Research Article

Research Article

Symbiotic Relationship of Internal and External Auditing in Enhancing Fraud Management: Insights from Nigerian Deposit Money Banks in Bayelsa State

Israel S Akinadewo*, Emekekume C Minesoma, Muyiwa E Dagunduro and Jeremiah O Akinadewo

Department of Accounting, Afe Babalola University, Ado-Ekiti, Ekiti State, Nigeria

Israel S Akinadewo, Department of Accounting, Afe Babalola University, Ado-Ekiti, Ekiti State, Nigeria.

Received Date: August 30, 2023; Published Date: September 12, 2023

Abstract

Fraud represents a formidable challenge to financial institutions worldwide, imposing not only substantial economic costs but also jeopardizing the trust and integrity upon which these institutions are built. This study, therefore, aimed to investigate the impact of auditing on fraud management in Nigerian deposit money banks in Bayelsa. This study employed a survey research design and data were sourced through the distribution of wellstructured questionnaires administered to the targeted respondents. The population covered the employees of all the Deposit Money Banks in Bayelsa State. The study purposively sampled 50 employees across the selected banks. Data were analysed using descriptive and inferential statistics.

The findings showed that internal and external auditing exhibited a statistically significant and positive effect on fraud management among the selected deposit money banks in Nigeria. This study concluded that if the management of banks in Nigeria is in adherence and compliance with all the relevant statutes and regulations, it will drastically reduce fraud occurrence in Nigerian banking Sectors. This study recommends that Nigerian Deposit Money Banks should continue to strengthen their internal auditing practices. This can be achieved by investing in training and development for internal auditors to keep them up-to-date with evolving fraud risks and control techniques.

Keywords: Auditing; Internal auditing; External auditing; Fraud management; Deposit money banks

Introduction

Fraud represents a formidable challenge to financial institutions worldwide, imposing not only substantial economic costs but also jeopardizing the trust and integrity upon which these institutions are built. For Nigerian Deposit Money Banks (DMBs), the need to mitigate fraud risks while ensuring financial stability has never been more critical. Amid this backdrop, the efficacy of internal and external auditing emerges as a paramount consideration in the ongoing battle against fraudulent activities [1]. Fraud is the deliberate distortion of information to gain an advantage, especially in the banking sector where financial statements can be manipulated to attract investors or present a false financial picture. To combat fraud, banks employ fraud management, which involves practices to detect, prevent, and control fraudulent activities. Internal and external auditing are recognized methods in both academic and corporate circles for achieving effective fraud management [2].

In a developing country like Nigeria, the banking sector plays a crucial role as an intermediary between those with surplus funds and those in need of loans. It facilitates borrowing for those in need and expects repayment with interest at a later date. Additionally, banks provide a secure place for individuals to save their money, often offering interest on these deposits [3]. The operations of banks are vital for the overall well-being of the economy. Consequently, the government, customers, and investors closely monitor their activities to ensure transparency and accountability in their financial records. Despite this heightened scrutiny, there have been instances of fraudulent activities within Nigerian deposit money banks.

Throughout history, it’s evident that persistent engagement in fraudulent activities can lead to the downfall of any company. This is exemplified by the bankruptcy and eventual collapse of notable firms such as Enron, Bernie Madoff, WorldCom, HIH Insurance Ltd, Lehman Brothers, Parmalat, Tyco International Ltd, and Adelphia Communications Corporation [4,5]. In Nigeria’s financial services sector, particularly within the banking industry, fraud, and illicit practices have significantly impeded organizational performance [6]. Since the country’s independence, there have been numerous fraud cases involving the banking sector, prompting the government to enact various policies. However, despite these efforts, the prevalence of fraud appears to persist unabated.

This study delves into the symbiotic relationship between internal and external auditing, shedding light on their roles as significant components of the fraud management system within Nigerian DMBs. In recent years, scholars, regulators, and industry practitioners have increasingly recognized the pivotal roles played by these auditing mechanisms in safeguarding the integrity of financial systems and protecting stakeholders’ interests. This recognition is not only critical for the continued growth and stability of Nigerian DMBs but also offers invaluable insights for financial institutions globally grappling with similar challenges. In this context, this research work explores the empirical evidence supporting the assertion that both internal and external auditing, when harmoniously integrated, create a robust defense against fraud within Nigerian DMBs. Through a comprehensive review of literature, analysis of industry data, and expert opinions, this article aims to provide a comprehensive understanding of how these auditing practices, when employed synergistically, contribute to the development of a more resilient and responsive fraud management framework.

