Research Article

Research Article

Industry 4.0 Adaptation of Denizli Textile Companies

Duygu ERDEM AKGÜN1* and Mihriban Kalkanci2

1Faculty of Architecture and Design, Selçuk University, Turkey

2Denizli Vocational School of Technical Sciences, Pamukkale University, Turkey

Duygu ERDEM AKGÜN, Faculty of Architecture and Design, Selçuk University, Turkey

Received Date:March 04, 2025; Published Date:March 13, 2025

Abstract

“Industry 4.0”, which has emerged with the rapidly developing science and technology every passing day, is causing the transformation and adaptation process to accelerate in the textile sector as in other sectors. One of the main goals of this transformation is to integrate information technologies into production. In this study, a survey was conducted to determine the Industry 4.0 adaptation of textile companies exporting in Denizli. The companies’ use of Industry 4.0 technologies and their current applications were examined and suggestions were presented for their adaptation to the process.

Keywords:Industry 4.0; Textile Sector; Industry 4.0 Technologies

Introduction

The concept of Industry 4.0 was first officially recognized in April 2011 at the Hannover Trade Fair, where industry, politics and academic representatives came together to develop a strategic plan for the strengthening of the German national industry [1]. It is a new industrial revolution that is integrated with information technology and directly linked to changes in automation areas. Industry 4.0 aims to reach smart factories by encouraging production automation and thus increase productivity and can be characterized by the integration between the internet and production processes with the help of artificial intelligence by adding sensors to the machines used [2]. The aim here is to provide effective communication between all units involved in the production process, to be able to follow the data in real time and to make process improvements in light of this information [3]. Industry 4.0 consists of components such as the internet of things, cyber-physical systems, big data, autonomous robots, integration of systems, virtual reality, augmented reality, cloud computing system, additive manufacturing and smart factories [3]. Thanks to these components, all steps related to production can be in communication with each other and with people [4].

In recent years, Far East Asian countries and developing countries with cheap labor have come to the fore and have gained a competitive advantage in the world of production. Turkey is one of these countries. However, systems using advanced technologies such as Industry 4.0 will provide a competitive advantage to countries such as Germany, America and Japan again. This is a disadvantageous situation for developing countries, including our country [4]. When the current situation of Turkey is examined, it is stated that it is still at a point between Industry 2.0 and Industry 3.0 revolution, and even that it has not yet fully transitioned to Industry 3.0, and will have difficulties in transitioning to Industry 4.0. If the necessary investments are not made on time, it is predicted that labor-intensive production will continue, the products produced will be sold cheaply and competition will be avoided [5]. In our country, the subject of Industry 4.0 has gradually started to take place in state policies, but the new industrial revolution must be truly recognized and given the necessary importance [4].

Industry 4.0, as in other sectors, includes the use of technologies that aim to improve business management by increasing productivity in the textile and ready-to-wear sectors in general. In the textile and ready-to-wear sectors, automation, traceability and process control are highlighted by IoT (internet of things), RFID (radio frequency identification technology), QR code, sensors and actuators; software for planning, control and management of the production process and integration of robotic systems into production processes. [6-9] (Figure 1). Some textile industries that have passed this stage are using applications such as Big Data, cloud computing, horizontal and vertical integration of systems and cybersecurity to strengthen the connection between processes, products and people. The aim is still automation and control, but with the contribution of the additional technologies mentioned, there is a possibility of creating smart products, smart factories and smart retail [10].

In this study, a survey was conducted to determine the Industry 4.0 compliance of textile enterprises exporting in Denizli and the use of Industry 4.0 technologies by these enterprises and their contributions to their companies were investigated.

