Review Article

Review Article

The Position of Greek Laterites in the World

Dr. Stylianos Tampouris*

GMMSA LARCO, General Mining and Metallurgical Company, Egialias 54, 15125 Athens, Greece

GMMSA LARCO, General Mining and Metallurgical Company, Egialias 54, 15125 Athens, Greece

Received Date: March 07, 2025; Published Date: March 24, 2025

Abstract

In recent years, the huge increase in demand for nickel has resulted in a surge in its production levels that exceeded 3.5 million tons and expects to exceed 4.000.000 tons next year. Asia is the most important producer and consumer of nickel. Several countries outside China are promoting the production and use of electric vehicles (EVs) to achieve carbon neutrality but lack the self-sufficiency in raw materials that such a transition requires. Today, available data show that in several regions, including the European Union, current production capacity and primary nickel reserves cannot meet the growing demand for nickel. The only European Union country to produce nickel from its own deposits was Greece, where laterite mining and ferronickel production stopped in 2022, though the recent geopolitical situation changes create a new opportunity for the Nickel production in Greece.

Nickel and Its Uses

Nickel (Ni) is the fifth most common element on earth and has excellent physical and chemical properties, making it indispensable for hundreds of products. Ni occurs in oxide, sulfide, and silicate ores. The gradual reduction of ore qualities from extensive mining intensifies research efforts to develop more efficient extraction and processing technologies [1]. Significant deposits of Ni also exist in Mn oxides found in the oceans. Recent estimates indicate that such contains deposits more than three hundred million tons of Ni. However, the development of mining technologies in the oceans is needed to enable their use [2]. The five main uses for nickel are developed below [3]:

Stainless steel production

One of the most important uses of nickel is in stainless steel construction, as nickel adds the necessary hardness and corrosion resistance that makes stainless steel an ideal material for every thing from skyscrapers to spoons. It is exciting how adding just a little nickel can turn iron and chromium into something we rely on every day. Also, nickel has a significant role in maintaining the shiny appearance of stainless steel over time. Nickel is the unsung hero that ensures that kitchen appliances, cutlery, and even medical instruments can stand the test of time and use without losing their luster. As the best-known example of monumental construction where nickel plays a crucial role, the Eiffel Tower can be mentioned, which over the years has been protected from rust by a coating that includes nickel, resulting in this iconic landmark standing tall and rust-free, thanks to nickel’s protective properties.

Battery production

Nickel is used to make batteries that power everything from smartphones to electric vehicles (EVs). Nickel-based batteries, particularly nickel-lithium batteries, are preferred for their higher en ergy density and longer service life compared to alternatives. This means more power and longer usage times for our gadgets and vehicles. As the world turns to electric mobility to combat climate change, nickel’s role becomes even more critical. EV batteries require a significant amount of nickel to operate efficiently. The metal’s ability to store energy makes it a key ingredient in pushing for greener transportation options. With the growing demand for nickel metal in battery production, recycling is becoming paramount. The nickel in batteries can be recycled and reused, reducing the need for new raw materials and minimizing environmental impact. This cycle of use, recycling, and reuse highlights nickel’s role in the sustainable development of technology.

Alloying

The uniqueness of nickel lies in its ability to mix well with other metals to create superalloys. These superalloys are not only powerful. They can withstand extreme temperatures and corrosive environments, making them ideal for aerospace engines, power plants, and even in the oil and gas industry.

Plating

Nickel plating is more than just achieving a glossy surface. It is a critical process to enhance the durability and corrosion resistance of metals. Through electroplating, a thin layer of nickel is applied to various objects, acting as a barrier against rust, wear and tear. This process ensures that everything from car parts to kitchen faucets can withstand the rigors of everyday use and adverse environmental conditions, significantly extending their service life. Beyond its protective properties, nickel plating adds aesthetic value, providing a shiny, silver finish that is both attractive and functional. This finish is not just about looks. It helps reduce friction, enhance electrical conductivity, and prevent the accumulation of dirt on surfaces. The dual benefit of beauty and functionality makes nickel plating an indispensable process for the manufacture of a wide range of consumer goods, such as car parts (e.g., bumpers, rims), door handles, kitchen and bathroom faucets, electrical connectors and accessories, surgical and dental instruments, etc.

