Research Article

Research Article

A Feasibility Study for Different Crops in a High-tech Greenhouse in Turkey

Ahmet Kurklu*

Akdeniz University, Faculty of Agriculture, Department of Agricultura Machinery and Technologies Engineering, Dumlupınar Bulv. Kampüs, Turkey

Ahmet Kurklu, Akdeniz University, Faculty of Agriculture, Department of Agricultura Machinery and Technologies Engineering, Dumlupınar Bulv. Kampüs, Post code: 07058, Muratpaşa/Antalya/Turkey.

Received Date: October 13, 2022; Published Date: October 27, 2022

Abstract

Turkey is a developing country and has the richest geothermal resources in Europe for greenhouse heating, in almost every part of the country. High-tech greenhouse Investment is going on. Mostly tomatoes are grown in these greenhouses and alternative crops are also taking a lot of interest. This study focuses on the investment and production costs, calculation of return on investment (ROI) and pay-back time of the investment for four different crops(cluster and cherry tomatoes, strawberry and rose) in high-tech soilless greenhouses in a particular region covering the area between 38-40 degrees latitude and 27-30 degrees longitude, west-central part of Turkey, including Manisa, Uşak, Balıkesir and Izmir cities as hightech greenhouses are concentrated in this area. The cluster and cherry tomatoes were considered with inter-planting in a semi-closed greenhouse, strawberry in a traditional venlo type glasshouse and in a gotic type plastic greenhouse and roses in a semi-closed greenhouse. The financial study showed that both cluster and cherry tomatoes were economically feasible, return on investment (ROI) being 18.36% and 20.73%, payback periods of the investments were 5.45 and 4.82 years, respectively for both crops. A sensitivity analysis indicated that both yield/m2 and sales price/Kg were the key factors affecting ROI and payback periods along with production costs. For strawberries, payback periods for venlo type glasshouse and for gotic type plastic greenhouse were 10.61 years and 5.65 years, respectively. This meant that venlo type glasshouse would not be preferred in Turkey for strawberry investment. As for roses, profitability was 14.36% and payback period was 6.97 years, a promising area for investment. The results are expected to help and guide the high-tech greenhouse investors not only in Turkey but also all around the world.

Keywords:Hydroponic; Semi-closed; Greenhouses; Tomato; Strawberry; Rose; Investment; Feasibility; Turkey

Introduction

High-tech hydroponic or soilless greenhouses supply healthy and sustainable vegetables and in some cases fruits for the ever-increasing number of consumers almost all around the world, even in areas where the conventional growing cannot be applied either due to harsh climate, lack of agricultural land and inadequate sun light, such as depths of Siberia, desert-like harsh arid climates and heavily populated metropolitan areas [1-3]. Hydroponic crop production systems are developing and improving quite rapidly [4]. Indeed, according to a hydroponics market report, the worldwide hydroponics market was valued at USD 9.5 billion in 2020; it is now projected to reach USD 17.9 billion by 2026 [5]. It is also stated in the same report that many companies in the hydroponics market are investing heavily into R&D for obtaining state-of-art technologies that will boost the productions and also bring about variety of cultivation techniques possible. In addition, it is also indicated that strategic partnerships with research labs and institutes further drive the growth of the hydroponics market. In another report, European market though, has a lower hydroponic market value, estimated to rise from 182.1 million USD in 2021 to 200.21 million USD in 2026 [6].

High-tech greenhouses first started and built in Holland and according to Rujis and Benninga [7], Holland has about 10.000ha of greenhouses in 2019, a great majority of them being hydroponic (95%). Pardossi et al. (2004) indicates that in high-tech greenhouses, maximum yield/m2, maximum market price and maximum net income are all in Holland when compared to other countries. Some very good ideas and suggestions are laid down to boost a, what is called, “circular horticulture” especially for using high technology and management tools, in a report prepared by EIP-AGRI Focus Group [8].

Chang et al. [9] indicates that countries with extensive greenhouse usage in terms of total area include China, Spain, South Korea, Japan, and Turkey. In the European continent, Spain has the largest greenhouse area and Turkey comes second, with a total “greenhouse” area of about 35.000ha with total undercover area being 70.000ha according to the Turkish Ministry of Agriculture and Forestry [6]. Whilst Turkey has no soilless greenhouse existence in 2001 according to Pardossi et al. (2004), Aydogan et al. [10] informs that soilless growing in Turkey started in 1995 and in 2009 the total hydroponic(high-tech greenhouse) area reached 185ha, with 37% of the greenhouses utilizing geothermal energy for heating, vegetables, predominantly tomatoes grown in 92% of the greenhouses. Again, according to the Turkish Ministry of Agriculture and Forestry [6], Turkish high-tech hydroponic greenhouse area reached 1.300ha as of today, less than 1% of the total “greenhouse” area and 35% of the hydroponic greenhouses are heated by geothermal energy, the highest rate geothermal energy use in the world in greenhouses.