Materials and Methods

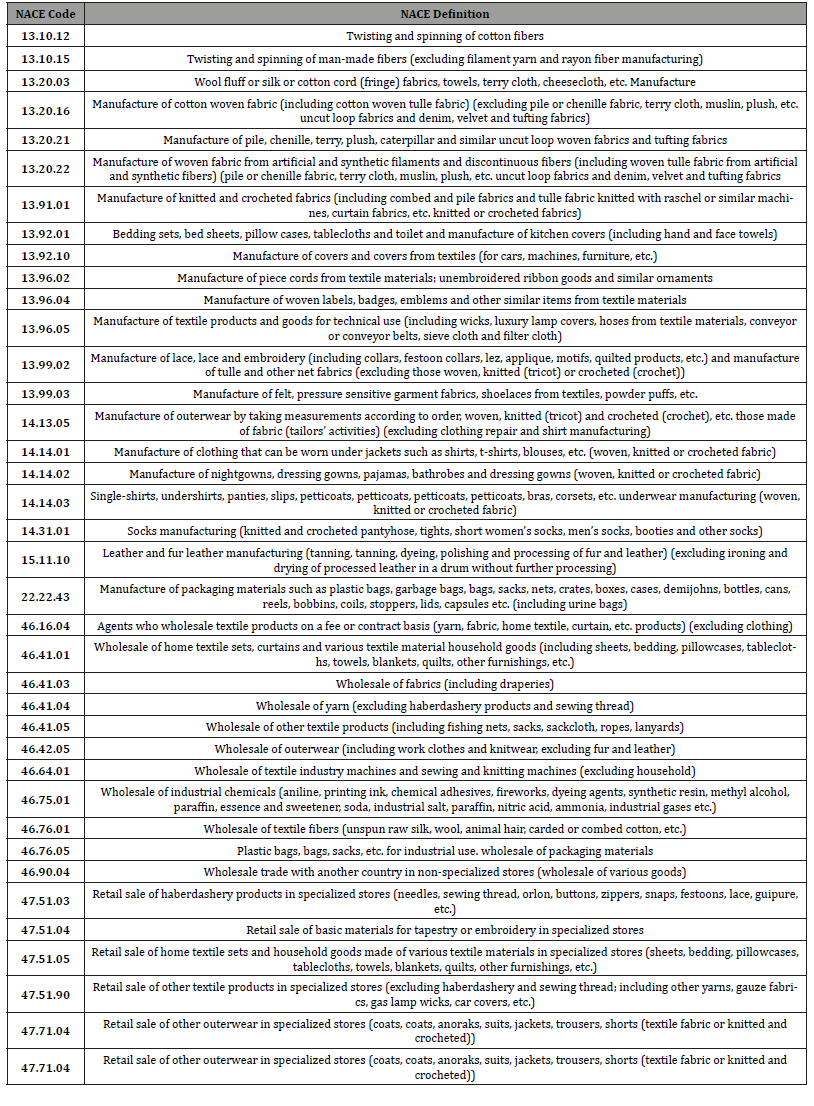

Denizli, known especially for its products such as towels, bathrobes and home textiles, became one of the largest export cities in Turkey with textile exports of approximately 1.4 billion dollars in 2024. According to 2023 data, Denizli’s textile and apparel exports constitute 8.3% of Turkey’s total textile exports, revealing its power in the sector [7, 10]. This study aims to examine the adaptation of textile enterprises operating and exporting in Denizli to Industry 4.0. Companies registered with the Denizli Chamber of Commerce, which has the most comprehensive list operating in the textile sector in Denizli, that are both producing and exporting were included in the scope of the study. In order to determine the impact of Industry 4.0 on companies in Denizli in terms of sales, competitiveness and marketing, companies that both export and produce textiles were selected as the research group. Denizli Chamber of Commerce has a total of 544 companies exporting textile products. However, not all of these companies produce textiles. Companies that actively export with their own production activities were also determined with the help of NACE codes and the number was found to be 308. The groups that are not included are the groups that only trade without producing. The NACE codes and fields of operation of the companies that export and are registered with Denizli Chamber of Commerce are given in Table 1. According to this list, companies that only trade (starting with NACE codes “46” and “47”) are excluded from the scope.

The survey method was preferred to obtain data in the research. The research questions to be applied to the companies were designed via “Google Forms” and remained online in the system for a month. In the first part of the survey; there are 9 questions about the person who filled out the survey and their business. In the second part; 6 questions were asked in the multiple choice group to analyze the perspective of textile businesses on Industry 4.0, the Industry 4.0 technologies they use, their expectations from these technologies and the current situation. As a result, survey questions were sent to all 308 companies that constitute the main population of the research and responses were received from 96 businesses (31% of the research population). The data obtained from the relevant surveys are included in the findings and discussion section.

Table 1:Production areas of companies exporting textile products according to NACE codes [11].