Renewable energy technologies

In the search for sustainable and clean energy solutions, nickel is emerging as a key player, particularly in renewable energy technologies. Its resistance to extreme conditions makes it an ideal ingredient in wind turbines and solar panels, where materials are subject to harsh weather conditions and constant use. Nickel-based alloys and coatings protect these linings, ensuring they can generate energy efficiently over their intended lifetime. The role of nickel in the energy transition can be described as the backbone of green technology as it is not limited to building blocks but is vital for storing clean energy. The role of Nickel in our transition to a more sustainable future is especially important. Its contribution to renewable energy technologies exemplifies how unique this metal is in achieving our environmental goals. In every wind or solar farm, in the batteries that power the future of clean energy, nickel is there. As we have listed the top uses of nickel, from its critical role in stainless steel production and battery manufacturing to its application in alloy making, plating, and renewable energy technologies, it is clear that nickel’s impact is very significant.

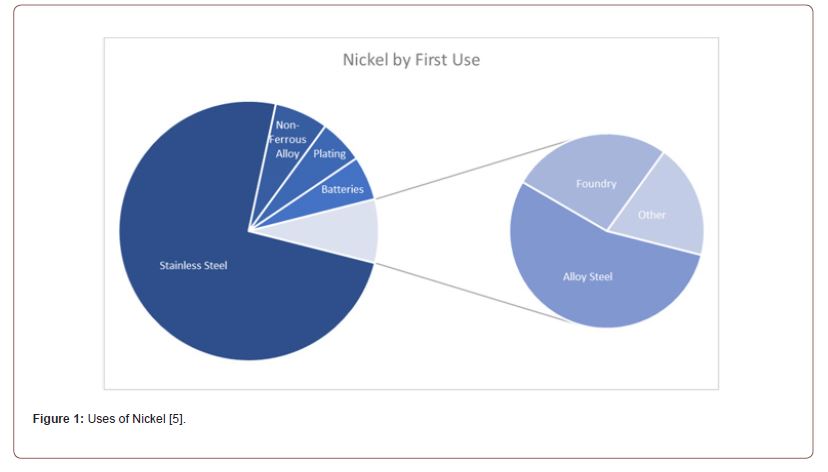

In conclusion, nickel’s journey from the Earth’s crust into our daily lives and to the forefront of technology and sustainability is a testament to human ingenuity and our ongoing quest for progress. Its myriad applications underscore its value not only in the economy, but also in promoting innovation and protecting our planet. The ongoing exploration and exploitation of its potential Nickel will undoubtedly play a leading role in shaping our future as a strategic raw material. This designation was recently given based on the 2023 European Union study (Study on the Critical Raw Materials for the EU, 2023), which clearly states that Ni may not meet the criteria for characterizing critical raw materials (CRM), but is included in them, as well as copper, as both metals are considered strategic raw materials (SRM) [4]. The distribution of nickel consumption or uses in different industry sectors for the year 2021 is shown in Figure 1. From this figure it is evident that most of Ni is used to produce stainless steel (69%), while significant quantities are consumed to produce batteries (13%) and alloys and superalloys (7%).

Worldwide Production

A good picture of global production can be presented based on the survey of the statistical service of the USGS National Ore Information Centre (United States Geology Survey), which records the global production of nickel ores for the years 2022 and 2023, as well as their estimated reserves. The data from this survey are presented in Table 1 [6]. As far as Greece is concerned, mining activity stopped in 2022, while based on LARCO data, the reserves as presented in the company’s 2018 inventory report, the measured – indicative resources with those used as optimal for the mines Cut Off Grades 0.80% for the ores of Ag. Ioannis and Evia and 0.90% for Kastoria ore, are estimated at 99,512,000 tn with an average nickel content of 0.95%.

Table 1: Global nickel mining production for the years 2022 and 2023 and estimated reserves (in thousands of metric tons).

