Research Article

Research Article

How Corporate Governance Mechanisms Improve the Financial Performance of Shareholding Companies

Reulah Chalabi1*, Bilel Jarraya2

1Department of Accounting, College of Business and Economics, Qassim University, Saudi Arabia

2Department of Accounting, College of Business and Economics, Qassim University, Saudi Arabia

Bilel Jarraya, Department of Accounting, College of Business and Economics, Qassim University, Qassim, Saudi Arabia.

Received Date: June 12, 2023; Published Date: July 24, 2023

Abstract

This study aims to investigate the impact of good corporate governance on firms’ financial performance. First, this study explores the corporate governance emergence. In this part, we introduce the corporate governance concept, and after that, we highlight the principal motives giving birth to this concept, its importance, and its objectives. Second, the study will focus on corporate governance practices. In this part, we examine corporate governance’s principles, implementation, and determinants. Third, the paper will examine the relationship between corporate governance and firms’ financial performance. In this part, based on existing research, we will clarify the role of corporate governance in enhancing firm performance. Finally, we summarize how corporate governance plays a significant role by attracting the interest of potential investors, suppliers, and other stakeholders, thus, the economy’s growth

Keywords:Corporate governance; Agency theory; Determinants; Firm performance; Financial performance

Introduction

The term corporate governance emerged in the late last century as it has become the focus of attention of many capital and other stakeholders, because of its great importance in managing large companies with a regional and international dimension, as the term governance is also closely related to in the successive crises that rocked many countries [1].

Especially after the financial tremors that struck international companies, especially those in developed continents such as America and Europe through the financial and administrative corruption cases that were revealed and which were the precursor to the collapse of many giant companies where it became clear many of the violations, the most prominent of which were the inflation of the salaries and bonuses of the Board of Directors, with these bonuses not being associated with the results of the business not to mention the weak transparency and disclosure, to the extent of manipulating the financial statements of major international companies through auditing offices and other influential people and beneficiaries, which led to the beginning of the global financial crisis [1].

Governance rules and regulations aim to enhance the concepts of monitoring the performance of companies, to preserve the interests and financial rights of shareholders, to encourage and develop investment, maximize profitability, and provide new job opportunities also, these rules emphasize the importance of adhering to the provisions of the law and work to ensure an audit of financial performance, and the existence of administrative structures that enable accountability of management to shareholders with the formation of the audit committee from nonmembers of the executive board of directors that have many tasks, powers, and powers to achieve oversight [2].

The awareness of economic units on the importance of improving their governance systems is an essential element, and their self-adoption is more effective than imposing laws or regulations as in a world that has become characterized by freedom of investment and transfer of capital, it has become difficult for economic units to attract the necessary financing from investors without creating good governance systems under international standards [2].

Economies are affected by variables, factors, and conditions, whether regional or international, and therefore the application of corporate governance principles to shareholding companies in stock exchange markets will increase their ability to develop and grow, similar to international and large companies that It works in the neighboring environment.

The rest of the paper is divided as follows: the second section explores the corporate governance emergence. The third section focus on corporate governance practices. The fourth section examines the relationship between corporate governance and firms’ financial performance. Finally, we summarize how corporate governance plays a significant role by attracting the interest of potential investors, suppliers, and other stakeholders, thus, the economy’s growth.

The corporate governance emergence

The concept of corporate governance

Corporate governance means the system by which the rights and responsibilities of different parties, such as the board of directors, managers, shareholders and other stakeholders in the company, are defined [3].

The Organization for Economic Cooperation and Development (OECD) defines corporate governance as a set of relationships between the company’s management, the board of directors, owners and all related parties. It is the method by which the structure is set by which the company’s goals are set, performance monitoring, results, and direction are directed in the successful way of exercising and managing the authority, through which all incentives are offered. Necessary to the Board of Directors and senior executive management in their endeavors to achieve the agreed goals to serve the interests of the company and its shareholders by the control procedures and the optimal guidance for the use of the company’s resources efficiently and effectively [3].

The genesis of governance and the motivation behind its emergence

The concept of corporate governance arose after the emergence of the agency theory and the concomitant conflicts of interests between the company’s management, shareholders and stakeholders in general, and this has led to increased interest in finding laws and rules that regulate the relationship between parties in companies [4].