Results and Discussion

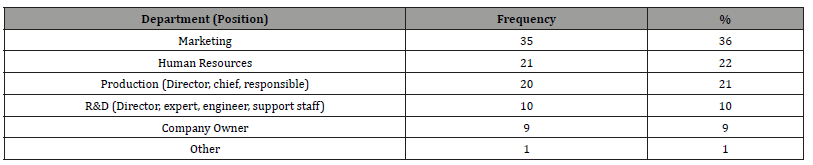

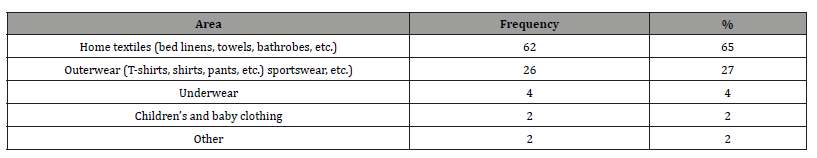

There was a response from 96 of the 308 companies operating in Denizli that are both manufacturing and exporting. In order to increase the number of participants in the survey, companies were reached and some stated that they did not participate because they did not want to share private information. The answers to the questions are below. The positions of the participants in the companies participating in the survey are given in Table 2. Accordingly; 35 (36%) people are in marketing, 21 (22%) people are in human resources, 20 (21%) people are in the production department; managers, chiefs and responsible people, 9 (9%) people are company owners, 10 (13%) people are in the R&D department; managers, experts, engineers and support staff. Denizli textile industry has been producing home textiles (towels, bathrobes and sheets) for many years. As seen in Table 3, the majority of enterprises (65%) operate in the home textile sector.

Table 2:Position of Respondents in Their Companies.

Table 3:Company Production Area.

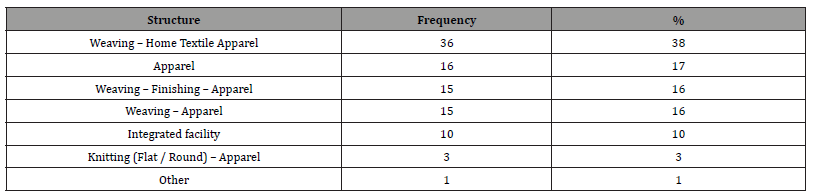

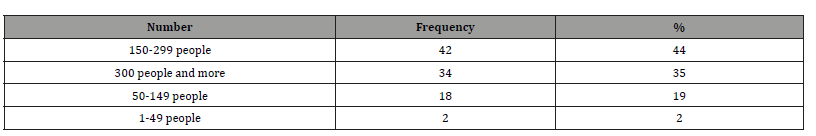

Table 4 shows the facility structure of the companies participating in the survey. Accordingly, 36 (38%) of the responding companies operate in the field of weaving - home textile apparel, 16 (17%) only in home textile apparel, 15 (16%) in weaving-finishingapparel, 15 (38%) in weaving - apparel, 10 (10%) in integrated facilities, and 3 (3%) in knitting - apparel. According to Table 5, 42 (44%) of the enterprises participating in the survey have 150- 299 employees. There are 34 (35%) enterprises with 300 or more employees. There are 18 enterprises (19%) with 50-149 employees and 2 (2%) with 1-49 employees.

Table 4:Company Facility Structure.

Table 5:Total number of employees in the company.

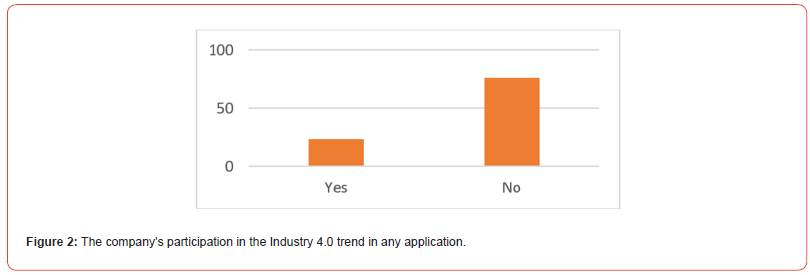

According to Figure 2, most of the companies participating in the survey (76%) did not participated in the Industry 4.0 trend in any application.

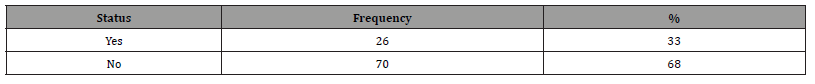

According to Table 6, only 33% of the companies use a new technology that has not been available in the region in recent years.