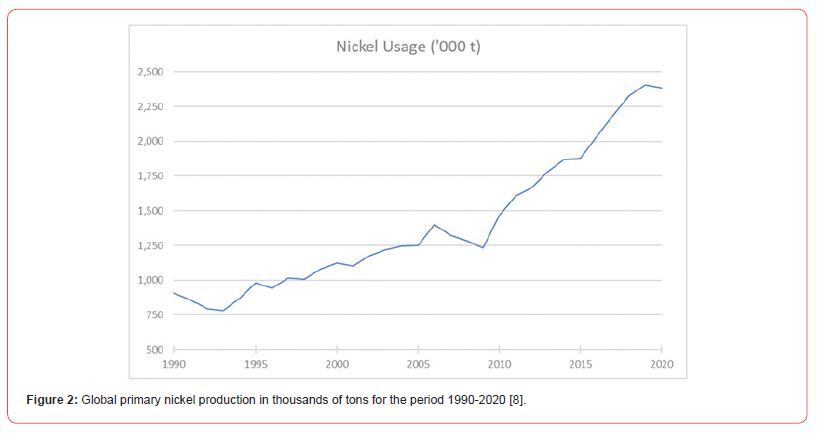

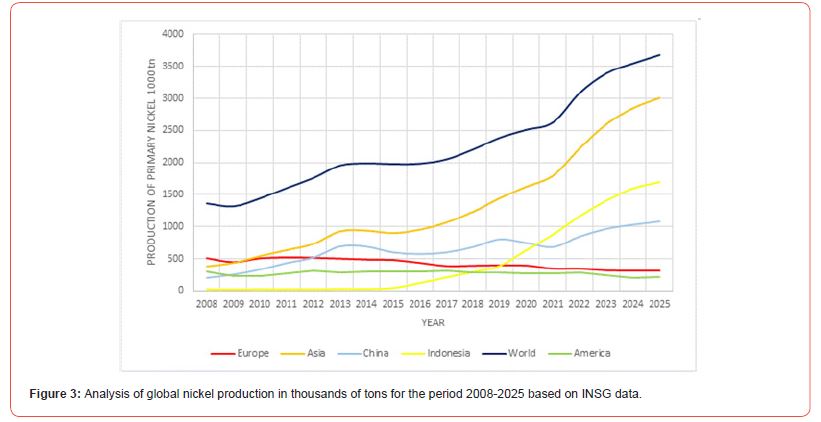

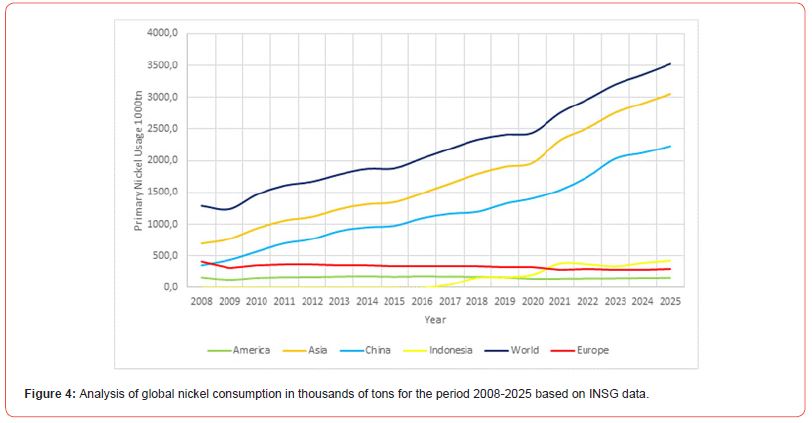

Alternatively, the measured – indicative mineral resources with Cut Off Grades of 0.50% for all ores are estimated at 198,267,000 tn with an average nickel content of 0.83% [7]. These figures show that the largest mining activity takes place in Indonesia, while other countries with notable production are Australia, the Philippines, Russia, New Caledonia, Canada, and China. Figure 2 shows the global primary production of NI in thousands of tons for the period 1995-2020, highlighting the periods when changes occur [8]. These Figures 3 &4 show that global primary production of Ni increased sharply over the period 2009-2019, before the disruptions caused by the COVID19 pandemic in 2020 [8]. Based on the data, up to September 2024 by the International Nickel Study Group (INSG) it projects that nickel pig iron (NPI) production in Indonesia will continue to increase, with a further decline in China. Also in Indonesia, the conversion of NPI to matte nickel is increasing, high-pressure acid leaching units (HPAL) to produce mixed hydroxide precipitate (MHP) continue to increase production, and the first nickel sulfate project became operational in March 2023. Based on the data of the INSG, the following charts for the production and consumption of Nickel are derived.