Turkey is becoming a significant player in the high-tech greenhouse business producing and selling not only the vegetables but also inventing, manufacturing and selling the technology and know-how for greenhouses, competing with European, especially French, Spanish and Dutch, rivals both in and out of Turkey. This study therefore aims to expose the market situation partly in such an important country for its hydroponic greenhouse production and investment potential.

The market potential of the crops considered

Fresh tomato consumption for 2019 in Holland was about 7.4 kg per capita per year and 9.1 kg per capita per year for USA [7]. According to a report by Koop [11], 55-95% of the Europeans eat tomatoes regularly. According to same report, on average, every Italian consumes almost 75 kg of tomatoes per year from a wide range of tomatoes. According to the data of Turkish Ministry of Agriculture and Forestry, tomato consumption in Turkey in 2019 was 114 kg per capita, which is presently almost the highest in Europe [12].

When it comes to Strawberry production; according to Eurostat Report [13], for strawberries, Spain, UK, Belgium, The Netherlands, Germany and Poland are the main producers. Spain has the highest production with 352.000 tons, then followed with 175.000 tons by Poland (all seems domestic consumption), 134.000 tons by Germany (all seems domestic consumption), 128.000 tons by UK (all seems domestic consumption), 66.000 tons by the Netherlands, the other countries much less production or no production at al. Interestingly, Greece has no strawberry production and no imports in 2019 data but seemed to export 44.000 tons of strawberry in 2019. The Netherlands export 24.000 tons of the produced strawberry (36%). Turkey is both a strawberry exporter and an importer. Turkey’s strawberry consumption in 2019 is about 4.7kg per capita, increasing steadily since 2016 [12].

As for roses, there are two segments: bigheaded roses that represent high quality roses for the flower shops. These have high in sales price and are coming from Latin America and Holland. Turkey has about 24ha total rose production area which is only just about 2% of the total flower production area and approximately 15 million roses are produced per year, which is about 1.4% of the total cut flowers [14].

By looking at the flower export statistics of 2019, Turkey seemed to be at the 25th place in the world, exported flowers were mainly other than roses. But the biggest rose exporter was, of course, Holland as usual [14].

The most flower consumption per capita was in Japan, followed by Switzerland, Denmark and Germany according to AIPH Statistical Yearbook [15]. For Turkey, no data were available on the flower consumption per capita.

Large greenhouse investments in Turkey are still very attractive and ongoing as Turkey has extensive and rich resources of geothermal energy, adequate sunlight and cheap/available labor almost in each location of the country along with being geographically almost in the center of Europe, Middle-East and North-East Asia, making it attractive also for reaching highly populated perimeter markets quite easily. The investments are also boosted by the continuous and increasing amounts of incentives and subsidies set by the Turkish state. The investments seem to focus and continue to be so on mainly tomato greenhouses(almost 99% of the high-tech greenhouses). The main reasons for such an interest are that tomato market are very stable and established, tomatoes are easy to pick up and transport, long shelf life and a very good accumulation of technical know-how on tomato growing, high tomato consumption in the local market also and finally availability of free energy source, the geothermal.

In recent years, other than tomatoes, alternatively, flowers (roses) and especially strawberry greenhouse investments are under way, offering potential investors a flexibility in marketing for relatively restricted but increasingly demanded products. That is why this study focused on 4 crops: vine (cluster) tomatoes, cherry or cocktail tomatoes, roses and strawberry.

The aim of this study is to lay down basic investment and cost data and show profitability levels of the investments for these crops. The data could be adapted to different climates of the world with some modifications.

Financial state supports/subsidies

There are mainly 4 significant incentives or subsidies in Turkey

for greenhouse investments irrespective of whatever vegetables or

flowers are grown:

• VAT (18%) exemption on locally supplied and imported goods

for the investment

• Customs tax exemption (2%),

• Ziraat Bank (a state bank) undercover production support:

this bank finances such investments with the condition that

25% of the investment must be financed by the investors own

resources and 75% is credited by the bank. The interest rate

on Turkish lira for this credit is reduced about 60% than the

standard market interest rate of the bank. There is an upper

limit for such a credit and that was about 2 million euro for

2021. The pay-back time is 7 years, first 2 years is grace period,

only interest to be paid.

• The same bank offers also advantageous business loans once

the greenhouse is in operation.

• Regional development agency supports of a wide range.

• There are other additional supports of course such as insurance

supports for workers, tax advantages for certain periods,

payment of employer insurance bonuses by the state, etc. at

this moment.