There are several motives for the emergence of corporate governance, including those related to the economic climate in Western countries, which have contributed greatly to the crystallization of the concept of corporate governance, we mention [5].

The explosion of the Asian financial crisis in 1997: Which can be considered a crisis of confidence in the institutions and legislations that regulate the activity of workers and the relationships between workers ’facilities and the government, the many problems that have come to the fore during the crisis include the operations and transactions of internal employees, relatives and friends, and companies’ access to huge amounts of short-term debt at the same time that It made sure that shareholders are not aware of these matters and that these debts are hidden through innovative accounting methods and systems.

Rising corruption cases in major American companies: Like “Enron” and “WorldCom” in the United States, corruption cases escalated in major American companies the year 2001, as the financial statements of these companies were not considered as the actual reality, in collusion with the international companies for auditing and accounting, which makes an organization Economic Cooperation and Development issues a set of guidelines regarding the corporate government in general.

Multinational company practices: As a result of these practices, the call for the government of institutions has increased, as it acquires and merges companies to control global markets. Despite the presence of thousands of multinational companies, there are only 100 companies that control the capabilities of foreign trade worldwide. Through its monopolistic practices.

Poor quality of information: This leads to the prevention of supervision and control, widespread corruption, and lack of confidence.

The importance of corporate governance

Economy: Corporate governance contributes to raising the level of sufficiency of the economy because of its importance in helping to stabilize financial markets and raising the level of transparency and attracting investments from both outside and inside, in addition to reducing the size of the risks facing the economic system [3].

Companies: The application of corporate governance principles helps companies to create a sound work environment that helps the company to achieve better performance with providing good management and therefore the economic value of the company is greater, in addition to that good governance helps companies to access financial markets and obtain the necessary financing at a lower cost than it assigns To expand its activity, reduce risk, and build confidence with stakeholders [3].

Investors and shareholders: Corporate governance aims to protect investments from exposure to loss due to misuse of power in the interests of investors and also aims to maximize investment returns, shareholders ’rights, and investment value as well as reducing conflicts of interest. The company’s commitment to implementing corporate governance standards activates the role of shareholders in Participate in making key decisions related to the company’s management and knowing everything related to their investments [3].

Other stakeholders: Governance seeks to build a close and strong relationship between the company’s management, its employees, suppliers, creditors, and others. Good governance enhances the confidence level of all dealers to contribute to raising the level of company performance and achieving its strategic goals [3].

Transparency, justice, and fighting corruption: Corporate governance seeks to reduce the risks of financial and administrative corruption faced by companies and countries, improve accounting, financial and administrative practice and work to develop them in the company [6].

The objectives of corporate governance

The Saudi Corporate Governance Regulations aims to establish an effective legal framework by activating the following objectives [3]:

a) Activating the role of shareholders in the company and facilitating the exercise of their rights.

b) Clarify the responsibilities and Terms of reference of the Board of Directors and the Executive Management.

c) Activating the role of the board and committees and developing their efficiency to enhance decision-making mechanisms in the company.

d) Achieving transparency, integrity, and fairness in the financial market and its dealings and business environment and promoting disclosure in which.

e) Provide effective and balanced tools to deal with conflictof- interest situations.

f) Strengthening the control and accountability mechanisms of the company’s employees.

g) Set the general framework for dealing with stakeholders and observing their rights.

h) Increasing the efficiency of supervising companies and providing the necessary tools for that.

i) Educating companies about the concept of professional behavior and urging them to adopt and develop it in a way that suits its nature.

The Corporate Governance Practices

Corporate Governance Principles

Several international bodies and organizations have established rules for corporate governance such as the New York Stock Exchange, the International Settlement Bank (BIS), the International Organization of Securities Commissions (IOSCO), and perhaps the most famous of those corporate governance rules issued by the Organization for Economic Cooperation and Development (OECD), Which included five areas after its amendment in 2004, where each rule includes several mechanisms that work to interpret these rules, and they are as follows [7]:

a. Shareholders’ equity.b. Equal treatment of shareholders.

c. The role of stakeholders.

d. Disclosure and transparency.

e. Responsibilities of the board of director’s.