From these charts it is evident that both world production and world consumption of nickel are increasing year by year and that this increase is only due to the production and consumption that takes place in Asia as Europe and America show stability over time if not a slight decline in both production and consumption.

Based on the nickel market observations for 2024 and 2025 reported in the INSG press release [9], the following are worth mentioning:

a) In Indonesia, it is expected that the production of nickel products will continue to increase for 2024 and 2025.

b) In China, it is also forecast to increase.

c) In the rest of the world, due to profitability issues, some production facilities have closed or reduced production.

d) Companies that are still operating in the rest of the world are considering these two possibilities.

e) The World Stainless Steel Association (formerly the International Stainless-Steel Forum / ISSF) has released data for the first three months of 2024 showing that stainless steel production increased by 5.5% year-on-year to 14.6 million tons.

f) INSG expects growth in the stainless-steel sector in 2024 and 2025, especially in China and Indonesia.

g) The growth rate of nickel in batteries for electric vehicles (evs) has been lower than expected, weighed down by the increased relative use of nickel-free batteries and the recent increase in demand for plug-in hybrid evs at the expense of battery electric vehicles.

h) New pcam production projects in various parts of the world will start producing, which will support the expansion of the use of nickel.

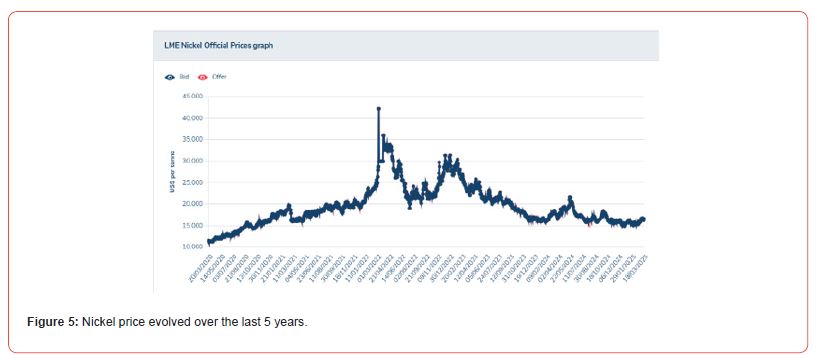

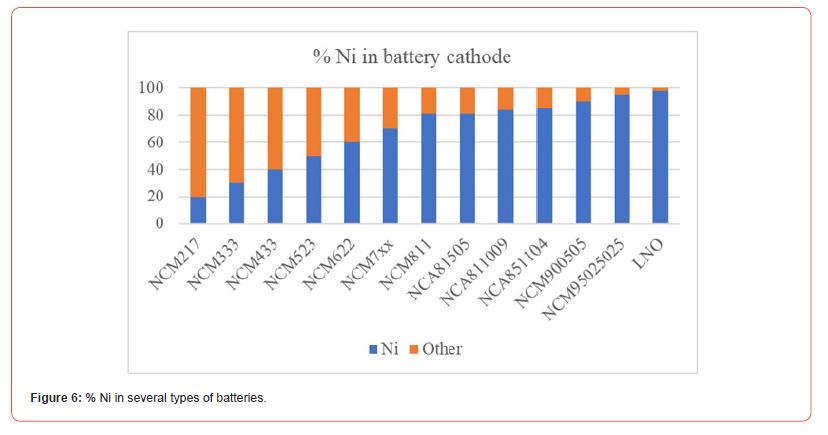

The interruption or reduction of nickel production in various parts of the world is due to the stabilization of the price at low levels below the cost of production of companies and various geopolitical developments that have led to the increase of prices in energy in the Western world. The following figure shows the evolution of the nickel price in recent years [10]. As for Ni amount used to produce batteries, it is known to increase rapidly. Ni is used in several types of batteries. The use of nickel in lithium-ion (Li-ion) batteries, due to the high energy density of Ni- containing cathodes, has increased significantly in recent years, and this increase is expected to continue. Figures 5 & 6 shows the % of Ni in several types of batteries [8]. In a recent publication the Nickel Institute [11] reports that as the electric vehicle industry continues to grow, nickel’s role in battery technology is becoming increasingly apparent. From the high-nickel cathodes used by Tesla to LGES’ high-voltage medium-nickel cathodes, nickel is at the core of innovations that promise to extend range, improve efficiency, and reduce costs. At the same time, advances in safety additives, alternative chemicals like NiZn, and the push towards solid-state batteries offer a glimpse into the future of safer and more efficient EV batteries.

However, in 2025, Indonesia, taking into account the gradual decline of the price of nickel in the stock markets, announced that for the next few years it will limit the unregulated laterite mining by about 15%, this is expected to have a positive effect on the price increase due to the limitation of production and market rules (demand/ supply). It is not yet possible to determine the evolution of production and price in 2025 [12]. These developments, based on the latest information, lead either to the closure of large Chinese companies operating in Indonesia, exemplified by PT Gunbuster Nickel Industry, whose Nickel production plant was inaugurated in 2021 [13], or to the acquisition of factories and mines by Chinese companies outside Asia, such as the one owned by Anglo America in Brazil that includes the Barro Alto and Niquelândia mines as well as the units ferronickel production Barro Alto and Codemin, whose production in 2024 was 39,400 tn of nickel. factories from China-backed MMG Limited [14].