Our investigation navigates through the distinctive roles that internal and external auditors assume within the context of Nigerian DMBs. It scrutinizes the internal audit function’s role in enhancing internal controls, early fraud detection, and proactive risk management. Simultaneously, we explore the external audit’s external validation, its role in compliance enforcement, and its contribution to bolstering transparency and accountability in the sector. By examining these functions in tandem, we uncover the intricate interplay that empowers Nigerian DMBs to not only identify and respond to fraud but also to deter potential wrongdoers and foster a culture of ethical conduct.

In an era marked by increasingly sophisticated fraud schemes and evolving regulatory landscapes, the imperative to strengthen the collaborative efforts of internal and external auditing in Nigerian DMBs is undeniable. This research underscores the significance of an integrated approach, advocating for enhanced coordination, communication, and knowledge sharing between these auditing mechanisms. In doing so, it not only contributes to the academic discourse on fraud management but also provides practical insights that can inform policy decisions, guide industry practices, and ultimately fortify the financial sector’s resilience in Nigeria and beyond.

Literature Review

The relevant variables, the theory underpinning this study, and empirical studies were reviewed.

Conceptual review

This study reviewed the arguments for and against the variables of this study.

Auditing

Auditing is regarded as a systematic and independent examination of financial information, records, transactions, operations, or processes of an organization to assess their accuracy, completeness, and compliance with relevant laws, regulations, and accounting standards [7]. The primary purpose of auditing is to provide assurance to stakeholders, such as investors, shareholders, creditors, and government authorities, that the financial statements and other information presented by the organization are reliable and fairly represent its financial position, performance, and adherence to established rules and principles [8]. Auditing is typically conducted by trained professionals known as auditors, who follow standardized auditing procedures and issue reports detailing their findings and opinions [9].

Internal auditing

Internal auditing involves an impartial and methodical assessment of an organization’s internal controls, procedures, financial data, operations, and adherence to policies and regulations. This evaluation is carried out by an internal audit unit or team within the organization (Miryam, 2022). Its primary purpose is to provide confidence to the management and board of directors that the organization’s activities are both efficient and effective, and that they comply with established standards and protocols. Internal auditing can be defined as a structured and rigorous approach to appraise and enhance the efficiency of processes related to risk management, control, and governance [10].

Conducting internal audits requires a well-defined plan to ensure that auditors don’t repeat tasks or overlook crucial examinations. In contemporary business, internal auditing plays a vital role in assisting organizations in accomplishing their goals. Therefore, it is imperative for businesses, particularly those in the banking sector, to ensure that their internal auditors possess a high level of knowledge, expertise, and competencies [8]. Internal auditing is a system of robust internal controls that organizations use to ensure they are progressing toward their objectives. While not mandatory for all organizations, it’s particularly important for banks. In smaller enterprises, accountants may take on auditing responsibilities, but this can lead to role overlap and might not be ideal in the long run. In contrast, banks benefit from having a dedicated internal audit unit [11].

External auditing

External auditing is an independent examination and evaluation of an organization’s financial statements, records, transactions, and related operations conducted by a certified professional accountant (CPA) or an external audit firm [9]. The primary purpose of external auditing is to provide an unbiased and objective assessment of the accuracy, reliability, and fairness of an organization’s financial reporting. This assessment ensures that the financial statements, such as the balance sheet, income statement, and cash flow statement, present a true and fair view of the organization’s financial position and performance [1].

External auditors are typically hired by the organization’s shareholders, board of directors, or regulatory authorities to provide an impartial opinion on whether the financial statements are in compliance with accounting standards and regulations. The external auditor’s report, often referred to as the audit opinion, communicates their findings and conclusions regarding the organization’s financial statements and internal controls [12]. External auditing is an essential practice for ensuring transparency, accountability, and the integrity of financial reporting in various sectors, including business, government, and nonprofit organizations. It enhances investor and stakeholder confidence by providing an independent assessment of the organization’s financial health and compliance with applicable financial reporting standards [13].

Fraud management

Fraud management refers to a set of strategies, processes, and actions that organizations implement to detect, prevent, respond to, and mitigate fraudulent activities within their operations [14]. The primary goal of fraud management is to safeguard an organization’s assets, reputation, and financial well-being by identifying and addressing fraudulent behavior, which can include activities such as theft, embezzlement, bribery, cybercrime, financial statement manipulation, and various forms of deception [15]. Fraud management is crucial in various industries, including finance, healthcare, retail, and government, as it helps organizations protect their assets and maintain the trust of stakeholders, customers, and the public.

