive results. Therefore, the importance of food supplements in pharmacies and the contribution to the sales of in-pharmacy categorization, visual quality and information were emphasized in this study.

Introduction

The food supplements market is getting bigger and bigger in Turkey. These are concentrated or extracted dietary supplement products that are administered orally in addition to any nutrients in our diet. Both local and international manufacturers are introducing new food supplements to the market with each passing day. Studies have demonstrated that food supplements are being used widely in our country just like the rest of the world. The most popular food supplements tend to be vitamins and vitamin-mineral complexes. These supplements are available as tablets, capsules, soft gel, gelatin capsules, liquid or powder. According to the results of the National Health and Nutrition Examination Survey (NHANES) conducted periodically in the USA; the frequency of regular vitamin and mineral use by adults which was 25% in NHANES I was increased to 35% in NHANES II and 40% in NHANES III. Numerous international studies serve to prove that multivitamins and minerals are the most widely used food supplements. Nearly half of the US population is using food supplements. Euromonitor International anticipates that the European food supplements market [2] will increase from 7,2 billion Euros to 7,9 billion Euros in 2020 with a growth of 9,5%. Food supplements are vital for life and comprise a health requirement for persons of particular ages and with specific health conditions.

Materials and Methods

In Turkey, the food supplements market segment is getting bigger and bigger every day. Despite this, limited number of visuals and marketing studies on customer behavior are employed in order to vitalize sales in pharmacies and to increase awareness about food supplements. This study is an exploratory study about the awareness of consumers using food supplements and sales in pharmacies. This study is conducted on September-October- November 2018 (3 months) in 219 pharmacies throughout Turkey and by filling in the questionnaire during face-to-face interviews of 219 pharmacists. The questionnaire contains a total of fifteen questions about categories contributing to sales in the pharmacy, positioning, customers entering the pharmacy on the basis of the pharmacy’s location, the preferred price range, product categories and the mean age of customers.

The survey questions are as follows:

• Daily number of visitors

• Location of the pharmacy

• Mean ages of persons visiting the pharmacy

• % of drugs sold in the pharmacy

• % of dermocosmetic products sold in the pharmacy

• % of food supplements sold in the pharmacy

• The first product requested by customers

• Busiest days of the pharmacy in a month

• Price range preferred by customers

• Advantages of the product variety available in the pharmacy in terms of sales

• Number of marketing campaigns organized on a monthly basis

• Contribution to sales of marketing campaigns in %

• Impact of visuals and notices available in the pharmacy on customers

• % sales of products placed at the checkout counter

• Contribution to the sales of category management in the pharmacy

Results

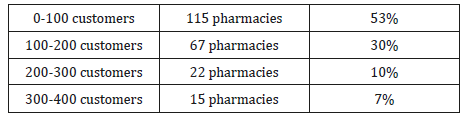

Daily number of visitors

(Table 1) According to the survey, the daily number of visitors is less than 100 in 53% of pharmacies and between 100-200 in 31% of pharmacies. 17% of the pharmacies indicated that the daily number of visitors is above 200.

Table 1:Ranges of the Numbers of Visitors to the Respondents’ Pharmacies (%).

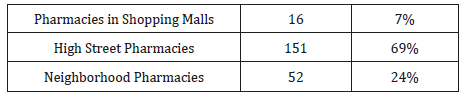

Location of the Pharmacy

(Table 2) When pharmacies are classified in 3 groups, 69% are high street pharmacies whereas 24% are neighborhood pharmacies and 7% are located in shopping malls.

Table 2:Locations of the Respondents’ Pharmacies (%).

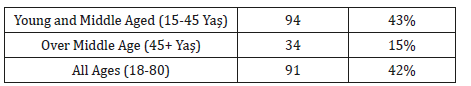

Mean ages of visitors to the pharmacy

(Table 3) The examination of the mean age of daily visitors revealed that 42% of visitors are people of all ages whereas 43% comprise of young and middle aged (15-45 years) persons and 15% are middle aged (45+ years).

Table 3:Mean ages of persons visiting the Respondents’ Pharmacies (%).

% of drugs sold in the pharmacy

(Table 4) When the products sold in pharmacies are classified in 3 groups as drugs, dermo cosmetics and food supplements, the following results are obtained: 7% of drugs sold in pharmacies account for 0-25% of sales whereas 29% account for 25-50% out of which 46% and 19% account for 50-75% and 75-100%, respectively.

Table 4:Order of Preference of Drugs sold in the Respondents’ Pharmacies (%).

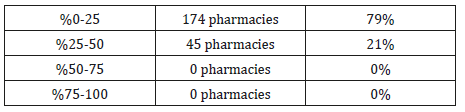

% of dermocosmetics sold in the pharmacy

(Table 5) While 79% of dermocosmetics sold in pharmacies account for 0-25% of sales 50-75% and 75-100% groups have no sales whatsoever and thus score 0%.