The Position of Greek Laterites

Regarding the position of Greek laterites, the following can be mentioned, [8]:

a) GMMSA LARCO was until recently the only producer of FeNi in the European Union from privately owned mines, the third largest producer in Europe and one of the seven largest in the world.

b) on average, about 95,000 tons of granulated FeNi with an average Ni content of 20% were produced annually by General Mining and Metallurgical S.A. LARCO from domestic nickel laterite ore deposits.

c) FeNi production at Larco accounted for 32% and 4% of European and world production, respectively.

The production of both the mines and the pyrometallurgical plant interrupted since 2022 due to the increase in the price of electricity as well as international changes in ferronickel production that made its production unprofitable under the given conditions. In the last two years, great emphasis placed on the development of new innovative technologies for the utilization of the company’s primary and secondary resources through its participation in European Union research programs with promising results for the future [15-22]. Through the application of other technologies such as hydrometallurgy for the exploitation of laterites or other secondary raw materials of the company, the company could revive, as this method could also produce cobalt, which is also one of the critical metals for battery production. According to the above, the demand for nickel as well as cobalt is increasing on a global scale. Greece has quite large reserves in relation to the size of the country in laterites and it is considered that it would be a very positive development to complete the tender for the sale of the factory and mines of LARCO since new technologies can be developed and applied so that the exploitation of the mineral wealth of the company can resume and the company continues to play its important role in the Greek economy as well as in the past.

Conclusions

Nickel is a strategic metal, and its demand expects to increase significantly in the coming years. The end of the COVID-19 pandemic, the expected end of the Russian Ukrainian conflict and the increased demand for batteries are factors that expects to drive the increase in demand and production in the coming years. However, the aggressive policy of Asia, especially China, in setting the price of raw materials in general and nickel in particular leads companies in the rest of the world to cease production partially or completely, without however observing any significant effect on the continuous increase in production and consumption.

Of course, the latest developments in Indonesia and the Philippines, as well as the change of attitude of the US, partially change the road map and offer an opportunity to Greece, which has significant for its size laterite reserves. This opportunity is because with proper planning and appropriate exploitation, Greek lateritic reserves could play a significant role in Europe’s effort to become independent of China and integrate nickel production in Greece under conditions in the Critical Raw Materials Act of the European Union.

References

- (2023) ENICON project, https://enicon-horizon.eu/ (accessed 23 May).