Effective fraud management contributes to minimizing financial losses and legal liabilities associated with fraud, thereby enhancing an organization’s overall sustainability and integrity. Fraud management involves establishing rules and regulations within a company to prevent fraud and the misappropriation of resources [13]. It includes actions and checks to ensure that financial reports accurately represent figures and statistics. Both internal and external auditing play vital roles in managing fraud within an organization.

Auditing and fraud management

Auditing and fraud management are closely related aspects of organizational governance and risk management, with auditing being a key tool in the broader practice of fraud management. Auditing, both internal and external, serves as a preventive measure against fraud. Internal auditors review an organization’s internal controls, financial processes, and transactions to identify weaknesses that could be exploited by potential fraudsters [7]. External auditors, on the other hand, provide an independent review of an organization’s financial statements, which can help detect any discrepancies or irregularities that might indicate fraud. Internal auditors are often trained to recognize signs of fraud in financial records and operational processes. When they come across suspicious activities, they can investigate further to determine if fraud has occurred. External auditors may also uncover fraudulent activities during their examination of an organization’s financial statements [6].

Auditing helps organizations strengthen their internal controls. Strong internal controls are a critical component of fraud management. Auditors assess these controls and recommend improvements, which can help prevent fraud by making it more difficult for individuals to engage in fraudulent activities [8]. Auditing includes assessing fraud risks within an organization. This involves identifying areas where fraud is most likely to occur and evaluating the effectiveness of existing controls in mitigating these risks. This risk assessment informs fraud management strategies. Auditors ensure that organizations comply with antifraud regulations and industry standards. By adhering to these regulations, organizations reduce the risk of engaging in fraudulent practices [2].

Auditing generates documentation and evidence that can be crucial in fraud investigations and legal proceedings. If fraud is suspected or detected, the audit trail can be used to support disciplinary actions or legal actions against the perpetrators. Auditing is an integral part of fraud management. It helps prevent, detect, and respond to fraudulent activities by assessing controls, evaluating financial data, and ensuring compliance with regulations [1]. Auditing and fraud management are complementary approaches that organizations employ to ensure financial accuracy, regulatory compliance, and ethical behavior. While auditing serves as a tool to assess and validate the effectiveness of internal controls, fraud management focuses on actively preventing and addressing fraudulent activities to protect an organization’s assets and reputation [3].

Theoretical review

This study reviewed the fraud triangle theory and was underpinned by this theory.

Fraud triangle theory

The proponent of this theory is actually credited to American Criminologist Donald Cressey [16]. The core assertion of this theory is that there are three related angles that must be connected before fraud is committed. The triangle includes opportunity, pressure, and rationalization. For opportunity, Cressy [16] said that employees could use their position and authority to commit fraud when internal controls and audit systems are weak, or where there is low management oversight of internal control systems. In agreement with this view, it can be deduced that committing fraud is not a mistake, neither does it happen by chance. Thus, there should be a consistent and conscious effort to manage fraud in any organization. Most employees including managers who commit fraud do so because an opportunity to access assets and information that permits them to commit fraudulent deeds presents itself.

Bassey [15] stated that this can make a staff commit fraud; in addition, he asserted that pressure does not only mean financial pressure. Lister [17] argued that there are three types of pressure to commit fraud; employment pressure from constant compensation structures, or management’s financial concern, individual pressure to pay for lifestyle, and external pressure such as danger to the business’s financial stability, covenants, and market expectations. According to Yolanda [5], rationalization as part of the triangle of fraud is an effort by an employee to defend his/her reason for committing fraud. For instance, an employee who needs to pay the school fees of his children and also needs to pay his house rent might commit fraud; and validate his action with the fact that he is being owed some month’s salary. In today’s business organization, it can be argued that one of the main reasons why people commit fraud is that they feel they are owed some sort of compensation by the organization where they work. Despite the logic behind this theory and its accuracy in measuring three areas where fraud might be perpetrated, it has been criticized and limited because of some factors.

