Research Article

Research Article

Determinants of Savings and Capital Accumulation among Rural Women Farmers in Ganye Local Government Area of Adamawa State, Nigeria

Moses JD1, Okpachu SA2*and Okpachu OG3

1Department of Agricultural Economics and Extension, Adamawa State University, Mubi

2Department of Agricultural Education, Federal College of Education (T), Potiskum

3International Institute of Tropical Agriculture, Abuja

Okpachu SA, Department of Agricultural Education, Federal College of Education (T), Potiskum.

Received Date: October 23, 2019; Published Date: October 29, 2019

Abstract

This study examined the determinants of savings and capital accumulation among rural female farmers in Ganye Local Government Area of Adamawa State. A multi-stage random sampling technique was used to select 100 rural female farmers. Data were analyzed with the use of descriptive statistics and the multiple linear regression analysis. The study showed that the mean age of farmers in the study area was 37years with mean household size of 11 persons. The mean farm size is 0.74 hectares with a mean annual income of 45, 0000 Naira. The result also showed that majority of the rural farmers save or accumulate capital in non-monetary form as a strategy of saving and are motivated to save in order to increase production. The result of the multiple regression analysis showed that farm cash income, non-farm cash income, total farm output and nearness to local market had a significant positive influence on the rural female farmers volume of savings and accumulation of capital, while, household size had a significant negative influence on the farmers volume of savings. It is therefore the recommendation of the study that to further improve on rural farmers savings in the study area, the government should make credit available by empowering formal and informal financial institutions activities in rural areas. The study recommended that Government, stakeholders and policy makers should provide incentives in the form of shortand medium-term loans to enhance the productivity and income levels of the rural female farmers. Also, informal savings institution like the Asusu club should be allowed to register with the state ministry of commerce and industry

Keywords:Savings; Capital accumulation; Rural female farmers; Agricultural credit

Introduction

Agriculture is an engine of growth and poverty reduction in countries where it is the main occupation of the poor but the sector is underperforming in many developing countries, in part because women, who represent a crucial resource in agriculture and the rural economy through their roles as farmers, laborer’s and entrepreneurs, almost everywhere face more severe constraints than men in access to productive resources. Women make essential contributions to the agricultural and rural economies. Women farmers represent more than a quarter of the World’s population and comprise about 43 per cent of the agricultural labor force in developing countries. Food and Agricultural Organization [1] estimates that if women globally had the same access to productive resources as men, they could increase the yields on their farms by 20-30 per cent thereby increasing incomes and decreasing hunger. Studies show that resources controlled by women are more likely to be used to improve household food consumption and welfare, reduce child malnutrition, and increase the overall well-being of the family. In developing countries, Nigeria in particular, Women play vital roles in food production, processing and marketing; producing about 60- 80 percent of food in the country [2,3] and contributing about 60-80 percent of agricultural labor force [2]. Egwu and Nwibo [4] reported that rural woman spends most of their income immediately on household needs and often have to make up deficiencies of what their husbands provided for them. Women also use their income to meet a variety of household and personal expenses and thus will be left with little or nothing to save. Even though millions of women throughout the world contribute to national agricultural output and family food security, detailed studies from developing countries consistently indicate that rural women are more likely to be financially constrained than men of equivalent socioeconomic status.

In recent years, there has been a paradigm shift from microcredit provision to microfinance with savings as the means for capital accumulation. Given the scarcity of economic resources and insatiability of human wants, there can never be a better future or development of any kind without capital accumulation in the present. Savings therefore becomes a necessary factor for development and investment at rural and national levels. Saving is a means of accumulating assets that perform specific function for the saver [5]. Capital on the other hand is the large amount of money that is used to set up a business (capital funds) while accumulation is the process of building up capital stock through positive net investment. Capital accumulation is low in developing countries such as Nigeria due to low levels of income and low saving level. With low investment output becomes low which leads to low income and as well translates to low savings. This situation perpetuates the vicious cycle of poverty. According to Osondu, Obike and Ogbonna [6], capital accumulation is very difficult because with low incomes, very little savings or investment occur out of existing income.

