Research Article

Research Article

Impacts of Host Country Financial Risk on China’s Investment in BRI Countries

Tao Xu, Professor of Finance, Soochow University, China

Received Date:June 27, 2025; Published Date: July 15, 2025

Abstract

This paper investigates how financial risks in BRI host countries affect China’s FDI decisions. Using the HMR model, we find Chinese investors demonstrate risk tolerance - being more likely to enter high-risk markets and commit larger investments once established. The results reveal financial risks’ dual role as both deterrents and strategic opportunities, offering valuable insights for emerging market investment strategies.

Keywords:China; BRI; financial risk; foreign direct investment

Introduction

China’s Belt and Road Initiative (BRI) has reshaped global investment patterns, yet host-country financial risks - such as non-synchronization of financial cycles between investing and host countries - play a critical role in shaping capital flows [1]. While these risks may deter traditional investors, they also create opportunities for strategic arbitrage and higher returns. This study examines how financial risk influences China’s BRI investments, distinguishing between entry decisions and investment scale. By applying the HMR model, we reveal the dual nature of financial risk as both a deterrent and an incentive for cross-border capital flows.

Research framework

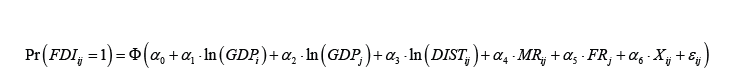

The Helpman-Melitz-Rubinstein (HMR) model offers a twostage framework to analyze how host-country financial risk affects FDI, distinguishing between location selection stage and scale decision stage while correcting for selection bias [2]. The first stage (Equation 1) models entry probability using a probit function with financial risk (FRj) (measured through indicators like financial cycle volatility or sovereign credit risk), GDP, distance, and controls, which are similar to relevant literature [3].

where Φ(·) represents the standard normal cumulative distribution function, GDPi and GDPj capture the economic sizes of home and host countries respectively, DISTij measures geographical distance between countries, and Xij includes other bilateral control variables such as common language or colonial ties.

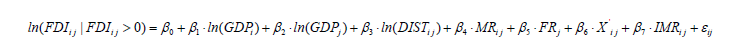

The second stage (Equation 2) estimates investment volume, incorporating the inverse Mills ratio to address sample bias.

where IMRij is the inverse Mills ratio from the first stage that corrects for selection bias.

Empirical Research

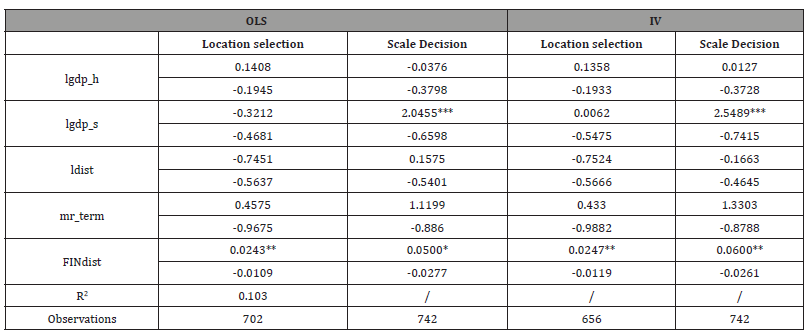

We estimate the two-stage equations (1) and (2). The results are reported in Table 1. The coefficients for FINdist reveal financial risk positively influences China’s BRI investments at both stages. For location selection (extensive margin), FINdist shows significant positive effects, indicating Chinese firms are more likely to invest in riskier BRI markets. For investment scale (intensive margin), the positive coefficients suggest larger investments in higher-risk destinations once established. These results demonstrate China’s risk-tolerant approach in BRI countries, where financial risks may create strategic opportunities rather than deterrents for Chinese investors.

Table 1:Estimation Results.

Note: *, **, *** indicate p<0.10, p<0.05, and p<0.01 respectively. Coefficients of control variables are not reported.

Conclusion

This study highlights the dual role of financial risk in China’s BRI investments, revealing that while financial risks such as volatility and credit instability pose challenges, they also present strategic opportunities. Empirical results demonstrate that Chinese firms are more likely to invest in higher-risk BRI countries and allocate larger capital once established, reflecting a risk-tolerant approach. These findings underscore the importance of financial risk as both a barrier and a catalyst for FDI, offering insights for policymakers and investors navigating cross-border investments in emerging markets.

Funding

This paper is sponsored by the National Social Science Funds: The Measurement and Countermeasure of the Country Risk in China Outward Investment against the Background of OBOR Initiatives (Fund No.: 20BJY237).

References

- Rey Hélène (2013) Dilemma not Trilemma: The Global Financial Cycle and Monetary Policy Independence. Federal Reserve Bank of Kansas City Economic Policy Symposium.

- Helpman E, Melitz M, Rubinstein Y (2008) Estimating Trade Flows: Trading Partners and Trading Volumes. Quart J Econ 123(2): 441-487.

- Xu T (2019) Economic Freedom and Bilateral Direct Investment. Economic Modelling 78(2): 172-179.

-

Tao Xu*. Impacts of Host Country Financial Risk on China’s Investment in BRI Countries. Iris J of Eco & Buss Manag. 3(1): 2025. IJEBM.MS.ID.000554.

-

China; BRI; financial risk; foreign direct investment; iris publishers; iris publishers’ group

-

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.