Dorminey et al. [18] noted that although Cressey’s fraud triangle was supported and used by a lot of auditory regulatory bodies, it has been criticized because the model cannot solve the fraud problem alone; because two sides of the fraud triangle, pressure, and rationalization cannot be easily observed. Before someone commits fraud, the amount of pressure on the person is not known, and neither is the reason why the person would want to commit it known. This theory is relevant to this current research because it highlights three significant factors which are involved in committing fraud. Hence, management should ensure that they do not make these factors or conditions present in their organization. Internal auditors also have a duty to perform to ensure that the amount of pressure coming from work does not motivate staff to commit fraud. On the other hand, the external auditor needs to ensure that these three conditions are unavailable to internal auditors, in order to ensure that the figures in the financial statements are true and faithful representations of what they purport to represent.

Empirical review

Akanni [1] assessed the impact of auditors captured by risk assessment, system audit, and verification of financial reports on banking fraud control in Southwest Nigeria. Multiple regression techniques were used for the analysis. The results indicated that audit roles captured by risk assessment, system audit, and verification of financial reports were statistically significant in determining the fraudulent act in the banking industry in Nigeria. In Egypt, Kassem [9] explored the significance of various fraud factors in assessing the risks of financial reporting fraud and examined how external auditors could assess these fraud factors. Correlation analysis was the preferred analytical tool used in the study. Findings showed that external audits should be viewed in terms of management motivations rather than just the audit of financial statements figures and disclosures.

Olaoye and Dada [19] examined the impact of auditors on banking fraud control in Southwest, Nigeria. Multiple regression techniques and ANOVA were used for the analysis. The results revealed that risk assessment management, system audit, and verification of financial reports adopted by the banking industry in Southwest Nigeria limited the fraudulent activities among Nigerian banks. In Indonesia, Miryam (2022) performed a qualitative study to synthesize relevant theoretical and empirical literature to develop a conceptual framework and propositions about the antecedents of the effectiveness of internal audits for fraud prevention. Thematic analysis was used in the study as its method of data analysis. It was proven that institutional theory, organizational support theory, and quality theory can help build a theoretical framework for the effectiveness of internal audits for fraud prevention. However, Khairini et al. [10] investigated the effect of internal audits in preventing and disclosing fraud. Thematic analysis was the preferred method of data analysis. Findings showed that internal audits did not have a significant effect on preventing and disclosing fraud.

Anyanwu and Okafor [3] examined the effect of internal audit functions on fraud control in manufacturing companies in Anambra state. Logistic Regression analyses were the chosen method of data analysis in the study. It was proven that internal audit functions positively and significantly influenced fraud prevention and detection in manufacturing firms. Joseph and Isiaka [8] examined the effect of the internal control system on fraud prevention of financial services firms in Nigeria. Correlation analysis was the preferred statistical tool for the study. Findings revealed the hat internal control system had a significant influence on fraud prevention. Sepala et al. [11] investigated the relationship between internal audits and fraud management among financial service firms in Sri Lanka. Descriptive statistics and correlation analysis were the chosen methods of data analysis. Findings gave credibility to the fact that internal audit competence influenced fraud management.

Nurlaela et al. [20] aimed to find the internal audit roles and the auditor professionalism at Fraud Prevention in NJC Bank. Simple Linear Regression was the preferred statistical tool used in the study. Findings showed that the role of the internal auditor had a significant effect on fraud prevention, and the auditor professionalism significantly affected fraud prevention.

In Cameroon, Yolanda [5] performed a study titled, ‘Impact of Internal Control on Fraud Detection and Prevention in Microfinance Institutions’. Thematic analysis was the preferred statistical tool used in the study. It was proven beyond all doubt that internal control had a positive impact on fraud detection and prevention in MFIs.

In Kenya, Kimetto (2019) examined the factors which impeded effective internal audit and profitability of Commercial Banks in Kericho Town. Descriptive statistic was the preferred analytical tool used in the study. Findings showed that internal auditors contributed to profitability of firms mainly through detection of fraud and advising management on internal control system. Further findings showed that the major constraints to internal audit effectiveness were lack of independence and lack of enough qualified audit staff. Alson, in Nigeria, Ezejiofor and Okolocha [6] examined the effect of internal audit function on financial performance of commercial banks in Enugu State. Simple regression analysis was preferred in serving as the means of data analysis. Findings proved that internal audit control and procedures had positive effect on financial performance of commercial banks in Nigeria.