Savings of rural women is one of the factors that could help them overcome the effect of constraints in production and achieve their potentials. Their savings have a multiplier effect to the economy. It contributes to the accumulation of financial capital at household as well as national levels. It also helps to reduce vulnerabilities in times of shocks.

Even though millions of women throughout the world contribute to national agricultural output and family food security, detailed studies from developing countries consistently indicate that rural women are more likely to be financially constrained than men of equivalent socioeconomic status [7]. Previous research findings on savings have dwelled more on household savings with the male heads of households as the respondents. While women are also active and constitute half of the working labor force in rural areas, they also take part in savings mobilization, but are not usually taken into consideration.

Considering the important contribution of women in the economy, it is imperative to understand their savings mobilization from the perspective of rural women. Therefore, this study intends to investigate the strategies employed by the rural female farmers in Potiskum Local Government Area to mobilize savings and accumulate capital. Also, the various financial institutions patronized by the farmers and the extent of their patronage as well as various problems and constraints facing rural female farmers in their savings and capital accumulation efforts were addressed. In the same vein, the effect of socioeconomic characteristics of these rural farmers on their level of savings and capital accumulation were also determined.

Methodology

Study area

The study was conducted in Ganye Local Government Area of Adamawa State, Nigeria. The local government is noted to be one of the major foods producing areas in Adamawa State. Ganye LGA is a local government area in Adamawa state located in the town of Ganye, as the area council consists of the following districts of Gurum, Yebbi, Timfore, Jaggu, Ganye, Bakarigusso and Sugu. According to the 2006 population census, the local government area has a population of 169, 948 people made up of 85,798 males and 72,335 females [8].

Sampling procedure

A multi-stage random sampling procedure was employed in the selection of respondents for the study. Ten communities were randomly selected from the twenty communities. 15 farming households were randomly sampled from each of the selected communities. This gave a total of 150 farming households that were sampled and administered with questionnaire for the study. However, out of the 150-questionnaire administered, 100 of the questionnaires were returned and analyzed for the study

Data collection

The data for the study were obtained from primary sources through the use of structured questionnaire that were administered to the sampled rural female farmers. The questionnaire was drawn to elicit information on the socioeconomic characteristics of the farmers, form and technique of savings and capital accumulation, various formal and informal savings institutions patronized and the rates, problems militating against their savings and capital accumulation efforts among others.

Data analysis

Data generated for the study were analyzed with the use of Descriptive statistics such as percentages, frequency distribution and means as well as multiple regression analysis. Following Ike and Umuedafe [9], the multiple regression expressed the effect of socioeconomic variables on the level of savings and capital accumulated. The regression model was implicitly specified as:

Y = β0 + β1X1 + β2X2 + β3X3 + β4X4 + β5X5+ β6X6 + β7X7 + β8X8 + μ

Where,

Y = volume of savings/capital accumulated

β0 = Constant

β0 – β8 = Coefficients

X1 = Family size of respondents.

X2 = Level of education (Years)

X3 = Farming experience (Years) β

X4 = Farm cash income (Naira)

X5 = Non-Farm cash Income (Naira)

X6 = Total farm output (Naira)

X7 = Distance of nearest saving institution (km)

X8 = Distance of nearest local market (km)

μ = Error term

The lead equation was chosen on the basis of conformity with a priori expectations of parameters, statistical as well as econometric criteria such as the magnitude of R2 and the t-values of the estimates and the number of significant variables in each estimated equation.