Table 5:Order of Preference of Dermocosmetics sold in the Respondents’ Pharmacies (%).

% of food supplements sold in the pharmacy

(Table 6) While 69% of dermocosmetics sold in pharmacies account for 0-25% of sales 29% account for 25-50 out of which only 2% reach the 50-75% level, and the 75-100% group has no sales and thus scores 0%.

Table 6:Order of Preference of Food Supplements sold in the Respondents’ Pharmacies (%).

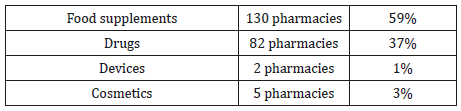

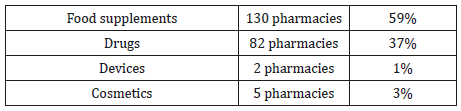

The first product requested by customers

(Table 7) The examination of the first category of product requested by customers entering the pharmacy revealed that 59% requested food supplements, 37% requested drugs, 1% requested medical devices and 1% requested cosmetics.

Table 7:Categories of Products First Requested in the Respondents’ Pharmacies (%).

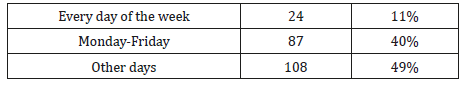

Busiest days of the pharmacy in a month

(Table 8) The examination of the busiest days of the pharmacies in a given month revealed that 11% of the pharmacies are busy every day while 40% are busy on Mondays and Fridays on a 7-day week basis. When other days are considered, it was established that 49% of pharmacies are busy on these days on a 6-day week basis (Sunday excluded).

Table 8:Ratio of the Busiest Days in the Respondents’ Pharmacies (%).

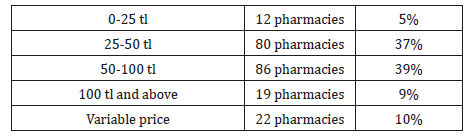

Price range preferred by customers

(Table 9) Based on the purchasing power of pharmacy visitors, the preferred price range is as follows: 5%, 37%, 39% and 9% of the visitors prefer products sold for 0-25 tl, 25-50tl, 50-100 tl and above 100 tl, respectively, whereas 10% prefer a variable price range.

Table 9:Price Ranges Preferred by Customers of the Respondents’ Pharmacies (%).

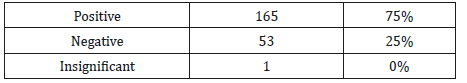

Advantages of the product variety available in the pharmacy in terms of sales

(Table 10) It was observed that the product variety available in the pharmacy has a positive effect on sales in 75% of cases whereas it has a negative influence for 25% of customers. The ratio of customers who consider this variety insignificant is 0%.

Table 10:Advantages of the product variety available in the respondents’ pharmacies in terms of sales (%).

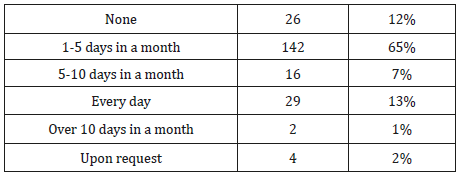

Number of marketing campaigns organized on a monthly basis

(Table 11) The examination of the rates of marketing campaigns organized by pharmacies on a monthly basis revealed that 12% of the pharmacies do not organize any campaigns while 65%, 7%, 13% and 1% organized campaigns for 1-5 days in a month, every day of the month, over 10 days in a month and upon the customers’ request and wishes, respectively.

Table 11:Rates of marketing campaigns organized on a monthly basis in the Respondents’ Pharmacies (%).

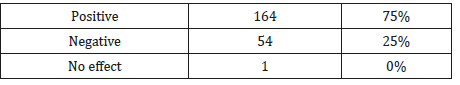

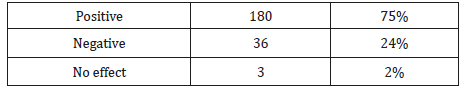

Contribution to sales of marketing campaigns in %

(Table 12) It is found out that campaigns organized in pharmacies have a positive effect in 75% of cases, a negative effect in 25% of cases and no effect in 0 cases.

Table 12:Contribution to sales of marketing campaigns in the Respondents’ Pharmacies (%).

Impact of visuals and notices available in the pharmacy on customers

(Table 13) It is established that visuals and notices available in pharmacies have a positive effect in 82% of cases, a negative effect in 16% of cases and no effect in 2% cases.

Table 13:Rates of Impact of visuals and notices available in the pharmacy on customers in the Respondents’ Pharmacies (%).