Chimeocha [7] undertook a study which investigated internal audit as an effective tool for fraud control in a manufacturing organization in Enugu State. T-test analysis was the preferred method of data analysis. Findings gave credence to the fact that internal audit had statistical significance association on fraud prevention and fraud detection in manufacturing organization. In Ghana, Alex et al. [12] explored a study which aimed to unveil the relationship between internal control systems and the effectiveness of audit program in prudential bank Weija branch. Descriptive statistic was the selected statistical tool used in the study. Findings proved that the internal control system was seen to be significant in detection of fraud in banks in Ghana.

Methodology

This study employed a survey research design and method is considered appropriate due to the ability to describe and record characteristics of the situations as they really occur than it does in providing an explanation. The population of this study covers the employees of all the Deposit Money Banks in Bayelsa State. The study sampled 50 employees across the selected deposit money Banks in Bayelsa State. 10 employees were selected across 5 Deposit Money Banks in Bayelsa State using a purposive sampling technique. Employees with a minimum of 5 years of working experience were selected for this study. These banks include; First Bank of Nigeria, Eco Bank, United Bank of Africa, Union Bank, and Sterling Bank.

A well-structured close-ended questionnaire was adopted to collect data from the targeted respondents. Responses made by the respondents were rated using the Five Likert scale of very agreed (5), agreed (4), undecided (3), disagree (2), and severely disagree (1). Statistics was used for both descriptive and inferential analysis of the data obtained. In a descriptive manner, frequency and percentage were used to analyze the respondents’ demographic data, mean and standard deviation were used to respond to questions regarding each of the specific variables, and multiple regression was used to analyze the hypotheses that have been put forth at a significance level of 0.05. The regression equation will be validated by taking into account the regression assumptions.

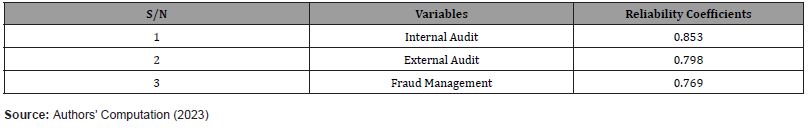

Reliability of the instrument

Reliability refers to the extent of consistency in results given by the instrument of measure on the repeated application. Five copies of the questionnaires were distributed to other employees not selected for the sample size as part of a pilot study for the reliability test. Thereafter, the internal consistency measurement tool Cronbach Alpha was applied. The dependability coefficient value was more than 0.70, as stated by Sekaran in 2003. Table 3.1 provided the dependability coefficient for each variable:

Table 1: Reliability Test Results

Results and Discussion

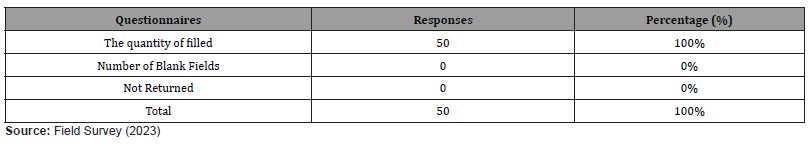

Analysis of the administered questionnaires

Table 2: Analysis of the Administered Questionnaires

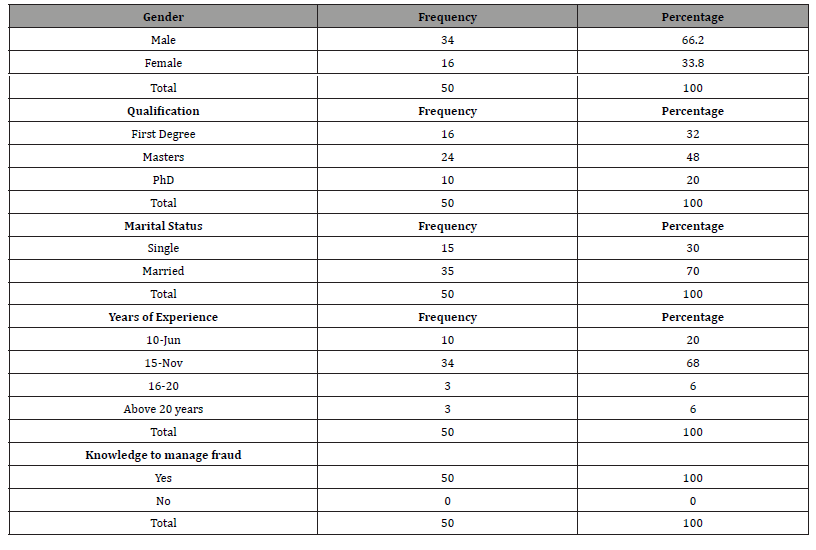

Background information of the respondents

The background information of the respondents is stated in Table 4.2

Table 3: Background Information of the Respondents

Table 4.2 shows that 34 respondents (66.2%) were male and 16 respondents (33.8%) were male. This reveals that 16(32%) of the respondents had a first degree as the highest educational qualification, 24(48%) had M.Sc. as the highest educational qualification while 10(20%) had Ph.D. as the highest educational qualification. The data also reveals that 15(30%) of the respondents were single, compared to 35 (70%) of the respondents who were married. This implies that the majority of responders were married.