Results and Discussions

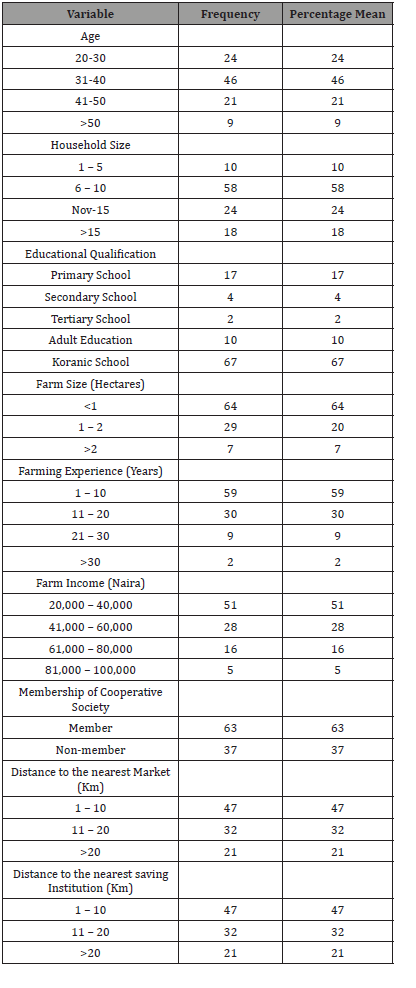

Socio- economic characteristics of respondents

The result of the socioeconomic characteristics of respondents is summarized in Table 1. The average age of the rural female farmers is 37 years which indicate that the farmers are young, active, energetic and in their productive age. Also, young people are believed to save more. The mean family size is 11 indicating that large family size which is typical of a developing country like Nigeria. Large family saves less since the needs of other members of the household have to be met. Table 1 also revealed majority of the respondents (67%) had Quaranic education, while 33% of the respondents were literate with diverse formal educational level ranging from primary school education to tertiary education. Possession of formal education will enable the farmers adopt agricultural innovations and this can impact on their level of income that could be generated from their farm activities through improved agricultural innovations, hence improving the capability of the farmers to save. The distribution of respondents according to farm size is shown in Table 1. The table showed that majority of the farmers (64%) had farm sizes of less than one hectare, while 29% of them had farm sizes of between 1 to 2 hectares. The mean farm size of the respondents is 0.74 hectares, indicating the small holdings of the rural women farmers result in low output, low income and lower propensity to save. In view of this, 51% of the farmers earn an income of between N20, 000-N40, 000 which on the average amounted to N45, 000 per annum. This finding signified a low-income generation level of the households in the area which will not support savings.

Furthermore, it was noted that the rural women farmers covered a mean distance of 13km to reach to the nearest market to sell their farm produce. A critical analysis on the distance showed that the women in African context spent relatively small distance to get to the market. Hence, the close distance will have positive impact in reduction of transportation cost which invariably encourages saving.

The nearness of financial institutions not only encourages saving and deposits, but reduces the cost and risks associated with cash movement. According to Obalola, Audu and Danilola [10], distance to banks predicts saving behaviour of rural consumers. Based on the foregoing, the study showed that the women farmers of Yobe State, Nigeria covered a distance of 13km and above to reach to the nearest financial institution. This showed a relatively large distance as most of the rural women lack mobility means to reach to the financial institutions which are mainly located in the urban areas. This in fact, does not encourage saving as most of them do lack information on saving, and face risks of theft during cash movement.

Table 1:Socio-economic characteristics of the respondents

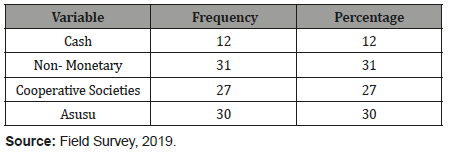

The methods of savings and capital accumulation

The findings of the survey of various methods of saving and capital accumulation in the study area are presented in Table 2. The result indicate that 12 percent of the rural female farmers save or accumulate capital in cash, 31% save in non-monetary from such as land, storing in barns, crop, livestock and other valuables etc. 27% save in co-operative societies, and 30 percent save in Asusu club This implies that majority of the rural farmers in the study area save or accumulate capital in non-monetary forms.

Table 2: Distribution of respondents according to Method of Saving and Capital Accumulation.

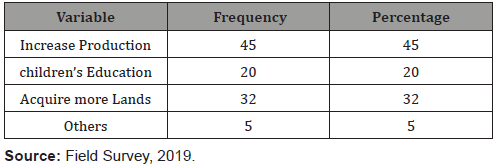

Motives for saving and capital accumulation

The various reasons for savings and capital accumulation as attested to by the respondents through multiple responses to items are presented in Table 3. About 45% save to increase their level of agricultural production while over 20% of the respondents save to enable them to educate their children. Again 32% were saving so as to acquire more land. This implies that most of the rural farmers are motivated to save or accumulate capital primarily to increase production as well as ensuring the proper education of their children.