Materials and Methods

For this study, the climate region selected was between 38 °and 40 ° latitude and 27 ° and 30 ° longitude, west-central part of Turkey covering approximately Manisa, Uşak, Balıkesir and Izmir cities, which all have very rich geothermal resources and most of the large size high-tech greenhouses in operation are concentrated in this region.

The greenhouse size for each crop was chosen as 5ha, as this was a commercial size to position the Turkish investor at an exporter level easily, which facilitates the loading of one truck (about 22 tons) of tomato for example, for each week, when the production was at its minimum in the month of January, therefore sustaining supply of the produce to the customers.

For tomato and rose greenhouses, semi-closed greenhouse technology was considered. This technology is a special climate control technology mainly, working with positive air pressure inside with higher light transmission, better CO2 use efficiency, less water consumption, less chemical use etc. Semi-closed greenhouse details can be found elsewhere [16-25].

For strawberry, as semi-closed greenhouse technology was estimated to be far from being economical, a traditional Venlo type glass greenhouse and a gotic type plastic greenhouse were considered.

For all the crops, latest greenhouse technologies were considered in the cost analysis, with minimum side wall height of 5m, venlo type glass and gothic type steel structures, thermal and shading screen, air circulation fans(only for strawberry traditional greenhouses), high pressure fog system(only for strawberry greenhouses), rail heating, side wall heating, hanging gutters, drip irrigation system, CO2 (liquid) distribution system, ground cover, water tanks, drain-water disinfection and reuse, irrigation water reverse osmosis system, electrical system and climate control system for tomato, Air Handling Units plus evaporative cooling pads for semi-closed tomato and rose greenhouses. In addition to these, for rose greenhouses, the cost of the tables and the latest technology for the management and transport of roses inside the greenhouse were included in the study.

Tomato running costs, yields and sales prices were regularly monitored by the author as the author himself installed more than 100ha high-tech hydroponic greenhouses in Turkey mainly with Dutch and Spanish builders for many years, actively in communication with the private sector. The yield and price data presentation style for tomatoes and rose were similar to that of Koop [11] with monthly production and sales prices listed. The data presented were also approved by a well-known high-tech tomato greenhouse consultant in Turkey, Güven [26], after checking also with some commercial scale tomato producers in the country. Some modifications and adjustments in number were made for semi-closed greenhouses considering geothermal energy use also, based on the semi-closed greenhouse experiences in and out of Turkey.

Strawberry running costs were obtained from [27] and data were slightly modified according to geothermal energy use and the region after consulting with a well-known strawberry consultant [28] in Turkey.

Rose data running costs were mainly obtained from a wellknown rose expert in Turkey [29] and adapted and modified for semi-closed greenhouse technology based on stem production numbers per m2 supplied by Van Tuijl [30].

The sale prices and production costs are very variable in Turkey, though quite stable in Europe. That is why all data were recent and up to date for Turkey for the year 2022 for the month of June, to have a healthier projection of the numbers.

The planting month for tomato and strawberry considered was August and the end of season was end of June-beginning of July of the next year. Year-round production with semi-closed greenhouse plus inter-planting was considered for tomatoes, also year-round production with roses. Inter-planting meant that while the firstly transplanted crop was still on the growing media, new young plants transplanted next to the older plants and as soon as the harvest from the new plants started, the old plants were removed from the greenhouse, resulting in a continuous growth and production.

The variety for cluster tomato chosen in this study was Mernice (De Ruiter Seeds) as it was a good export variety mostly preferred by Dutch growers, weighting about 150-160gr/fruit.

Though there were different varieties of cherry tomatoes in the market, a good and popular variety, Dulcito(Rijk Zwaan) was considered.

For strawberries, short day varieties (light periods less than 12-14 hours) are better for the region and these varieties are Camarosa, Florida Festival, Rubygem, Sabrina, Fortuna and Candonga. In Holland, smaller and fast ripening varieties are preferred, for example Verity variety. But, in the Turkish, Russian and Middle East markets, bigger and sweet varieties are preferred, so selected variety was Sabrina in the study. No artificial lighting was suggested for strawberry in this study.

Roses are planted for 4 or 5 years continuous production. Rose varieties that could be suggested for the region both for domestic and export purposes were many, all red roses with long stems and big heads. In the greenhouse additional lighting was required to a minimum level of 10.000lux to be able to compete with other producers and produce top quality roses in the region, so artificial lighting for this capacity was included. A popular Dutch rose variety, red Naomi was considered in the study

Total investment and running costs were entered into excel sheets for each crop and greenhouse type, then Return on Investment (ROI) and pay-pack period for each crop were calculated. ROI was calculated by first multiplying the profit/Kg by the greenhouse area and then diving it to total investment cost/m2. Pay-back period of the investment was calculated by dividing the total investment per/m2 by operational profit/m2. Operational profit was calculated by subtracting total costs from the revenue. A sensitivity analysis for especially tomatoes were carried out to check how ROI and pay-back period changes according to sales price and total yield in particular.