- Zhang H, Liu G, Li J, Qiao D, Zhang S, et al. (2023) Modeling the impact of nickel recycling from batteries on nickel demand during vehicle electrification in China from 2010 to 2050. Science of The Total Environment 859(1): 15996410-15996415.

- Top 5 Uses for Nickel | Full Guide to Nickel Uses (knollmont.com)

- (2023) European Union. Study on the Critical Raw Materials for the EU 2023- Final Report. ISBN 978- 92-68-00414-2 European Commission pp. 1-154.

- (2021) INSG (International Nickel Study Group), The World Ni Factbook 2021.

- (2023) USGS (Unites States Geological Survey). Nickel Statistics and Information.

- GMMAE LARCO (2019) STOCK REPORT FOR THE YEAR 2018.

- SP Tampouris, KA Komnitsas (2023) Future Trends in World Nickel Production and Consumption. conference in Responsible Consumption and Production, 2023, Technical University of Crete, Chania | Crete – Greece.

- (2024) INTERNATIONAL NICKEL STUDY GROUP, PRESS RELEASE INSG SEPTEMBER 2024 MEETINGS.

- https://www.lme.com/Metals/Non-ferrous/LME Nickel | London Metal Exchange.

- https://www.mining.com/web/indonesia-sets-2025-nickel-ore-mining-quota-at-around-200- million-tonnes/

- P Adeli (2024) Powering the future: advances in nickel-based batteries. Nickel Institute, USA.

- Indonesia’s Battery-Material Boom Is Forcing its Nickel Smelters to Shut Down – Bloomberg.

- Anglo sells Brazil assets for $500M, targets June to demerge Amplats - MINING.COM.

- K Komnitsas, A Peys, S Tampouris, V Karmali, G Bartzas, et al. (2024) Synthesis and morphology of slag-based alkali activated materials. Mining Metallurgy & Exploration 42(1): 1-13.

- FP Araujo, MD Virrey, E Vassilieva, N Magalhães, G Rollinson, et al. (2024) Mineralogical controls on the Ni and Co recovery from HCl leaching of laterites. Process Mineralogy, Kape Town, South Africa.

- M Bertau, C Rogoll, M Kraft, St Tampouris (2024) A novel approach for the treatment of EAF slag from LARCO Ferronickel Plant in Greece for the recovery of Nickel and Cobalt. SIPS 2024, 20- 24 October, Crete, Greece.

- A Eljoudiani, C Hoffmann Sampaio, J Oliva Moncunill, P Alfonso, H Anticoi, et al. (2024) Characterization of lateritic tailings from Greece for critical metals recovery. 11th International Conference on Sustainable Solid Waste Management, Rhodes Island, Greece.

- SP Tampouris, K Binnemans (2024) A novel leaching approach for the treatment of LARCO Ferronickel plant dust samples. 11th International Conference on Environmental Management Engineering, Planning and Economics (CEMEPE 2023) and SECOTOX Conference, Lefkada Island, Greece.

- S Sadeghi, S Riaño, K Binnemans, S Tampouris, V Chipakwe (2023) HCl- based leaching method for extracting Ni/Co from ore deposits and tailings. 2nd International Conference on Raw Materials and Circular Economy, Athens, Greece.

- K Komnitsas, V Karmali, S Tampouris, E Petrakis, A Kritikaki, et al. (2023) Properties of alkali activated materials produced from metallurgical slag and other additives. Tenth International Conference on Environmental Management, Engineering, Planning and Economics (CEMEPE 2023) and SECOTOX Conference, Skiathos Island, Greece.

- K Karalis, C Zografidis, A Xenidis, S Tabouris, E Devlin (2012) Contribution to the energy optimization in the pyrometallurgical treatment of Greek nickeliferous laterites. TMS 2012 141st Annual Meeting & Exhibition, Orlando, Florida.

-

Dr. Stylianos Tampouris*. The Position of Greek Laterites in the World. Adv in Mining & Mineral Eng. 1(4): 2025. AMME. MS.ID.000518.

-

Quartz sands; foundry sand; bioleaching; bio stimulants

-

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.