Table 3:Distribution of respondents according to Motives for Saving and Capital Accumulation.

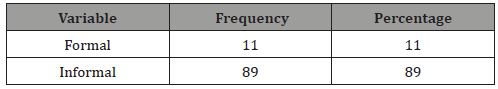

Table 4 shows that a total of 89% (94) of the rural farmers patronize informal saving institution while 11% patronize formal saving institution. This survey indicate that majority of the respondents patronize informal savings institution for credit needs. This as they claimed is because they prefer to save in institutions where they will get financial assistance in times of need.

Table 4:Distribution of respondents according to Savings Patronized by Respondents.

Determination of impact of socioeconomic characteristics on savings and capital accumulation

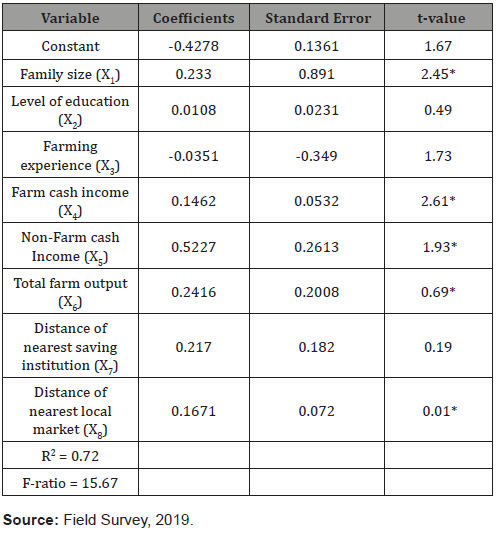

The result for the determination of the impact of socioeconomic characteristics on savings and capital accumulation of rural women farmers in the study area is presented in Table 5. Based on the regression outputs, the linear functional form was chosen as it conformed to the a priori expectations; a better line of fit (R2) and a greater number of significant variables. The R2 value of 0.72 indicate that about 72% of the variations in the dependent variable were influenced by the independent variables as entered in the model. In the same vein, an F-ratio of 15.67 indicates that the overall equation is significant at 5% level.

Table 5:Regression estimates for the determinants of Savings among Rural Female Farmers

Among the eight parameters included in the model, five were significant. The table shows that the coefficient for family size, farm cash income, non-farm cash income, total farm output and distance to nearest local market were all significant at 1% level, while the coefficient of household size was significant at 5%. However, the coefficient educational level, farming experience and nearness to saving institutions were not significant. This implies that the rural female farmer’s volume of saving or accumulated capital is based on their family size, farm cash income, non-farm cash income, total farm output and distance to nearest local market.

Household size had a significant negative coefficient on the volume of savings of small-scale farmers. This implies that a farmer with small household will likely save more of his income. Thus, this is in line with a prior expectation, as increase in household size, reduces the capacity of farmers to save. This contradicts the findings of Osondu, Obike and Ogbonna Osondu [6] that farmers with large household sizes save more of their income. The coefficient of farm cash income was positively signed and statistically significant at 1%. This conformed to the a priori expectation. Thus, an increase in the farm cash income of rural women farmers will lead to a significant increase in their saving capacity. This is expected since farm produce serves as a major source of farm income to rural households. The finding corroborated Nuhu, Bzugu and Kwajaffa [7] who posited that income viability of farm families had positive influence on their saving potentials. Non-farm income is statistically significant in the model. This implies that the earning from non-farm activities is most likely to influence their volume of saving or capital accumulation of the rural farmers. If they are intensively involved in these non-farm activities like petty trading, hair dressing, sewing etc. they are likely to save or accumulate more capital than those who are not involved. Again, the coefficient of farm output (x6) was positive and significant at 1% level. This showed that increase in farm output of rural women farmer will lead to a significant increase in their saving capacity. This conformed to the a priori expectation since increased yield may translate to increased income to farmers, hence impacting positively on the saving capacity. The coefficient of distance of the nearest market was positively signed as expected and statistically significant at 1%. Thus, the nearer a market is to the rural women famers, the higher will be their capacity to saved. This agrees with the a priori expectation since closeness of the market enables the farmers to sell off both their final and intermediates product with minimal wastage or loss. Equally, nearness of the market reduces the cost of transporting goods thereby increasing the revenue accruing to the farmers. Therefore, the above analysis shows that the rural women’s saving capacity is greatly influenced by any means that encourages the increase in their income generation.