Results

Cluster and Cherry tomatoes

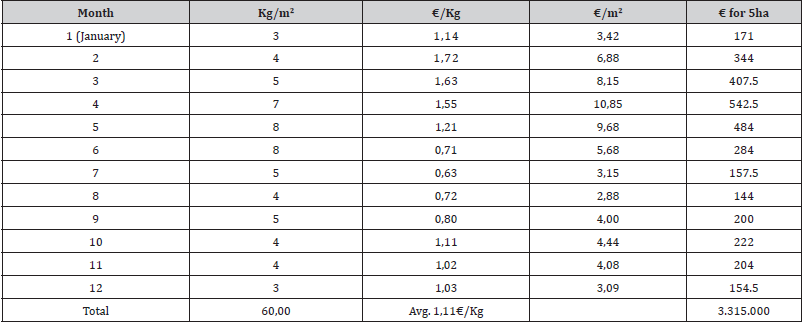

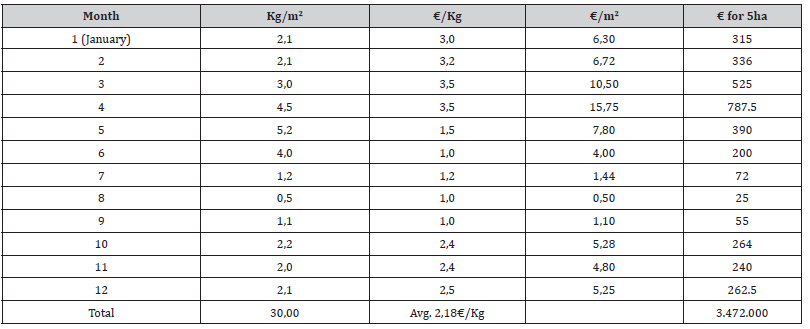

Estimated monthly yields and sales prices are shown in Table 1 for Cluster tomatoes and Table 2 for cherry tomatoes.

Table 1:Yield and price data of cluster tomatoes.

Table 2:Yield and price data of cherry tomatoes.

Cluster tomatoes average sales price was 1.11€/m2 and for cherry tomatoes, this was more than double, 2.18€/m2, which is almost a general market rule-of-thumb now. It should be kept in mind that these prices include transport and deliver to the European export markets. In the tables, €/Kg is the sales price of tomatoes. The minimum prices occur at different times for both tomatoes, totally depending on the market demands. Both Cherry tomatoes are demanded by the European market at high levels all year round and in the coming years its sales price will go higher.