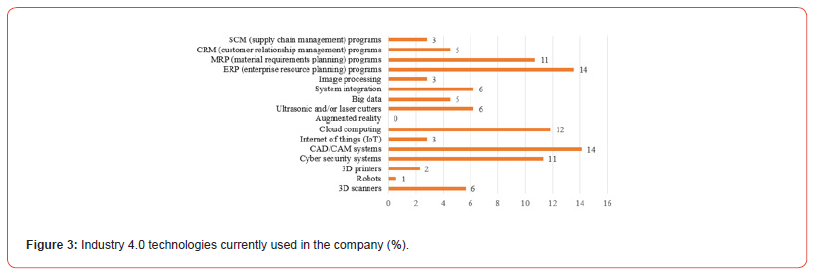

Figure 3 shows the technologies used by the companies. Accordingly, CAD/CAM systems (31.25%), cloud computing (26.25%), cyber security systems (25%) and ERP programs (22.5%) are the most used Industry 4.0 technologies in the companies. This is followed by ultrasonic and/or laser cutter usage, system integration and MRP programs with 13.75%. While other technologies are used in companies, albeit rarely, it is noteworthy that no business has an augmented reality application.

Table 6:The use of a new technology that has not been available in the region in recent years.

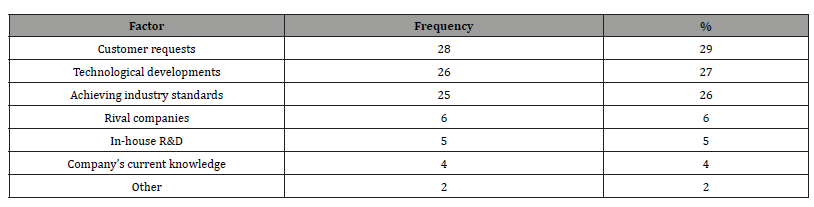

Table 7 lists the factors that force companies to engage in innovation activities. These factors are listed as customer requests 28 (%29), technological developments 26 (%27), reaching industry standards 25 (%26), competitor companies 6 (%6), in-house R&D 5 (%5), company infrastructure and knowledge 4 (%4), and other reasons 2 (%2).

Table 7:The most important factor that forces the company to engage in innovation activities.

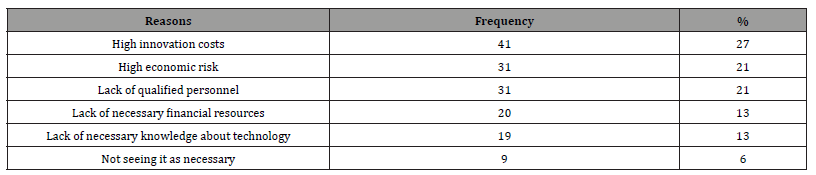

Table 8 shows the reasons why companies cannot innovate, respectively. Accordingly, most companies (27%) find innovation costs too high. Other answers; High economic risk with 21%, lack of qualified personnel with 21%, lack of necessary financial resources with 13% and lack of necessary knowledge about technology with 13%. In addition, 6% of companies do not see innovation as necessary.

Table 8:Reasons for failure to innovate in the company.

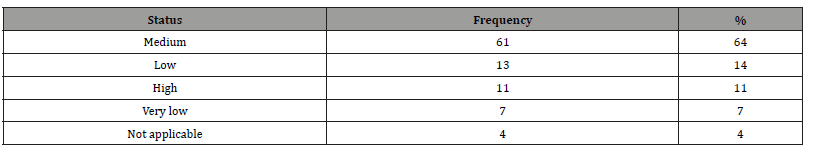

Evaluations regarding the applicability of Industry 4.0 technologies to the textile sector are given in Table 9. Accordingly, while most of the companies think that Industry 4.0 technologies are applicable at medium level (64%), only 4% of the companies think that they are not applicable.

Table 9:Applicability of Industry 4.0 Technologies to the textile sector.

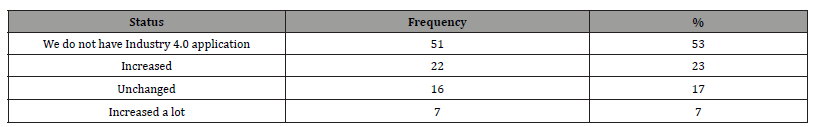

According to Table 10, 53% of the companies participating in the research stated that they do not have Industry 4.0 applications. This situation reveals that they could not see the effects of Industry 4.0 on profitability and sales, which is the main purpose of the question. On the other hand, the rate of companies stating that productivity, profitability and sales increase even with the limited technologies they applied is 23%.