As an additional example from emerging economies, the Saudi Corporate Governance Regulations issued by the Capital Market Authority focused on three main rules which are rules related to the Board of Directors, rules related to shareholders ’rights and the General Assembly, and rules related to disclosure and transparency, where the other rules published by the Economic Cooperation Organization fall under these three rules, as the role of stakeholders and the fair treatment of shareholders, as mechanisms that work to better guarantee governance practices [8].

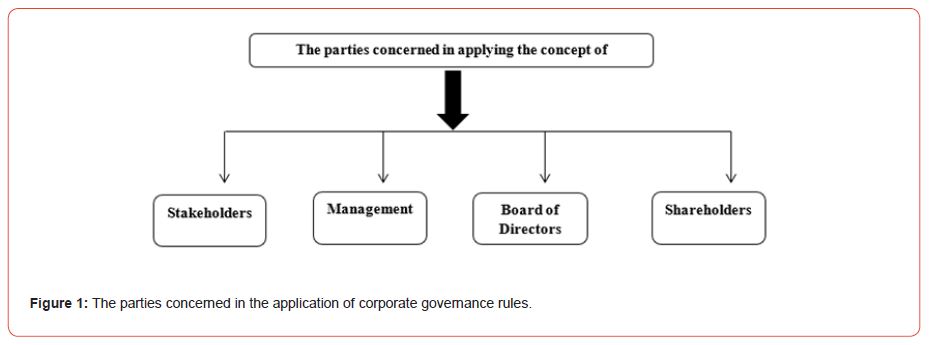

The Corporate governance implementation

The proper application of corporate governance rules depends on a group of parties that affect them and are affected by them, and through which the extent of success or failure to apply these rules is determined as this application governs a set of determinants and there are four parties affected by corporate governance and they are [9]:

1. The shareholders: They are the ones who provide the capital to the company through their ownership of the shares in exchange for obtaining the appropriate profits from their investments.

2. The Board of Directors: They represent the shareholders and other stakeholders, as the board of directors selects the executive directors who have delegated to them the day-today management of the company’s business in addition to overseeing its performance. The board of directors sets the company’s general policies and how to preserve the rights of shareholders.

3. Management: It is responsible for the actual management of the company and submitting performance reports to the board of directors.

4. Stakeholders: They are a group of parties who have interests within the company such as creditors, suppliers, shareholders, and others (Figure 1).

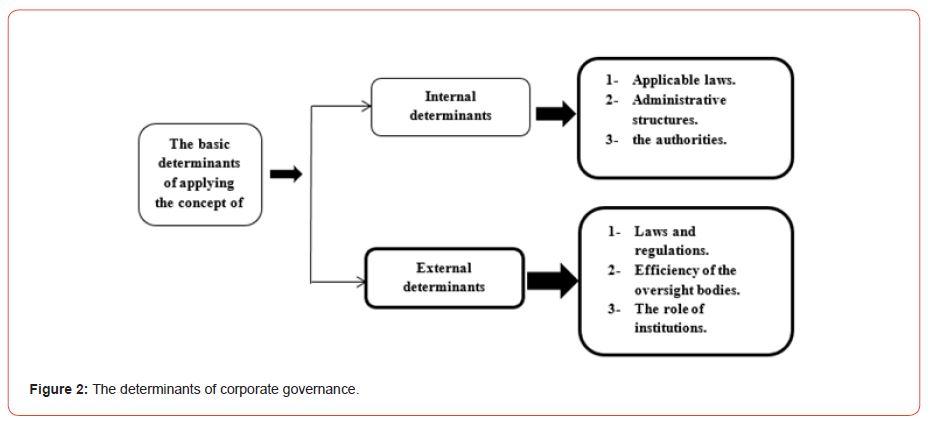

Determinants of corporate governance:

For companies to benefit from the benefits of governance, they must have a set of internal and external determinants that ensure proper and good application of corporate governance rules, and those limitations are as indicated [6,9,10]:

I. Internal determinants: It consists of a set of rules and foundations that define how decisions are taken and the distribution of powers within companies between three main parties in them: The General Assembly, the Board of Directors and the executives. The importance of these determinants is due to their presence reducing conflict between the interests of the three parties.

II. External determinants: The external determinants of governance refer to the general climate for investment in the country and include the following:

1. Laws regulating economic activity such as laws of international institutions, laws of the capital market and companies, regulation of competition, prevention of monopolistic practices and bankruptcy.