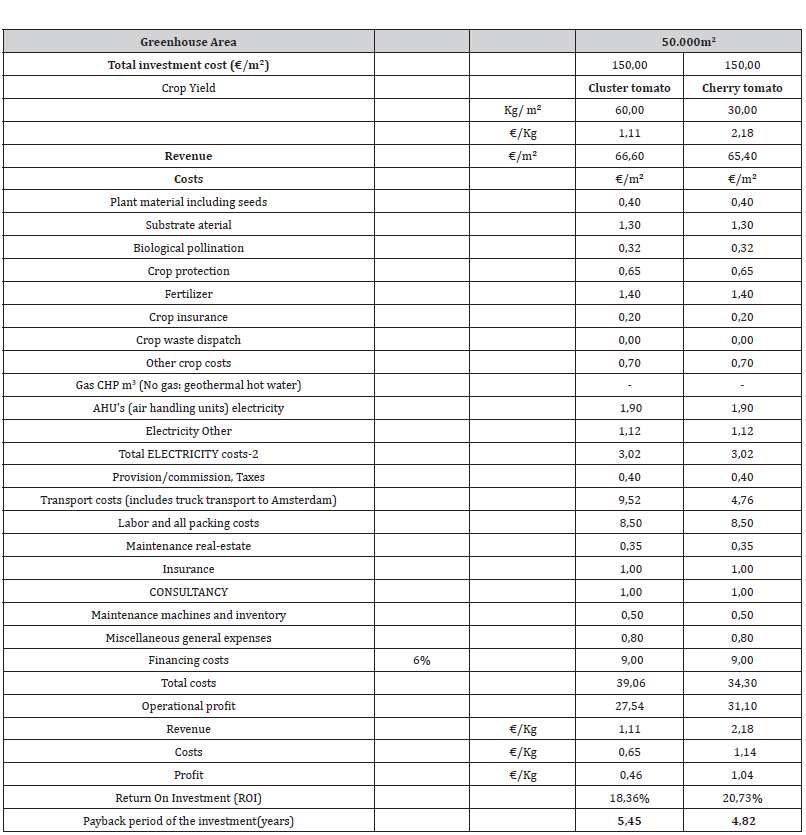

Based on these numbers, ROI study results for both cluster and cherry tomatoes are shown in Table 3 below. In this table, total turn-key investment cost for a semi-closed greenhouse(including all technologies mentioned and all logistics equipment’s necessary for the correct running of the farm) in Turkey is considered 150€/ m2, as detailed cost breaking of the technologies are not possible in this article due to space limitations, the figure is up to date based on many high-tech greenhouse projects, including semi-closed greenhouses, that was built and installed by the author himself for more than 8 years in private sector.

Table 3:ROI analysis of cluster and cherry tomatoes.

From the table, it may be commented that cherry tomato investment seems more profitable and ROI is shorter mainly because of higher sales price per kg despite the total investment is same and total yield is less. Further, as cherry tomatoes are “more valuable” in comparison with cluster tomatoes, transport costs to export market is almost halved despite same kg loading per truck. For tomatoes, first 4 biggest cost items are financing, transport, labor + packing and electricity costs. Any savings in these items without harming the yield/m2 will have positive impacts on the ROI.

Strawberries

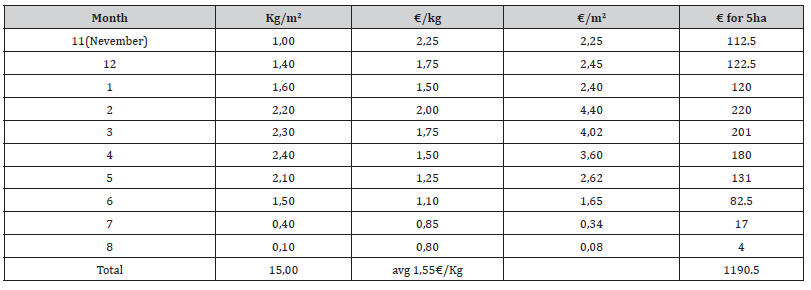

Table 4 shows yield and price data for strawberries, keeping in mind that there is no artificial lighting, the greenhouse type being Venlo glass or Gothic plastic covered, the yield data per m2 considered same, as this is the case in strawberry greenhouses in Turkey. The prices are for domestic market, delivered from the greenhouse or the packing area.

Table 4:Yield and price data of strawberry for traditional glass and plastic cover greenhouses.

Minimum strawberry prices/kg and yields/m2 are occurring in July-August as open-field strawberries are dominating the market in these months.

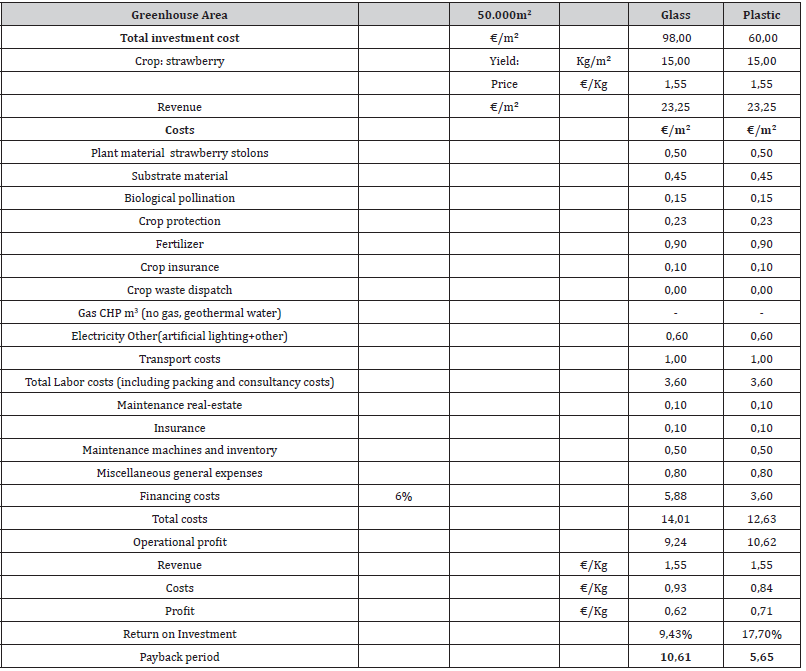

Strawberries are demanded in the Turkish market all year round and therefore these prices are excluding the export transport costs as strawberries are mostly consumed in the local market. ROI study is made for a traditional Venlo type glass greenhouse and a gothic type plastic covered greenhouse, the figures are presented in the Table 5 below . Both greenhouses have almost the same technologies inside, but the main cost difference is in their steel structures and cover. Generally, traditional Venlo glass greenhouse is 40-50% more expensive than plastic covered greenhouses with the same growing technology included.