Table 10:The effects of Industry 4.0 applications on productivity increase, profitability and sales increase in the company.

Conclusion

In this period when we are on the verge of a new industrial revolution, it is very important to adopt the technologies brought by the new revolution as soon as possible in order to survive in the tough global competitive environment. Denizli, a textile city with a deep-rooted history and many years of experience, should turn the Industry 4.0 transformation process that is inevitably experienced in the world into an opportunity. It seems necessary for the sector to transition to Industry 4.0 applications in production by focusing on elements such as “speed”, “innovation” and “flexibility” that Industry 4.0 technologies will bring, in order to continue for centuries. In the textile sector, thanks to Industry 4.0 technology applications, while the virtualization of prototype preparation will reduce stocks and waste, the use of artificial intelligence technologies in production will increase efficiency in terms of time, energy and material use, as well as quality. In addition, the use of important technologies such as wearable technology and 3D printer technology in textile production will open new horizons in the sector.

On the other hand, when the disadvantages of Industry 4.0 are evaluated, it is thought that it will cause a decrease in the need for unqualified labor. However, the need for qualified labor will increase in order to use the technological infrastructure of Industry 4.0, and labor with the necessary knowledge infrastructure will have the chance to receive higher wages. Technology is advancing at a dizzying pace all over the world. In today’s world where the transition to 5.0, the environmentally friendly transformation of Industry 4.0, has begun to be implemented, businesses that are deprived of these technologies and stay away from them are doomed to lose their competitive power day by day. In order for Denizli and Turkey to compete with other countries in the global economy in both textile and other sectors, great importance should be given to establishing the necessary technological and educational infrastructure on the road to Industry 4.0 and even Industry 5.0.

References

- Dal Forno AJ, Bataglini WV, Steffens F, Ulson de Souza AA (2023) Industry 4.0 in textile and apparel sector: a systematic literature review. Research Journal of Textile and Apparel 27(1): 95-117.

- Carvalho NGP, Cazarini EW (2020) Industry 4.0-What Is It?. In Industry 4.0-Current Status and Future Trends. IntechOpen pp. 1-134.

- İlhan İ (2019) Tekstil Üretim Süreçleri Açısından Endüstri 4.0 Kavramı. Pamukkale Üniversitesi Mühendislik Bilimleri Dergisi 25(7): 810-823.

- Kamber E (2019) Türkiye'de Endüstri 4.0 Farkındalığı (Master's thesis, Alanya Alaaddin Keykubat Üniversitesi) pp. 1-123.

- Öztürk E, Koç KH (2017) Endüstri 4.0 ve Mobilya Endüstrisi. İleri Teknoloji Bilimleri Dergisi 6(3): 786-794.

- https://www.denib.gov.tr/files/ozel/TekstilveKonfeksiyonSektorelVeriler20231101204.pdf

- M Saturno, V Moura Pertel, F Deschamps, E Rocha Loures (2018) Proposal of An Automation Solutions Architecture for Industry 4.0. DEStech Transactions on Engineering and Technology Research 14(2): 185-195.

- Raina A, Gries T (2017) Industry 4.0: understanding needs and challenges of technical textiles industry. International Journal of Textile Science & Engineering 2017(1): 1-15.

- Surindra MD, Caesarendra W, Królczyk G, Gupta MK (2024) Challenges of implementing Industry 4.0 in developed and developing countries: A comparative review. Mechanical Engineering for Society and Industry 4(3): 455-489.

- Kalkancı M, Erdem D (2025) Examining the Technical Textile Production Capabilities of Denizli Textile Companies. International Journal of Advanced Natural Sciences and Engineering Researches 9(2): 299-305.

- Denizli Chamber of Industry website (accessed date: 23 March 2025).

-

Duygu ERDEM AKGÜN* and Mihriban Kalkanci. Industry 4.0 Adaptation of Denizli Textile Companies. J Textile Sci & Fashion Tech 11(3): 2025. JTSFT.MS.ID.000764.

-

Digital fashion; NFTs; metaverse; augmented reality; virtual reality; embodied cognition; homuncular flexibility; psychological liberation; identity fragmentation; Hegelian dialectic; sustainability; consumer engagement

-

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.