2. The efficiency of the financial sector in providing the necessary financing for projects.

3. The degree of competitiveness of commodity and production markets.

4. Efficiency of regulatory agencies and bodies in tightening control over companies (Figure 2).

Corporate governance and firms’ performance

Certainly, all companies always strive to improve their performance and maximize their profitability and governments are working to improve the performance of these companies, too, to maintain their economic and financial stability. Governance came to achieve financial and administrative reform in companies to enhance the performance of companies, maximize their profitability and preserve their properties and ensure its continuity. Several studies have indicated that a good application of governance has a positive impact on the financial performance of companies and studies are still ongoing and the results are mixed where some studies have found the effect of some mechanisms of governance on financial performance, but not others but overall, the majority of these studies agree that the government has a strong and direct relationship to financial performance and that relationship differs from one sector to another and from one state to another according to the Validity of the laws and regulations used in companies, and the impact of regulatory and legal frameworks imposed by countries on the economic system in general [8].

Financial performance measures

The performance indicators that will be used in this research to measure financial performance are profitability ratios: are ratios that measure the result of project work, the efficiency of policies and investment decisions taken by senior management and their ability to make a profit, and management is concerned with these proportions to judge the company’s success in implementing the planned policies and its efficiency in using available resources (Al- Shabib, 2009). Profitability ratios reflect the overall performance of the company, as it examines the company’s ability to generate profits from its sales and is considered an important gauge to measure the effectiveness of the company’s investment, operational and financing management policies [11], and we will limit ourselves in this research to the following two ratios:

- Return on assets (ROA): The scale of return on assets and return on property fields is one of the very important measures for measuring the profitability of the company, and is equal to the net profit divided by the average value of the assets of the company [8].

- Return on equity: or return on investment, this rate measures the return that each one riyal of investment in the company brings. If the return is 10%, this means that the company achieved a net value of 10 halals for every riyal invested in the company and is measured by the following formula (net income / average equity). This indicator indicates the extent of the company’s success in benefiting from the investment with the rights of its owners and this indicator is considered one of the best indicators of profitability, and the lower this percentage, there is a weak of performance, while its high indicates that the company is performing its tasks well. Experts point out that companies usually need at least 10-14% as a return on investment [8].

A theoretical Framework on the relationship between corporate governance and firms’ performance

Agency theory is one of the theories widely used in previous studies, where it explains the relationship between corporate governance and the company’s financial performance, such as studying [2,8]. And the results of a previous Arab study showed that the practice of governance mechanisms contributes to reducing the problems of the information gap resulting from both the problems of the agency and conflicts of interest between management and owners and thus increases investor confidence in the information presented by those companies [12].

The results of previous studies, such as [12] revealed that there is a statistically significant impact on the application of companies listed on the Palestine Stock Exchange for Corporate Governance Rules related to the remunerations provided to the members of the Board of Directors and executives and the rules related to laws and internal regulations in preventing the financial failure of these companies. The results of the study [4] revealed that governance is one of the main reasons for improving financial performance, by applying the mechanisms and principles set forth by the International Cooperation Organization. The results of the study [13] revealed that the proper application of corporate governance supports economic performance and competitiveness, attracting investment to companies and increasing the growth rate in the Palestine Stock Exchange. The results of a local Saudi study also revealed that there is a statistically significant relationship between the availability of the corporate governance system and improving the performance of the Saudi Electricity Company [6].

The results of a study [4] revealed that two mechanisms have a significant impact on improving the financial performance of companies, namely the Board of Directors and internal audit committees the Board of Directors is the most important mechanism because it is one of the supervisory bodies within the company where it monitors the administration, supervises and evaluates it, and its decisions have a significant impact on the performance of any company. The results of the study [14] also revealed that the absence of the audit committee as a corporate governance mechanism affects the proper application of corporate governance where through the internal audit, the value of the parties benefiting from corporate governance is maximized and their rights protected, which include providing information to management at all levels, evaluating the internal control system, risk management and the institution’s commitment to corporate governance principles, and thus improving the financial performance of companies. Moreover, the results of the study [15] revealed the positive impact of the diversity of nationalities of the members of the board of directors as a measure of good governance on the financial performance of the Egyptian, and Jordanian, Omani, Saudi, and Emirati companies.