Table 5:ROI study for strawberries for glass and plastic covered greenhouses.

From the table, it may be commented that under the present economic situation and developments in Turkey(high interest rate, high inflation rate etc.), glass greenhouses seem to be not economically feasible for strawberry investment. The highest first 4 costs seem to be financing, total labor including packing + consultancy, transport and fertilizer for both greenhouses. Financing cost of the plastic greenhouse is less than glasshouse as the total investment cost is lower.

Roses

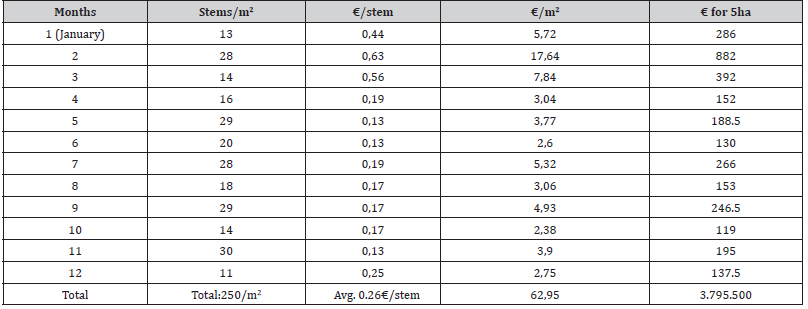

As for roses, the most important item is the number of stems per m2 that could be produced and sold from a semi-closed greenhouse with artificial lighting. This data was supplied by Van Tuijl [30] for Izmir region which is one of the cities included in this study, as 300 stems/m2. Stem lengths are between 45-55cm and bud height bigger than 45mm

However, after discussing with Kazaz [29], the number of stems/m2 was considered as 250 to be on the safe side. Table 6 shows all data for rose production from an artificially lit semiclosed greenhouse. Average stem sales price is up to date for both local and export markets.

Table 6:ROI study for strawberries for glass and plastic covered greenhouses.

It seems that for roses, stems/m2 numbers are variable as per month, minimum being in December. The highest sales price per stem seems to be in February, which is probably boosted by the lover’s day.

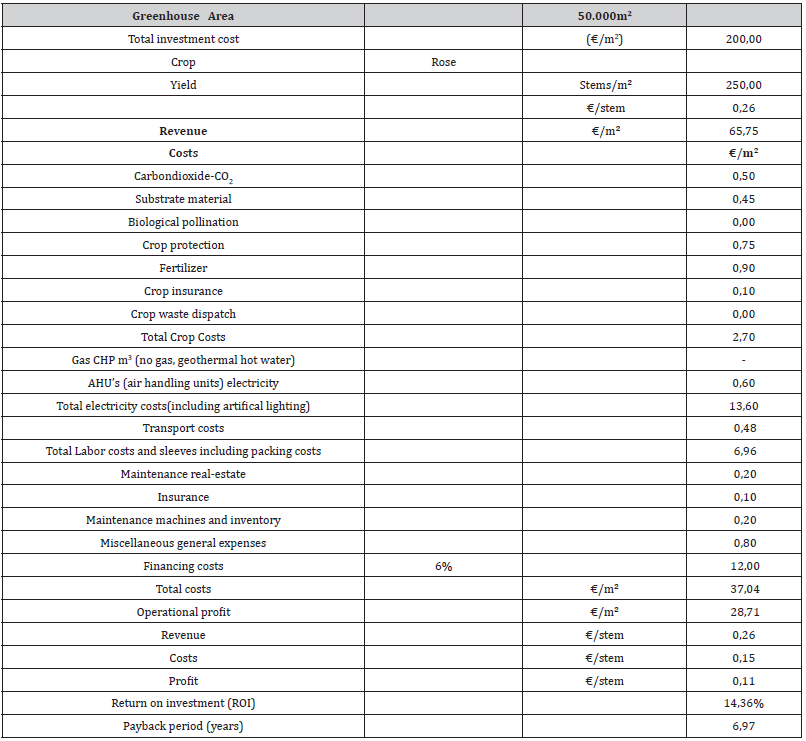

ROI study is shown in below Table 7.

Roses seem to be an attractive investment area in Turkey, and this is proven by the Table 7. Remember that estimated stem number was 300 stems/m2 but for the safety reasons, taking all the risks of climate and growing plus marketing bottlenecks

The highest cost item for roses is electricity (as artificial lighting included), followed by financing and total labor + packing costs.

Table 7:ROI data for roses.