Also, 10 (20%) of the respondents had a year of experience ranging from 6-10 years, 34 (68%) of the respondents had a year of experience ranging from 11-15 years, 3 (6%) of the respondents had a year of experience ranging from 16-20 years while 3 (6%) of the respondents had a year of experience above 20 years. Finally, it was unveiled that all the respondents had adequate knowledge on how to manage fraud in Banks.

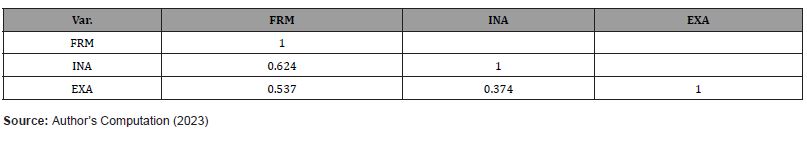

Correlation analysis

Table 4: Result of Pearson Correlation Matrix

From the result presented in table 4.6, a positive relationship exists between the pairs of variables included in the study. This implies that all the variables moved in similar direction.

Regression analysis of the impact of internal and external auditing on fraud management

Table 5: Multiple Linear Regression of the impact of internal and external auditing on fraud management.

Table 4.4 revealed the R2 (0.809), which implies that a cordial relationship exists between the identified variables. The adjusted R2 (0.654) also means that 65.4% systematic change in outcome variable could be traced to the predictor and the remaining 34.6% accounted for factors outside the model of this study. The F-statistics (51.147), with a p-value (0.000), shows that the model is statistically significant. According to the multiple regression estimation results shown in Table 4.4, fraud management in Nigerian deposit money banks is positively and significantly impacted by combining both internal and external auditing functions with coefficient and probability values of 0.579 (p=0.000<0.05) and 0.450 (p=0.002<0.05) respectively.

Discussion of findings

An attempt has been made in this study to independently investigate the impact of internal and external auditing on fraud management in Nigerian Deposit Money Banks. From the regression result being the most consistent estimation result, it was discovered that internal auditing has a positive and significant impact on fraud management in the Nigerian deposit money banks in Bayelsa. This suggests that this investigation has found evidence to support the idea that internal auditing practices have a beneficial and noteworthy effect on the management of fraud within Nigerian deposit money banks. This is in tandem with the basic objective of internal auditing which is to detect, control, and prevent fraudulent practices within the operations of the Nigerian Deposit Money Banks and this indicates that internal auditing is an effective and important tool in managing and combating fraud within Nigerian deposit money banks. This outcome agreed with the findings of Anyanwu and Okafor [3], Isiaka [8], Khairini [10], Miryam (2022), and Sepala et al. [11] among others who support that effective internal audits mechanism can greatly influence the prevention and detection of fraud in the banking sectors.

Also, it was discovered that external auditing has a positive significant impact on fraud management in Nigerian Deposit Money Banks. This suggests that the effect of external auditing on fraud management is not just minor or negligible but substantial and meaningful. It has a noticeable influence on how fraud is managed within these Nigerian Deposit Money Banks. This might be due to the high level of professionalism among the external auditors. This is in agreement with the findings of Akanni [1] and Kassem [9] and others who that opined external audits significantly influenced fraud control in the banking sector.

Finally, it was discovered that a combination of internal and external auditing has a positive significant impact on fraud management in Nigerian Deposit Money banks in Bayelsa to the tune of 0.579 (p=0.000<0.05) and 0.450 (p=0.002<0.05) respectively. This shows that a 1% increase in internal and external auditing would cause a 58% and 45% increase in fraud management in Nigerian Deposit Money Banks in Bayelsa State. This suggests that both internal and external auditing are significant components of the fraud management system in these banks. The combined effect became highly significant due to the high level of experience of both internal and external auditors in fraud management. A high level of experience attracts more knowledge, competency, and independence qualities.