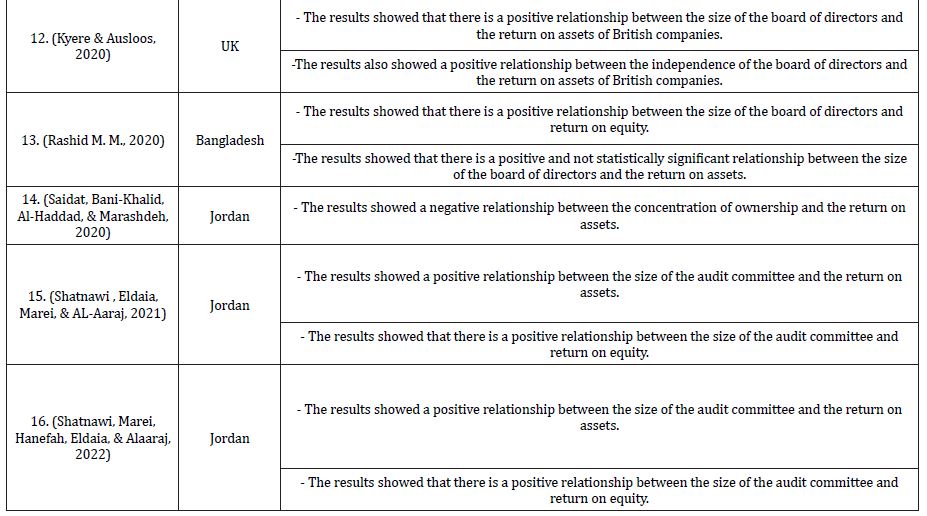

And foreign studies, [16,17] revealed a positive effect of the size and independence of the board of directors on the financial performance of British companies. And the study [18] demonstrated the positive impact of the board of directors’ independence on Thai companies’ financial performance. The results of the study [19] revealed the positive impact of the diversity of nationalities on the board of directors as a rational governance mechanism for the financial performance of Pakistani companies. The results of the study [20] revealed the positive impact of the size of the board of directors as a rational governance mechanism on the financial performance of Bangladeshi companies. The study showed [21] the negative impact of the concentration of ownership as a rational governance mechanism on the financial performance of Jordanian companies. The results of the [22] and [23-25] revealed the positive impact of the size of the audit committee on the financial performance of Jordanian companies Table 1.

Table 1: The impact of corporate governance on financial performance.

Conclusion

The corporate governance has become the focus of attention of many capital and other stakeholders, because of its great importance in managing large companies with a regional and international dimension, as the term governance is also closely related to in the successive crises in the world. Indeed, governance rules and regulations aim to enhance the concepts of monitoring the performance of companies, to preserve the interests and financial rights of shareholders, to encourage and develop investment, maximize profitability, and provide new job opportunities also, these rules emphasize the importance of adhering to the provisions of the law and work to ensure an audit of financial performance, and the existence of administrative structures that enable accountability of management to shareholders with the formation of the audit committee from non-members of the executive board of directors that have many tasks, powers, and powers to achieve oversight. In this study we have been investigating the impact of good corporate governance on firms’ financial performance. First, the study has exploring the corporate governance emergence. We have introduced the corporate governance concept and highlighting the principal motives giving birth to this concept, its importance, and its objectives. Second, the study has focusing on corporate governance practices. This part, we have examining corporate governance’s principles, implementation, and determinants. Third, we have examined the relationship between corporate governance and firms’ financial performance. In this part, based on existing research, we have clarifying the role of corporate governance in enhancing firm performance. Finally, corporate governance plays a significant role by attracting the interest of potential investors, suppliers, and other stakeholders, thus, the economy’s growth. So, the application of corporate governance principles to the companies participating in the stock markets increase their capabilities to develop and grow similar to the large and international companies that operate in the neighboring environment.

Acknowledgment

None.

Conflict of Interest

No conflict of interest.

References

-

Reulah Chalabi*, Bilel Jarraya. How Corporate Governance Mechanisms Improve the Financial Performance of Shareholding Companies. Iris J of Eco & Buss Manag. 1(3): 2023. IJEBM.MS.ID.000511.

-

Corporate governance, Agency theory, Determinants, Firm performance, Financial performance, Potential investors, Suppliers, Stakeholders, Economics growth, Markets, Disclosure, Transparency, Economic and financial stability

-

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.