Discussion

For both cluster and cherry tomatoes, with the present sales price and yield data presented in Table 1 and Table 2, payback periods of the investments are 5,45 and 4,82 years, respectively. A sensitivity analysis shows that the investment is very sensitive based on the yield kg/m2 and sales price €/Kg. For example, for cluster tomatoes, when the yield is reduced 10%, the ROI is reduced from 18.36% to 13.92% and the payback time increased from 5.45 years to 7.18 years, almost 32% increase. A similar sensitivity analysis shows that increasing the total investment cost 10% from 150 to 165€/m2, ROI decreases to 16.15% and the payback period goes up to 6.19 years, a 12% increase. That means that total investment cost seems to have less affect on the ROI in comparison with yield. A further sensitivity analysis shows that when the yield is kept at 60kg/m2 and total investment cost as 150€/m2, average sales price is lowered 10% as a worse scenario to 1,00 €/Kg instead of 1,11€/Kg, ROI is reduced to 13.96% and the payback time is increased to 7.16 years, about 32% increase again. It may be concluded that yield/m2 and price/kg has almost same effect on the ROI. For Cherry tomatoes, similar results are obtained in sensitivity analysis.

Strawberry profitability is dependent on yield/m2 and sales price/Kg also. Sales prices are determined by the market situation but yield/m2 could be developed further by recruiting experienced agronoms and input costs could be reduced by efficient measures to be taken.

For roses, however, when the number of stems increased by 10%, reaching to 275, the ROI goes from 14.36% to 17.64% and the payback period drops from 6.97 years to 5,67 years, 1-year decrease. Further, if the estimated 300 stems/m2 for a semi-closed greenhouse could be achieved, ROI further goes up to 20.93% and the payback period declines to 4.78 years, which makes the investment highly attractive.

For all 4 crops studied, basic input costs such as crop material, fertilizer, pesticides etc. seem to be much less than other input costs such as labor, packing, transport and electricity, together with financing costs.

The yield/m2 numbers in Tables 1,2,4 and 6 are based on years of experience in growing those crops in the greenhouses. The prices indicated should be considered as the minimum, as a worst scenario for the investment. This implies that the pay-back periods may be in fact shorter than calculated.

Financing cost is valid only when the investor would like to use credit from the banks. If the payments are done by the investor’s own resources by cash or by LC(letter of credit) at sight, the cost of financing will be eliminated and ROI for all crops will become much more attractive.

Conclusion

This study was conducted to discover the investment potentials of 4 crops (2 types of tomatoes, strawberries and roses) in the west part of Turkey within the borders of altitudes and longitudes given, considering semi-closed greenhouse technology for tomato and rose production and a traditional glasshouse + plastic greenhouse for strawberry production.

This study allows to conclude that tomato production and investment is number 1 attraction area still in Turkey as the experience- knowhow, market and manpower all are established for long years on. For tomato production, a semi-closed greenhouse technology plus interplanting is a must to obtain high yields/m2, which must be the main aim of the growing.

For strawberries, glass greenhouse seems not economically feasible, plastic greenhouses are much more attractive in terms of investment under Turkish economic conditions.

Roses seem to offer a great future for any investor provided that latest technologies are used, and market chain is set up well prior to the investment. High-tech semi-closed greenhouses offer huge advantages and possibilities not only in tomatoes but also especially for roses.

It must be warned that the data presented in this article is changing almost daily not only in Turkey but also all around the world.

Further studies on the issue must focus on the development of computational(software) tools for even more crops for an easy guide of the investors during the initial investment stages.

Ethical Compliance

All procedures performed in studies involving human participants were in accordance with the ethical standards of the institutional and/or national research committee and with the 1964 Helsinki Declaration and its later amendments or comparable ethical standards.

Acknowledgement

None.

Conflict of Interest

No conflict of interest.

References

- Okemwa E (2015) Challenges and opportunities to sustainability in aquaponic and hydroponics systems. Int J Sc Res Inn Tech 2(11): 23

- Schnitzler WH (2012) Urban hydroponics for green and clean cities and for food security. In International Symposium on Soilless Cultivation 1004: 13-26.

- Sharma N, Acharya S, Kumar K, Singh N, Chaurasia OP (2018) Hydroponics as an advanced technique for vegetable production: An overview. Journal of Soil and Water Conservation 17(4): 364-371.

- Grigas A, Kemzūraitė A, Steponavičius D (2019) Hydroponic devices for green fodder production: A Review. In Rural development 2019: research and innovation for bioeconomy, 9th international scientific conference, Agriculture Academy of Vytautas Magnus University. Akademija: Agriculture Academy of Vytautas Magnus University, pp. 26-28.

- (2021) Turkish Ministry of Agriculture and Forestry, Institute of Agricultural Economy and Policy Development. Agricultural Products Market Report, Tomatoes.