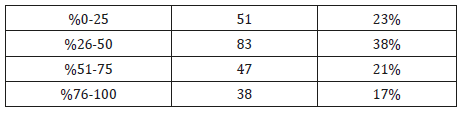

% sales of products placed at the checkout counter

(Table 14) The examination of the effect on sales of products placed at the checkout counter revealed that these products have an effect of 0-25%, 25-50%, 51-75% and 76-100% in 23%, 38%, 21% and 17% of cases, respectively.

Table 14:Rates of sales of products placed at the checkout counter in the Respondents’ Pharmacies (%).

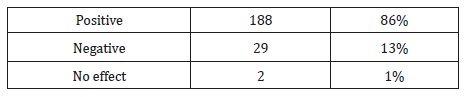

Contribution to the sales of category management in the pharmacy

(Table 15) It was established that the contribution to the sales of category management in the pharmacy was positive, negative and had no effect in 86%, 13% and 1% of cases, respectively.

Table 15:Ratios of Contribution to the sales of category management in the pharmacy in the Respondents’ Pharmacies (%).

Discussion and Result

As apparent from this study, the food supplements sector is continuing to grow in Turkey. For this reason, it is important to ensure that the timing for category management, product positioning and campaigns fall on the days during which the pharmacies are visited the most. In this study, pharmacists indicated that they are busiest on Mondays and Fridays. It was also understood that they preferred these 2 days of the week for campaigns in order to ensure circulation of stocked products and that they also organized campaigns for 1-5 days as action within the pharmacy. It was established that these campaigns have a positive effect for the pharmacy as they increased sales. While product variety provides an advantage, it also serves as a guide to how to position which products in a pharmacy. It is determined that it would be beneficial for each pharmacy to choose and implement campaigns by assessing requests based on its location and patient profile. Based on pharmacies responding the survey, it is found out that products in the 50-100 TL price range are preferred more. For this reason, companies should not overlook this range while establishing a marketing strategy for their products. While online trade is currently increasing, 43% of young people and adults still prefer to purchase food supplements and other healthcare products from pharmacies after consulting the pharmacist. At this point, any improvements in cross-sales will contribute to the sales in pharmacies. It was also understood that the period during which products placed at the checkout counter are in demand is over. Pharmacists are now requested to have available spaces in the pharmacy supported with visuals instead of checkout counters.

Furthermore, positive feedback was also obtained from pharmacists in terms of category management. Products can be categorized in order to attract the customers’ attention, to manage their perception based on their fields of interest and to ensure that they spend time with their most preferred category. It is observed that this method does not only ensure that the customer meets his/her needs outside of purchased products but also has positive impact on the sales potential.

Acknowledgement

None.

Conflict of Interest

The author declares no conflict of interests.

References

- World Health Organization et al. (2015) WHO traditional medicine strategy 2002–2005. Geneva: World Health Organization 2002.

- https://www.nutraingredients.com/Markets-and-Trends/Insiderview- European-foodsupplements-market-set-for-2bn-jump.

- Erden BF, Tanyeri P (2004) Besin Destekleri Kullanilmali Mi? 3-30.

- (2004) Ulkemizde Vitamin ve Mineral Eklentilerin Akilci Kullanimi. Sted 13.

- http://e-kutuphane.teb.org.tr/pdf/eczaciodasiyayinlari/ila_habreyll08/ 3.pdf.

- (2007) Gegez EA, Pazarlama Arastirmalari, Beta Basim Yayim Dagitim As. Istanbul.

- Gul C (2013) Endustriyel Bakis Acisiyla Bitkisel Urun Pazari, MISED, Sayi 31-32, p.28-30.

- Halsted Charles H (2003) Dietary supplements and functional foods: 2 sides of a coin. Am J Clin Nutr 77(4): 1001S-1007S.

- http://cmepub.com/?reqp=1&reqr=, Medical - Clinical Research & Reviews.

- https://www.dunya.com/ekonomi/ekonomi-diger/gida-takviyesipazari- 500-milyon-dolaribulacak.

- h t t p : / / h t c . c o . u k / B l o g / E u r o p e a n _ m a r k e t _ u p d a t e , % 2 0 Eri%C5%9Fim:%2028.01.2016.

- Istanbul Eczaci Odasi. https://www.istanbuleczaciodasi.org.tr/

- (2015) Food Support Market Grows Rapidly.

-

Asli Buyukkoc, Sidika Ozturk, Hale Buyukhelvacıgil, Beril Koparal, K Taha Buyukhelvacıgil. The Importance of Food Supplements in Pharmacies and The Evaluation of Sales Marketing Dynamics. Arch Phar & Pharmacol Res. 1(4): 2019 APPR.MS.ID.000517.

-

Herbal additives, Euromonitor, Marketing, Dermocosmetics products, Food Supplements, Sales Marketing, Dynamics, Pharmacies

-

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.