Conclusion and Recommendations

In this study, the impact of internal and external auditing on fraud management in Nigerian Deposit Money Banks was investigated. The study specifically evaluated the impact of internal auditing on fraud management in Nigerian Deposit Money Banks in Bayelsa State, investigated the impact of external auditing on fraud management in Nigerian Deposit Money Banks in Bayelsa State, and examine the impact of the internal and external auditing on fraud management in Nigerian Deposit Money Banks in Bayelsa State. In order to fulfill the mentioned objectives, a thorough analysis of the available most recent and pertinent research was conducted. When assessing the fraud management in Nigerian Deposit Money Banks IN Bayelsa State, the independent variable, internal and external auditing was independently and jointly examined.

The research conducted showed that internal auditing has a positive non-significant impact on fraud management in the banking sector to the tune of 0.217(p=0.065>0.05). Also, it was discovered that external auditing has a positive significant impact on fraud management in the banking sector to the tune of 0.424(p=0.035<0.05). Finally, it was discovered that a combination of internal and external auditing has a positive significant impact on fraud management in Nigerian Deposit Money banks in Bayelsa to the tune of 0.579 (p=0.000<0.05) and 0.450 (p=0.002<0.05) respectively.

Conclusion

Despite immense and capable research discussing the internal and external auditing on fraud control in the banking sector in Nigeria, there seemed to be a gap to fill on the combined effects of internal and external auditing on fraud control in the banking sector in Nigeria. Due to this gap, this study was established, to close up the differences. In lieu of this, it unveiled the impact of internal and external auditing on fraud management in Nigerian Deposit Money Banks in Bayelsa State. Through the findings carried out in the study, it was concluded that if the management of banks in Nigeria is in adherence and compliance with all the relevant statutes and regulations, it will drastically reduce fraud occurrence in Nigerian banking Sectors [21].

Recommendations

In line with the findings of the study, the study recommends that Nigerian Deposit Money Banks should - continue to strengthen their internal auditing practices. This can be achieved by investing in training and development for internal auditors to keep them up-to-date with evolving fraud risks and control techniques; encourage effective communication and collaboration between internal and external auditors. This synergy can lead to a more comprehensive understanding of fraud risks and better fraud detection and prevention strategies; banks continue to engage highly professional external auditors to maintain the effectiveness of external auditing. This professionalism enhances their ability to contribute significantly to fraud management; conduct regular and thorough fraud risk assessments. These assessments can help banks identify emerging fraud risks and tailor their auditing and control measures accordingly; ensure that recommendations from both internal and external audits are promptly implemented. This proactive approach can address vulnerabilities and reduce the likelihood of fraud; utilize advanced technologies, such as data analytics and artificial intelligence, to enhance auditing processes.

These tools can help auditors detect irregularities and anomalies more efficiently; ensure regulatory authorities continue to monitor and enforce auditing standards in the banking sector. Strict adherence to auditing regulations can contribute to a more robust fraud management framework; ensure that banks benchmark their auditing and fraud management practices against industry best practices. Learning from successful approaches in other organizations can lead to more effective fraud management strategies. Meanwhile, the study’s findings underscore the importance of both internal and external auditing in fraud management within Nigerian Deposit Money Banks. By implementing these recommendations, banks can further enhance their fraud management capabilities and contribute to the overall integrity and stability of the banking sector.

Suggestions for further study

This study is delimited to internal and external auditing and fraud management in DMBs in Bayelsa State. Scholars interested in the subject matter could proxies both the predictors and outcome variables of the study. Also, further studies could focus on other sectors of the economy to validate the outcomes of this study. Geographically, this study is delimited to cover deposit money banks in Bayelsa State. Further studies could include other states across Nigeria.

Acknowledgement

None.

Conflict of Interest

There is no conflict of interest.

References

-

Israel S Akinadewo*, Emekekume C Minesoma, Muyiwa E Dagunduro and Jeremiah O Akinadewo. Symbiotic Relationship of Internal and External Auditing in Enhancing Fraud Management: Insights from Nigerian Deposit Money Banks in Bayelsa State. Iris J of Eco & Buss Manag. 1(4): 2023. IJEBM.MS.ID.000518.

-

Auditing; Internal auditing, External auditing, Fraud management, Deposit money banks, Financial picture, Government, Customers, Investors, Adelphia Communications, Tyco International Ltd, Lehman Brothers, Parmalat

-

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.