Conclusion and Recommendations

This study investigated savings and capital accumulations strategies among rural farmers in Potiskum Local Government Area of Yobe State. Family size, Farm cash income, non-farm cash income, total farm output and nearness to local markets were found to significantly affect the volume of savings and capital accumulation in the study area. It shows that these socioeconomic variables have impact in the volume of savings and capital accumulation of the rural female farmers. To further improve on savings and capital accumulation of rural female farmers and in view of their deficiency in the study area, it is suggested that:

The government should make credit or loan available to rural female farmers by empowering formal and informal financial institutions to meet the credit needs of rural dwellers.

The government should create enabling socio-economic environment that will increase the rural women farm income through market creation for farm output and subsidy in the price of farm input. Again, the rural financial intermediaries should encourage farmers to save by raising the interest paid on saving; this will discourage farmers from saving in kind or hoarding cash in the house which usually lead to loss of wealth in case of thefts,

Creation of market corridors to be close to production areas to reduce distance to local market. The informal savings institution like the Asusu club, co-operative societies among others should be brought into the national credit system. In order to achieve this, they should be allowed to register with the state ministry of commerce and industry.

Acknowledgement

None.

Conflict of Interest

No conflict of interest.

References

- Food Agricultural Organisation (2017) Women and Food Security, FAO Programme.

- International Labour Organisation (2017) Working in the rural areas in the 21st century: Reality and prospects of rural employment in Latin America and the Caribbean, Regional Office for Latin America and the Caribbean 3: 1-38.

- Nuhu HS, Bzugu PM, Kwajaffa AP (2015) Determinants of Savings among Rural Women in Borno State, Nigeria. Asian Journal of Agricultural Extension, Economics & Sociology 5(4): 202-214.

- Egwu PN, Nwibo SU (2014) Determinants of Saving Capacity of Rural women Farmers in Ebonyi State, Nigeria Global Journal of Agricultural Research, Published by European Centre for Research Training and Development UK 2(1): 1-10.

- Uhuegbulem IJ, Henri Ukoha A, Osuji MN, Ukoha II, & Oshaji IO (2016) Determinants of Savings among Small-Scale Food Crop Farmers in Owerri West Local Government Area of Imo state, Nigeria. Journal of Agriculture and Social Research (JASR) 16(2).

- Osondu CK, Obike KC, Ogbonna SI (2015) Savings, Income and Investment patterns and its Determinants among Small Holder Arable crop farmers in Umuahia capital territory, Abia state Nigeria. European Journal of Business and Innovation Research 3(1): 51-70.

- Nuhu HS, Donye AO, Bzugu PM, Ani AO (2015) The Relationship between Savings Mobilization Techniques and Livelihood Activities of Rural Women in Borno State, Nigeria. International Journal of Academic Research in Business and Social Sciences 5(3).

- National Population Council (NPC) (2006) Census Report. National Population Commission (NPC) Umuahia, Abia State, Nigeria.

- PC Ike, Umudafe DE (2013) Determinants of Savings and Capital Formation among Rural Farmers in Isoko North Local Government Area of Delta State, Nigeria. Asian Economic and Financial Review 3(10): 1289-1297.

- Obalola TO, Audu RO, Danilola ST (2018) Determinants of Savings among Smallholder Farmers in Sokoto South Local Government Area, Sokoto State, Nigeria. Acta Agriculturae Slovenica 111(2).

-

Okpachu SA, Moses JD, Okpachu OG. Determinants of Savings and Capital Accumulation among Rural Women Farmers in Ganye Local Government Area of Adamawa State, Nigeria. World J Agri & Soil Sci. 3(4): 2019. WJASS.MS.ID.000569.

-

Savings, Capital accumulation, Rural female farmers, Agricultural credit

-

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.