- (2019) Europe Hydroponics Market Research Report – Segmented By Equipment; Type; Crop Type; Input Type; And Region - Industry Analysis, Share, Size, Growth, Trends, and Forecast (2022 to 2027). Market Data Forecast report, pp: 145.

- Rujis M, Benninga J (2020) Market Potential and Investment oppurtunities of high-tech greenhouse vegetable production in the USA. Wageningen Univ. and Research Report 2020-054: 50.

- EIP-AGRI FOCUS GROUP (2019) Circular Horticulture- FINAL REPORT, February, pp. 36.

- Chang J, Wu X, Wang Y, Meyerson LA, Gu B, et al. (2013) Does growing vegetables in plastic greenhouses enhance regional ecosystem services beyond the food supply? Front Ecol Environ.

- Aydogan NG, Kidoglu NF, Gül A (2009) A survey on the current status of soilless cultivation in Turkey. Acta Horticulturae 807: 565-570.

- Koop L (2005) Bergama Greenhouse Project. Wellant College International-screened by DLV(National Advisory Board), November 10 (Unpublished).

- (2021) Turkish Ministry of Agriculture and Forestry, Institute of Agricultural Economy and Policy Development. Agricultural Products Market Report, Strawberries.

- (2020) European Statistics Handbook. Published by Messe Berlin GmbH, pp: 40.

- Doğaka Report (2021) Ministry of Industry and Technolgy, Doğu Akdeniz Kalkınma Ajansı, Osmaniye ili kesme çiçek(gül) üretim serası ön fizibilite raporu, , Osmaniye branch (unpublished).

- Statistical Yearbook (2018) The International Association of Horticultural Producers (AIPH).

- Nederhoff E, van Weel P (2019) Semi-closed greenhouses.

- Coomans M, Allaerts K, Wittemans L, Pinxteren D (2013) Monitoring and energetic performance of two similar semi-closed greenhouse ventilation systems Energy Conversion and Management 76: 128–136.

- Katsoulas N, Sapounas A, De Zwart F, Dieleman JA, Stanghellini C (2015) Reducing ventilation requirements in semi-closed greenhousesincreases water use efficiency. Agricultural Water Management 156: 90–99.

- HF de Zwart (2008) Overall Energy Analysis of (Semi) Closed Greenhouses. Proc IS on Greenhouse Systems, Acta Hort 801: 811-818.

- Qiana T, Dieleman JA, Elings A, De Gelder A, Marcelis LFM, et al. (2009) Comparison of Climate and Production in Closed, Semi-Closed and Open Greenhouses. Proc. IS on High Technology for Greenhouse Systems - GreenSys2009 (Ed.: M. Dorais), Acta Hort 893: 807-814.

- Kaukoranta T, Juha N, Sarkka L, Jokinen K (2014) Effect of lighting, semi-closed greenhouse and split-root fertigation on energy use and CO2 use in high latitude cucumber growing. Agricultural and Food Science 23: 220-235.

- Campena JP, Kempkes FLK (2009) Climatic Evaluation of Semi-Closed Greenhouses. Proc. IS on High Technology for Greenhouse Systems - GreenSys, Acta Hort 893: 495-502.

- Sapounas A, Katsoulas N, Slager B, Bezemer R, Lelieveld C (2020) Design, Control, and Performance Aspects of Semi-Closed Greenhouses. Agronomy 10.

- Van Beveren PJM, Bontsema J, van ’t Ooster A, van Straten G, van Henten EJ (2020) Optimal utilization of energy equipment in a semi-closed greenhouse. Computers and Electronics in Agriculture, pp. 179.

- Katsoulas N, Sapounas A, De Zwart F, Dieleman JA, Stanghellini C (2015) Reducing ventilation requirements in semi-closed greenhousesincreases water use efficiency. Agricultural Water Management 156: 90-99.

- Güven M (2022) Consultant-grower, personal communication.

- Yilmaz S (2022) Katli sistem modern kelebek havaladirmali çilek serasi yapimi fizibilite raporu, Sera Mekatronik Müh. san ve tic. A.Ş. (unpublished).

- Danışman M (2022) Consultant-grower, personal communication at various times for the input costs of the strawberries in high-tech hydroponic greenhouses in Turkey.

- Kazaz S (2022) Consultant-grower, personal communication at various times for the input costs of the roses in high-tech hydroponic greenhouses in Turkey.

- Van Tuijl H (2020) Kubo sales manager at the time, personal communication.

-

Ahmet Kurklu*. A Feasibility Study for Different Crops in a High-tech Greenhouse in Turkey. World J Agri & Soil Sci. 8(3): 2022. WJASS.MS.ID.000688.

-

Hydroponic; Semi-closed; Greenhouses; Tomato; Strawberry; Rose; Investment; Feasibility; Turkey

-

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.